Full Coverage Auto Insurance Illinois

Full Coverage Auto Insurance in Illinois

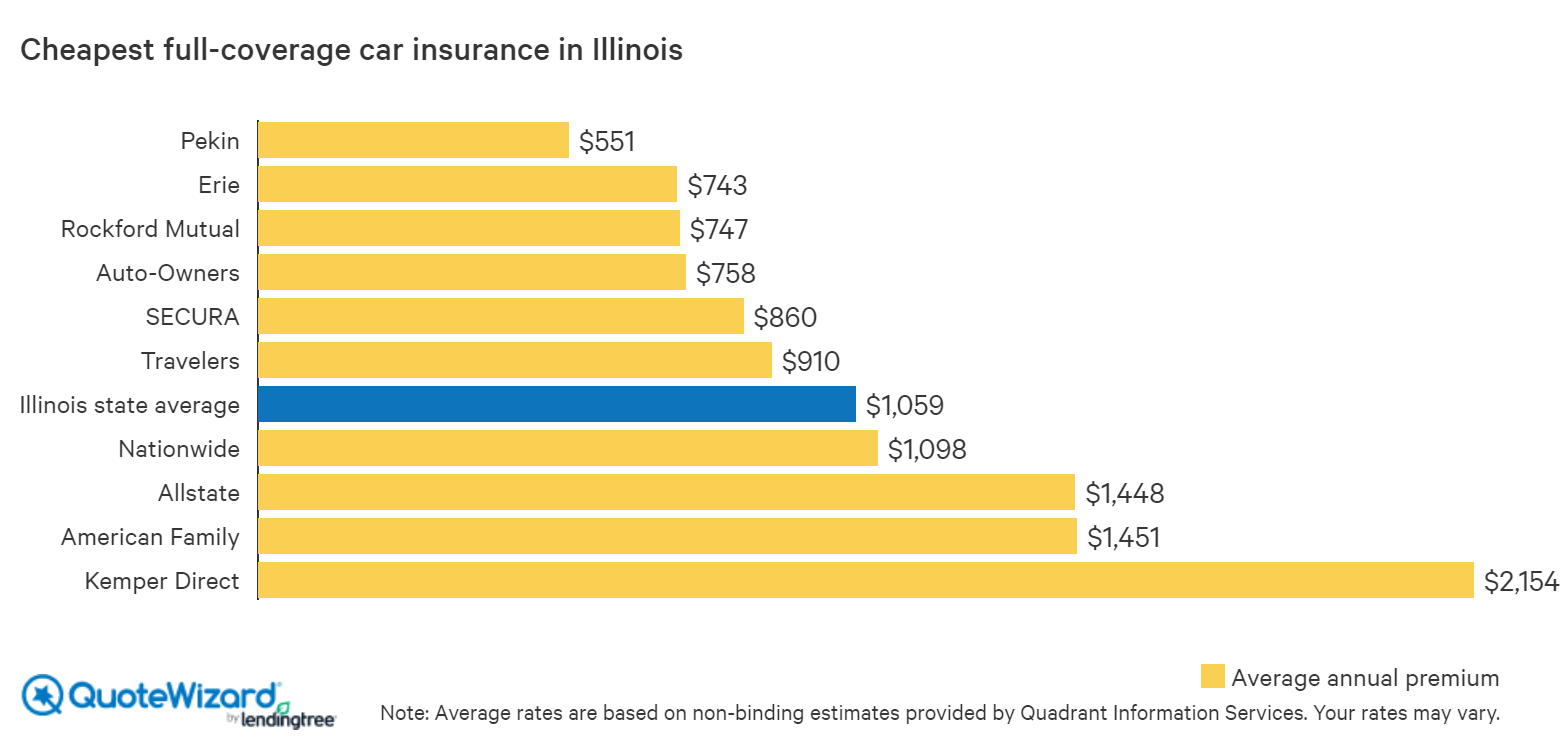

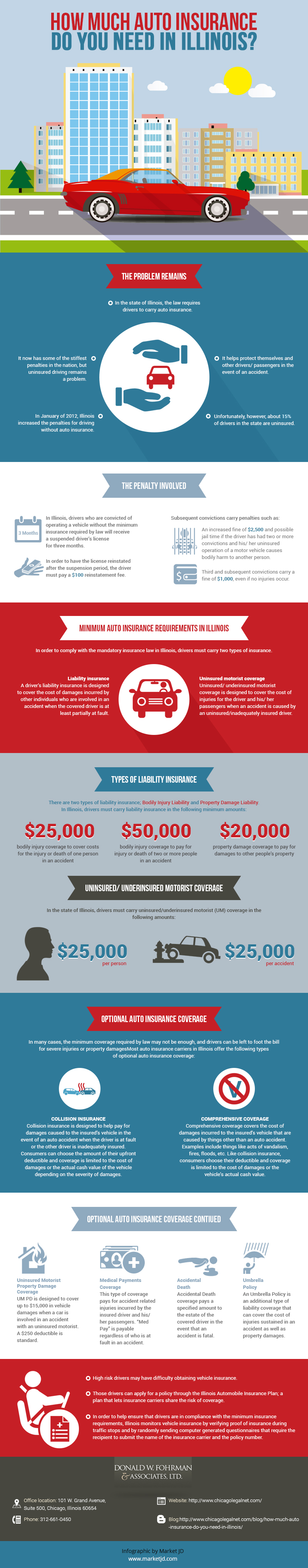

When it comes to auto insurance, Illinois residents have a lot of options. Although there are no state-mandated rules for auto insurance coverage, there are still a few minimums that should be met in order to remain in compliance with the law. Full coverage auto insurance is a great option for anyone who wants to make sure they are fully protected in the event of an accident.

Full coverage auto insurance is a combination of both liability and comprehensive insurance. Liability insurance covers you in the event that you are responsible for an accident, while comprehensive coverage provides additional protection in the form of medical payments, uninsured motorist coverage, and other forms of property damage coverage. By combining both types of coverage, you can be sure that you are adequately protected in the event of an accident.

What Does Full Coverage Auto Insurance Include?

When it comes to full coverage auto insurance, there are a few basic components that are almost always included. The most common include: Bodily Injury Liability, which covers medical expenses for anyone injured in an accident you cause; Property Damage Liability, which covers any damage to another person’s property that you may cause; Uninsured/Underinsured Motorist coverage, which covers damages from an accident caused by someone without insurance; Medical Payments coverage, which covers medical expenses for you and your passengers; Collision coverage, which covers repairs to your car in the event of an accident; and Comprehensive coverage, which covers damage to your car caused by theft, vandalism, or other non-accident related incidents.

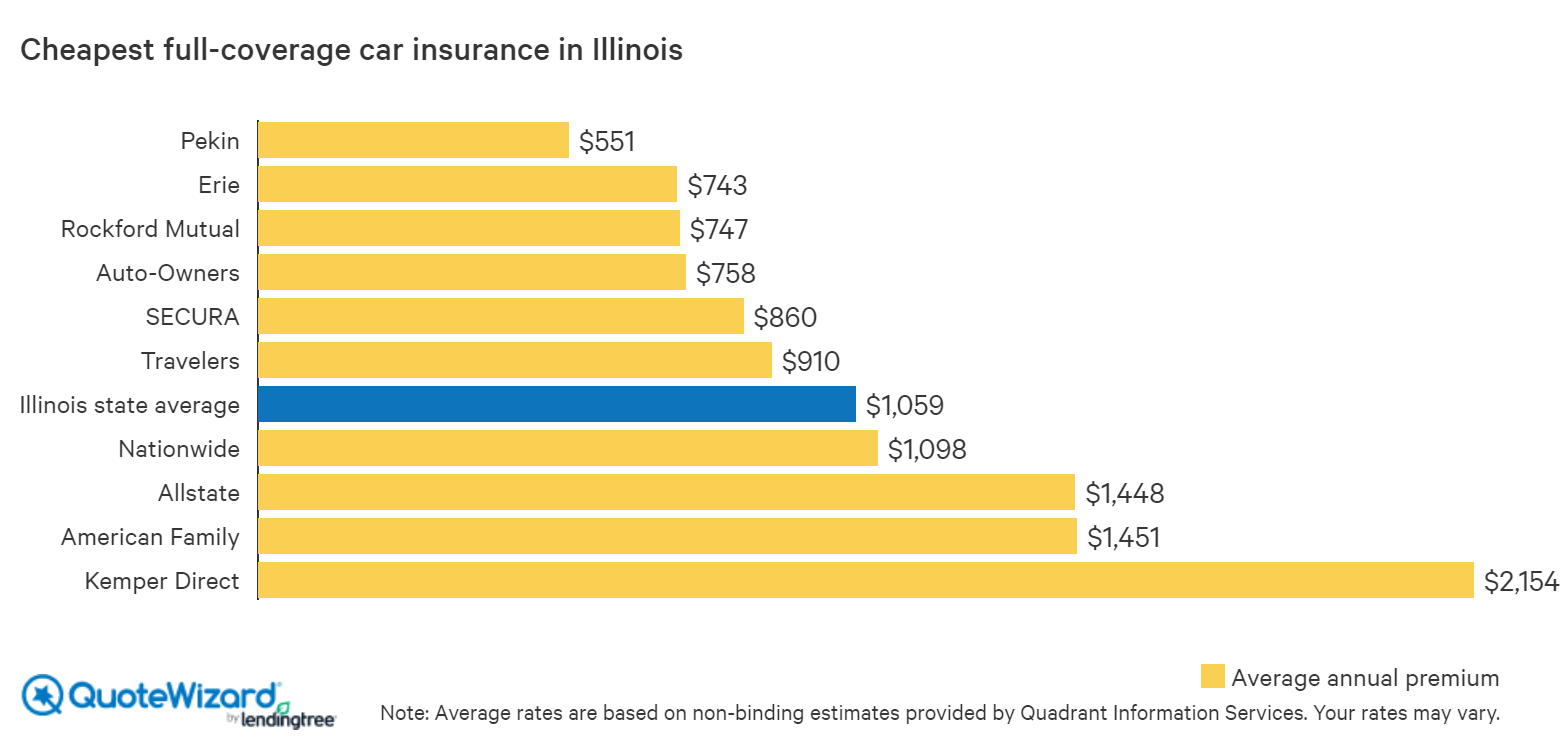

What Does Full Coverage Auto Insurance Cost?

The cost of full coverage auto insurance varies depending on the type of car you drive, your driving record, your age and other factors. Generally, however, you can expect to pay anywhere from $500 to $1000 per year. If you are looking for the most affordable option, you may want to consider increasing your deductible. This will lower your monthly premium, but you will be responsible for a larger portion of the cost if you do have to file a claim.

How Can I Find Affordable Full Coverage Auto Insurance in Illinois?

If you are looking for affordable full coverage auto insurance in Illinois, the best place to start is by shopping around and comparing rates from different insurers. You can do this online, by speaking with an insurance agent, or by visiting your local insurance agency. It is important to make sure that you are getting the most comprehensive coverage for the best price possible. Additionally, you may want to look into any discounts or incentives your insurer may offer, such as a good driver discount or a multi-policy discount.

Full coverage auto insurance is an important part of any driver’s insurance policy. With the right coverage, you can be sure that you will be protected if you find yourself in an accident. Illinois residents can find affordable full coverage auto insurance by shopping around and comparing rates from different insurers.

Find Cheap Car Insurance in Illinois | QuoteWizard

Auto Insurance Illinois | Personal Injury Lawyers

An Illustrative Guide to Illinois Auto Insurance | American Auto

Illinois Vehicle Auto Insurance - 1073 N Liberty St Elgin, IL 60120 - Yelp

PPT - Cheap Full Coverage Car Insurance For All People PowerPoint