Car Insurance Rates In Virgina Vs National Average

Car Insurance Rates In Virginia Vs National Average

What is the Average Car Insurance Cost in Virginia?

If you're a driver in Virginia, or you're planning to move there, you may be wondering what the average car insurance cost is in the Old Dominion. The answer is that it depends on a few factors. The type of car you drive, your driving record, and the insurance company you choose will all affect the cost of your insurance premium. On average, however, Virginians pay around $1,109 per year for their car insurance.

That's slightly lower than the national average of $1,311. While the difference isn't massive, it can add up over time. If you're shopping around for a car insurance policy in Virginia, you may be able to find a better deal than what the average driver pays. It's important to shop around and compare quotes from multiple insurers to find the best policy for you.

What Factors Impact Car Insurance Rates in Virginia?

There are several factors that can affect your car insurance rates in Virginia. The type of car you drive is one of the most important factors. Insurance companies generally consider sportier cars to be more risky, and thus, more expensive to insure. Your driving record is another important factor. If you have a history of traffic violations or accidents, you could be charged a higher rate than someone with a clean record.

Your age and gender can also impact your rates. Typically, younger drivers pay more for insurance than their older counterparts. Additionally, statistics show that men are more likely to be involved in accidents than women, so they may be charged higher rates. Where you live is also a factor. If you live in a densely populated area, you may have to pay more for insurance due to the increased risk of accidents.

How Can I Save Money on Car Insurance in Virginia?

The best way to save money on car insurance in Virginia is to shop around and compare quotes from multiple insurers. This can help you find the best policy for your needs at the lowest possible price. Additionally, taking defensive driving courses or enrolling in usage-based insurance programs can help you qualify for discounts. You may also be able to save money by bundling your car insurance with other policies, such as homeowners or renters insurance.

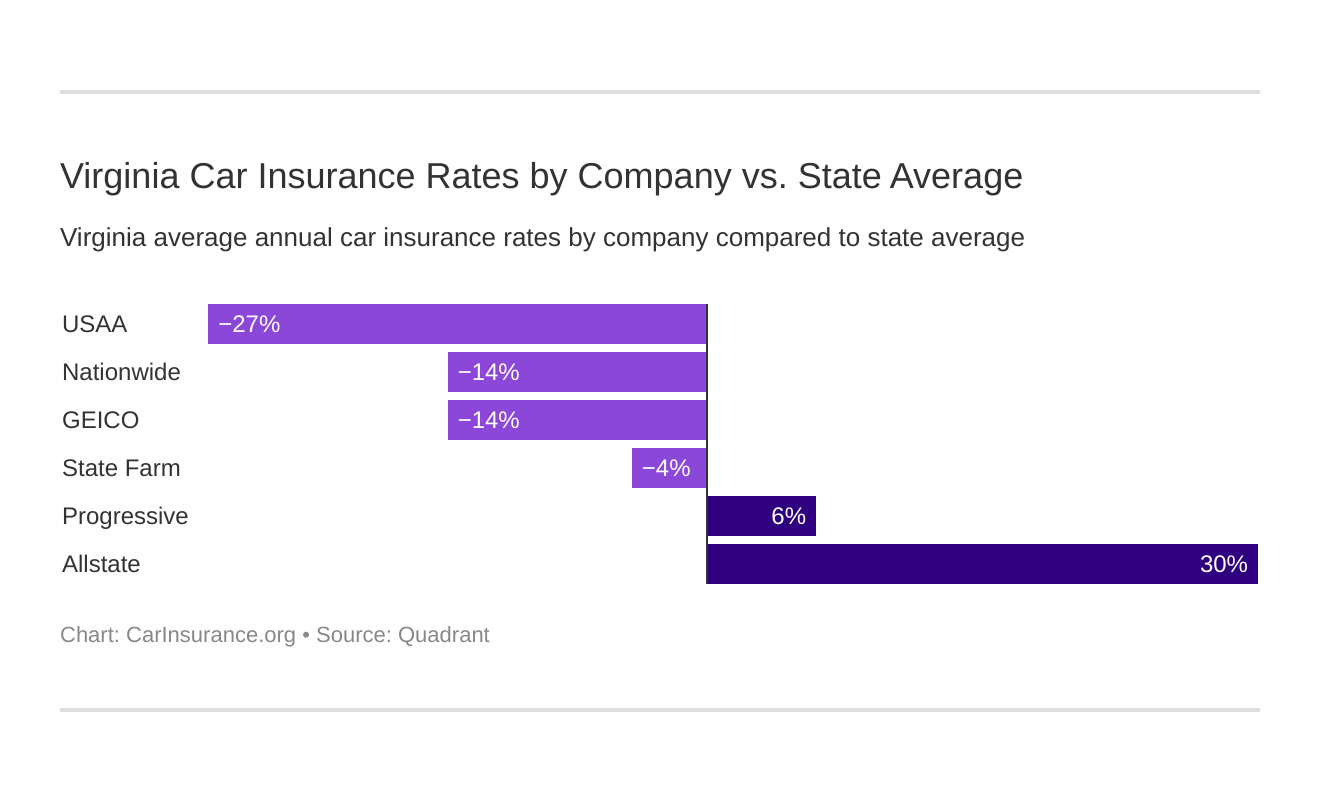

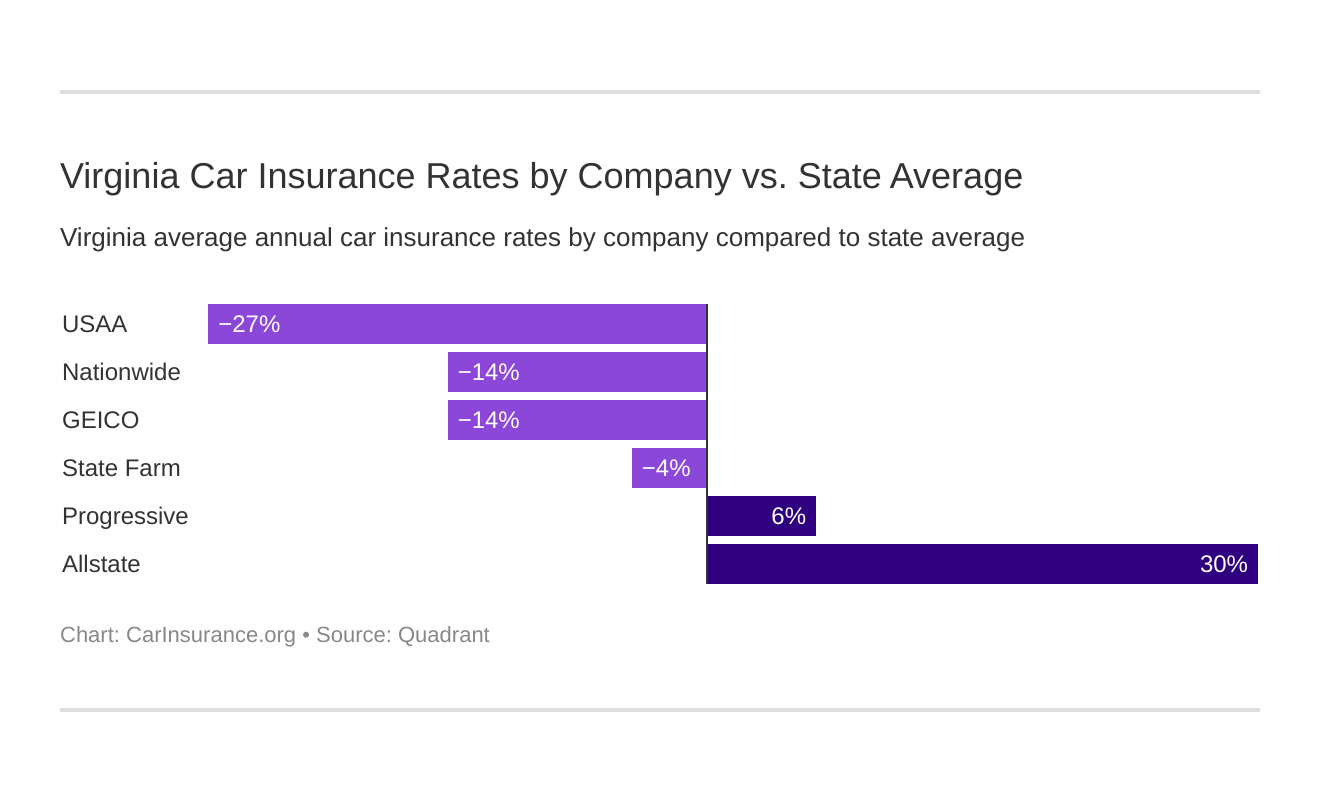

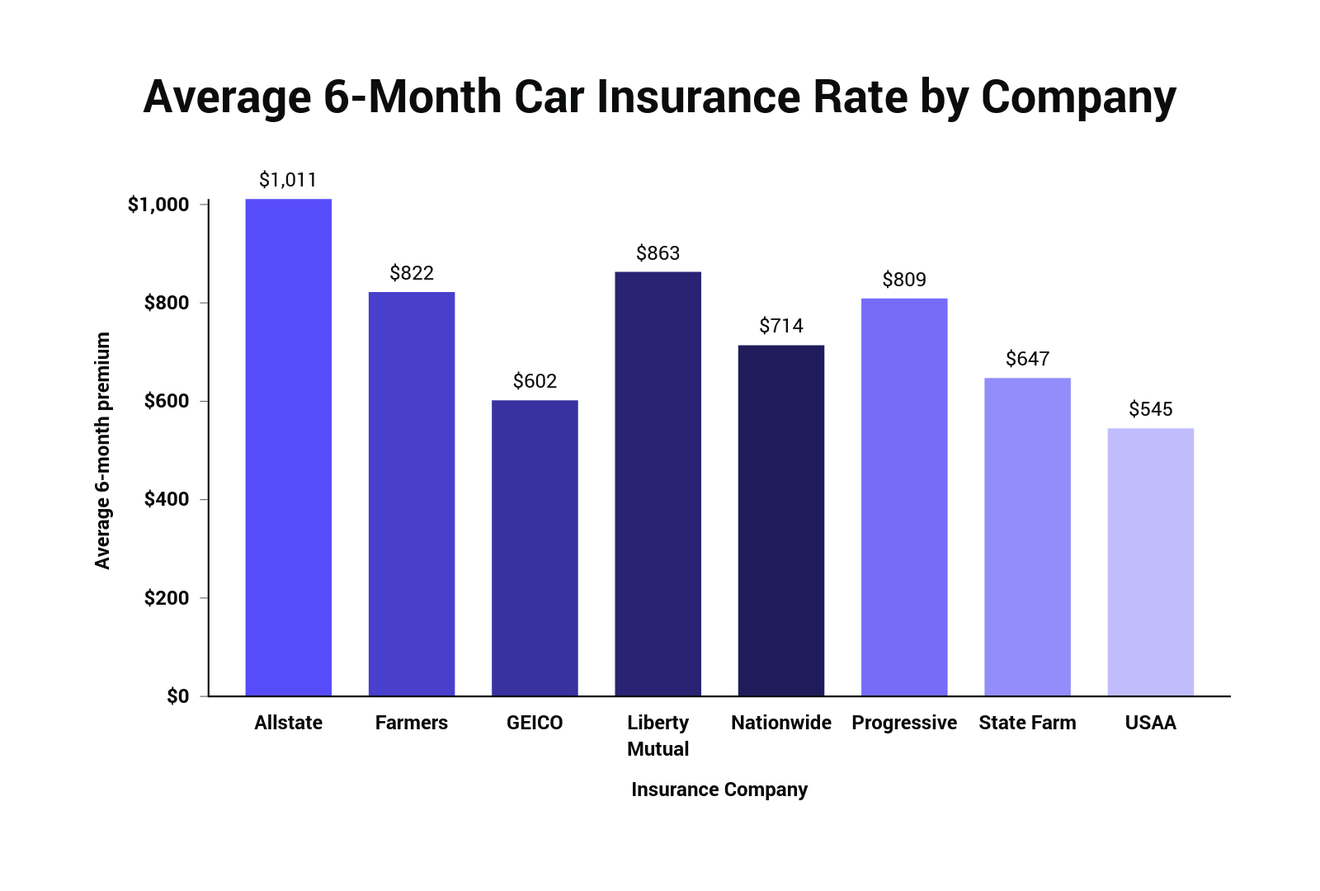

What is the Cheapest Car Insurance Company in Virginia?

The cheapest car insurance company in Virginia will vary depending on your individual needs and risk profile. It's important to shop around and compare quotes from multiple insurers in order to find the best coverage at the lowest price. Some of the top car insurance companies in Virginia include State Farm, GEICO, Nationwide, Allstate, and Progressive. However, each company offers a variety of discounts and different coverage options, so it's best to compare quotes to find the best policy for you.

Virginia Car Insurance Guide [Cheap Rates + Best Companies

Virginia Auto Insurance Rates - Average Cost Of Car Insurance Per Month

Virginia Auto Insurance Rates - Average Cost Of Car Insurance Per Month

Quotes Compare – LowestQuotes.com

Study: Women Now Pay More Than Men for Car Insurance in 25 States | The