Car Insurance Options To Save Money

Car Insurance Options To Save Money

Understand Your Coverage Needs

Before you can explore the different car insurance options available, you must first understand your coverage needs. Beyond the legal minimums set in your state, you'll want to consider additional coverage for your car and yourself. If you're financing your car, you may be required to carry full coverage, including comprehensive and collision coverage. These two coverages provide protection for damage to your car caused by an accident or other events. Comprehensive coverage helps pay for damages from things like fire, theft, vandalism, and hail. Collision coverage helps pay for damages from a collision with another vehicle or an object. You may also want to consider carrying uninsured/underinsured motorist coverage and personal injury protection, both of which provide protection in the event you're injured in an accident or your car is damaged by an uninsured or underinsured driver.

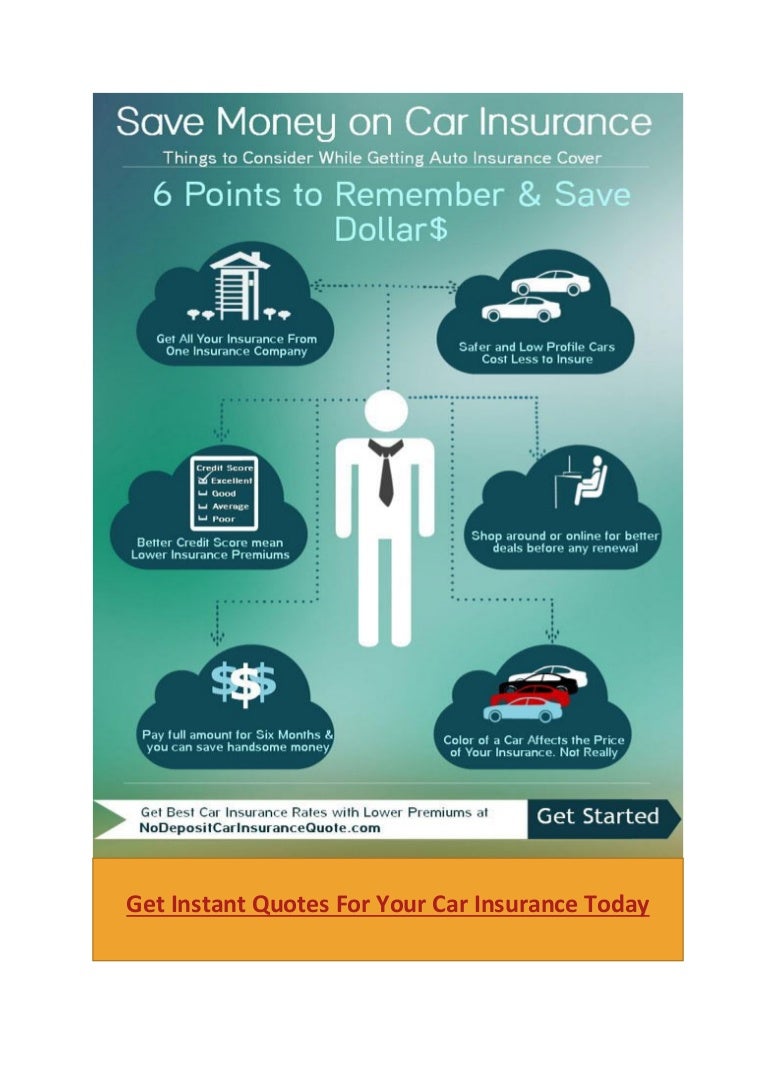

Shop Around To Compare Rates

One of the best ways to save money on car insurance is to shop around and compare rates. Start by getting quotes from several insurers, including your current insurer. Make sure that the quotes are for the same coverage limits and deductibles and that the quotes are for the same type of vehicle. You should also ask about any discounts that may be available. Many insurers offer discounts for things like having multiple policies, having a clean driving record, or having certain safety features on your car. Once you have your quotes, compare them side by side to see which one offers the best value.

Consider A Higher Deductible

One way to save money on car insurance is to consider raising your deductible. A deductible is the amount of money you have to pay out of pocket before the insurer will pay for any damage. By raising your deductible, you can reduce your premium. However, it's important to make sure you can afford the higher deductible if you need to file a claim. It's also important to note that raising your deductible will only save you money if you don't file a claim.

Look Into Usage-Based Insurance

Many insurers offer usage-based car insurance, which is based on how you drive. The insurer will track your driving habits, such as how many miles you drive, how often you drive, and how quickly you accelerate and brake. The insurer will then use this information to determine your premium. This type of insurance can be a great way to save money if you have a good driving record, as you may be able to get a lower premium than you would with a traditional car insurance policy.

Look Into Paying Annually

Another way to save money on car insurance is to look into paying your premium annually instead of monthly. Many insurers offer discounts for paying your premium in full upfront. Paying your premium annually may also help you save money on interest, as some insurers charge interest on monthly payments. However, make sure you can afford to pay your premium in full before signing up for this option.

Look Into Low-Mileage Discounts

If you don't drive very much, you may be able to get a discount on your car insurance. Many insurers offer low-mileage discounts for drivers who don't drive very often. This type of discount can be especially helpful if you don't use your car to commute to work or school but rather use it for recreational purposes. Be sure to ask your insurer about any low-mileage discounts they may offer.

Car Insurance 101: Ways to Save on Car Insurance

5 Ways to Save Money on Car Insurance

7 Ways to Save Money on Car Insurance | AGirlsGuidetoCars

Tips On How To Save Money On Car Insurance

How to save money on auto insurance in Ontario - Save.ca Community