California Home Insurance In High Fire Risk Areas

California Home Insurance In High Fire Risk Areas

The Growing Risk of Fire Damage in California

From the devastating effects of the Camp Fire to the Woolsey Fire, 2018 will be remembered as one of the worst years in California when it comes to the destruction caused by wildfires. And in 2019, the risk is only growing. With the dry and hot climate in California, fires can easily spread and cause extensive damage to homes and businesses.

This year, California is expected to experience another year of high fire risk. The California Department of Forestry and Fire Protection (Cal Fire) has already reported an increase in the number of wildfires in 2019 compared to the same period in 2018. And even though the majority of these fires are still contained, the risk of large-scale destruction is still very real.

Given the increased risk, it’s no surprise that California homeowners are increasingly concerned about the potential for fire damage to their homes. And for those living in high fire risk areas, it’s all the more important to make sure you have the right home insurance coverage to protect your home and belongings from fire damage.

What is High Fire Risk?

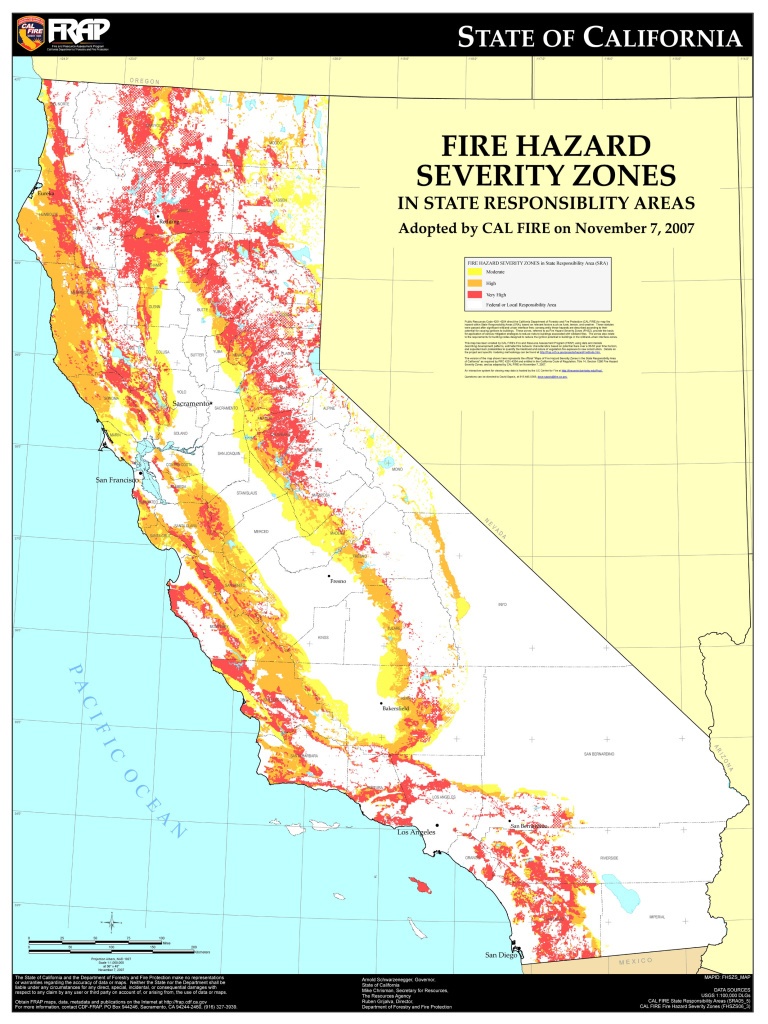

High fire risk areas are those that are most vulnerable to destructive wildfires. They tend to be situated in mountainous and rural areas, and are usually characterized by high temperatures, dry conditions, and dense vegetation.

California is home to some of the most fire-prone areas in the country. In addition to the widespread damage caused by the Camp Fire and Woolsey Fire in 2018, California has also seen numerous other destructive wildfires in the past few years.

For California homeowners living in high fire risk areas, it’s important to be aware of the potential for fire damage to their homes, and to make sure they have the proper home insurance coverage.

What Does California Home Insurance Cover?

Most home insurance policies in California include coverage for fire damage. This coverage includes damages caused by wildfires, as well as damages caused by other sources, such as electrical fires.

In addition to covering the cost of repairing damage to your home, your home insurance policy may also include coverage for personal property such as furniture, electronics, and clothing that are damaged in a fire.

Finally, your home insurance policy may also include coverage for additional living expenses if your home is damaged by a fire and you’re temporarily unable to stay there.

What Should I Do if I Live in a High Fire Risk Area?

If you live in a high fire risk area, it’s important to make sure you have adequate home insurance coverage to protect your home and belongings in the event of a wildfire.

It’s also important to take steps to reduce the risk of fire damage to your home. This includes clearing brush and other combustible materials from around your home, installing smoke detectors and fire alarms, and creating a designated evacuation plan in the event of a wildfire.

Finally, it’s a good idea to talk to your insurance agent about any additional coverage you may need, as well as any discounts you may be eligible for due to the increased risk of fire damage in your area.

Conclusion

For California homeowners living in high fire risk areas, it’s important to make sure you have adequate home insurance coverage to protect your home and belongings from fire damage. It’s also important to take steps to reduce the risk of fire damage to your home, and to talk to your insurance agent about any additional coverage you may need. By taking these steps, you can help ensure that you and your family are protected in the event of a wildfire.

California Home Insurance In High Fire Risk Areas

The Growing Risk of Fire Damage in California

From the devastating effects of the Camp Fire to the Woolsey Fire, 2018 will be remembered as one of the worst years in California when it comes to the destruction caused by wildfires. And in 2019, the risk is only growing. With the dry and hot climate in California, fires can easily spread and cause extensive damage to homes and businesses.

This year, California is expected to experience another year of high fire risk. The California Department of Forestry and Fire Protection (Cal Fire) has already reported an increase in the number of wildfires in 2019 compared to the same period in 2018. And even though the majority of these fires are still contained, the risk of large-scale destruction is still very real.

Given the increased risk, it’s no surprise that California homeowners are increasingly concerned about the potential for fire damage to their homes. And for those living in high fire risk areas, it’s all the more important to make sure you have the right home insurance coverage to protect your home and belongings from fire damage.

What is High Fire Risk?

High fire risk areas are those that are most vulnerable to destructive wildfires. They tend to be situated in mountainous and rural areas, and are usually characterized by high temperatures, dry conditions, and dense vegetation.

California is home to some of the most fire-prone areas in the country. In addition to the widespread damage caused by the Camp Fire and Woolsey Fire in 2018, California has also seen numerous other destructive wildfires in the past few years.

For California homeowners living in high fire risk areas, it’s important to be aware of the potential for fire damage to their homes, and to make sure they have the proper home insurance coverage.

What Does California Home Insurance Cover?

Most home insurance policies in California include coverage for fire damage. This coverage includes damages caused by wildfires, as well as damages caused by other sources, such as electrical fires.

In addition to covering the cost of repairing damage to your home, your home insurance policy may also include coverage for personal property such as furniture, electronics, and clothing that are damaged in a fire.

Finally, your home insurance policy may also include coverage for additional living expenses if your home is damaged by a fire and you’re temporarily unable to stay there.

What Should I Do if I Live in a High Fire Risk Area?

If you live in a high fire risk area, it’s important to make sure you have adequate home insurance coverage to protect your home and belongings in the event of a wildfire.

It’s also important to take steps to reduce the risk of fire damage to your home. This includes clearing brush and other combustible materials from around your home, installing smoke detectors and fire alarms, and creating a designated evacuation plan in the event of a wildfire.

Finally, it’s a good idea to talk to your insurance agent about any additional coverage you may need, as well as any discounts you may be eligible for due to the increased risk of fire damage in your area.

Conclusion

For California homeowners living in high fire risk areas, it’s important to make sure you have adequate home insurance coverage to protect your home and belongings from fire damage. It’s also important to take steps to reduce the risk of fire damage to your home, and to talk to your insurance agent about any additional coverage you may need. By taking these steps, you can help ensure that you and your family are protected in the event of a wildfire.

Home Insurance Companies California : 1 | News Detector

Ca Wildfires Map | Adriftskateshop

California Fires: Map Shows The Extent Of Blazes Ravaging State's

California Home Insurance: Pros & Cons - Homeowners Insurance Blog

California insurers drop policies in high-fire risk areas