Geico And Progressive Mobile Home Insurance Quote

Thursday, February 8, 2024

Edit

Geico and Progressive Mobile Home Insurance Quote Comparison

What is Mobile Home Insurance?

Mobile home insurance is a type of insurance policy that is designed to protect the owner of a mobile home from a variety of potential financial losses. The policy typically covers the structure of the mobile home and its contents, as well as personal liability for any injuries or property damage that may occur on the property. In some cases, the policy may also provide coverage for additional living expenses if the mobile home is damaged or destroyed by a covered event.

What does Geico and Progressive Mobile Home Insurance offer?

Geico and Progressive both offer mobile home insurance policies that provide coverage for both the structure of the mobile home and its contents. The coverage offered by each insurer varies, so it is important to compare the terms and conditions of the policies to determine which one best fits the needs of the individual. Generally, the coverage provided by both companies includes protection against a variety of perils, such as fire, wind, hail, theft, and vandalism. In addition, most policies also provide coverage for liability in the event that someone is injured on the property.

What are the Benefits of Geico and Progressive Mobile Home Insurance?

Geico and Progressive both offer a variety of benefits to mobile home owners. One of the primary benefits is the flexibility provided by the policies. Both companies allow for the policyholder to customize their coverage to best fit their individual needs. Additionally, the policies can be tailored to include coverage for additional living expenses should the mobile home be destroyed by a covered event.

In addition, both companies offer discounts for policyholders who have multiple policies with the same company or who have been a customer of the company for an extended period of time. Furthermore, both companies have mobile apps available for policyholders to access their policy information and make payments.

How to Obtain a Mobile Home Insurance Quote from Geico and Progressive?

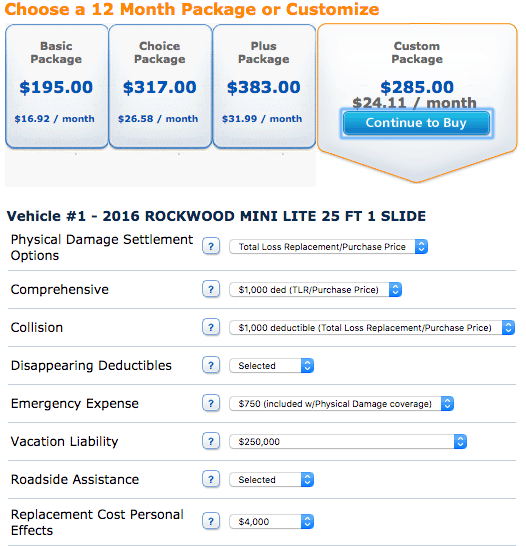

The best way to obtain a mobile home insurance quote from Geico and Progressive is to contact the company directly. Both companies have representatives available to answer any questions that may arise. Additionally, each company has an online quoting system that can provide an instant quote. The online quoting system allows the policyholder to enter their information and receive a quote in minutes.

After obtaining a quote, the policyholder should compare the terms and conditions of the policies to determine which one best fits their needs. Additionally, the policyholder should also consider the customer service and claims process of each company before making a final decision.

Conclusion

Geico and Progressive both offer mobile home insurance policies that provide coverage for the structure of the home and its contents. The policies can be tailored to provide additional protection for the policyholder, including coverage for additional living expenses in the event of a covered event. Additionally, both companies offer discounts for policyholders who have multiple policies with the same company or who have been a customer for an extended period of time. In order to obtain a quote, policyholders should contact the company directly or use the online quoting system. After obtaining a quote, it is important to compare the terms and conditions of the policies to determine which one best fits the individual needs.

Geico Quote Look Up - Quotes

How Much Does Travel Trailer Insurance Cost? - Camper Report

Geico Home Insurance Coverage - Home Sweet Home | Insurance - Accident

10 Things To Avoid In Geico Home Insurance | geico home insurance

Geico Home Insurance Quote for senior citizens - YouTube