Hired Non Owned Auto Coverage Definition

What is Hired Non Owned Auto Coverage?

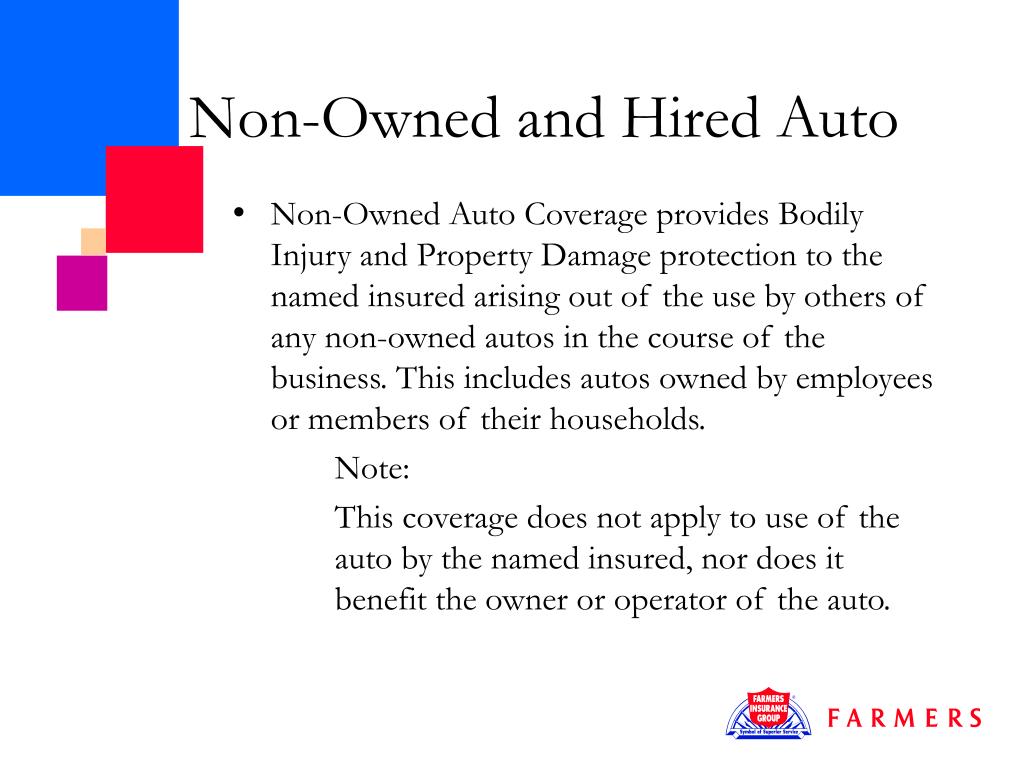

Hired non-owned auto coverage, also known as HNOA, is an insurance policy that provides coverage for liability and physical damage when an organization rents, borrows, or leases a vehicle for business purposes. It is an optional coverage that can be added to a business auto insurance policy and provides protection to the organization and its employees if they are in an accident while using a vehicle that is not owned by the company. HNOA coverage is important because it can help to protect the organization’s assets in the event of a claim or lawsuit.

HNOA coverage is not necessary for all businesses, but it may be a good idea for any organization that frequently borrows or rents vehicles for business use. For example, a company that frequently uses cars for sales calls, deliveries, or other business-related activities should consider having HNOA coverage. It is also important for companies that have employees who use their own personal vehicles for business purposes, as the company may be held liable for any damages or injuries that occur in an accident.

What Does HNOA Cover?

HNOA coverage typically provides coverage for liability, physical damage, and medical payments in the event of an accident. Liability coverage pays for damages or injuries that are caused by the organization or its employees while using a rented or borrowed vehicle. Physical damage coverage pays for repairs to the rented or borrowed vehicle, while medical payments coverage pays for medical expenses for any individuals who are injured in the accident. HNOA coverage can also provide coverage for property damage, towing and labor costs, or other related costs.

Who Does HNOA Cover?

HNOA coverage typically covers the organization and its employees while using a rented or borrowed vehicle for business purposes. It also may provide coverage for employees who use their personal vehicles for business purposes. However, it is important to note that HNOA coverage does not provide coverage for any passengers in the vehicle, or any damages or injuries caused by the use of the rented or borrowed vehicle.

Why is HNOA Important?

HNOA coverage is important for businesses that often rent or borrow vehicles for business purposes. Without HNOA coverage, the organization would be held liable for any damages or injuries caused by the use of the rented or borrowed vehicle. This could be costly for the company, as the organization would be responsible for paying for all damages and legal fees. HNOA coverage can also help protect employees who use their personal vehicles for business purposes, as the company may be held liable for any damages or injuries caused by the employee’s vehicle.

How Much Does HNOA Cost?

The cost of HNOA coverage will vary depending on the type of coverage and the company providing the coverage. Generally speaking, HNOA coverage is relatively inexpensive and can be purchased as an add-on to a business auto insurance policy. It is important to shop around for the best rate and to make sure that the coverage is sufficient for the organization’s needs.

Hired non-owned auto coverage is an important type of coverage for organizations that frequently rent or borrow vehicles for business purposes. It can help to protect the organization’s assets in the event of a claim or lawsuit, and can also provide coverage for employees who use their personal vehicles for business purposes. While HNOA coverage is not necessary for all businesses, it may be a good idea for any organization that frequently uses rented or borrowed vehicles for business use.

Hired/Non-Owned Auto Coverage | BIG Insurance Solutions

Commercial Auto vs. Hired and Non-Owned Auto Insurance | Insureon

PPT - COMMERCIAL REAL ESTATE PowerPoint Presentation, free download

Advice on Non-Owned Auto Coverage by Las Vegas Property Management

Hired And Non Owned Auto - Car Sale and Rentals