Buy Online Car Insurance Third Party

Saturday, February 24, 2024

Edit

Buy Online Car Insurance Third Party

The Benefits of Third-Party Car Insurance

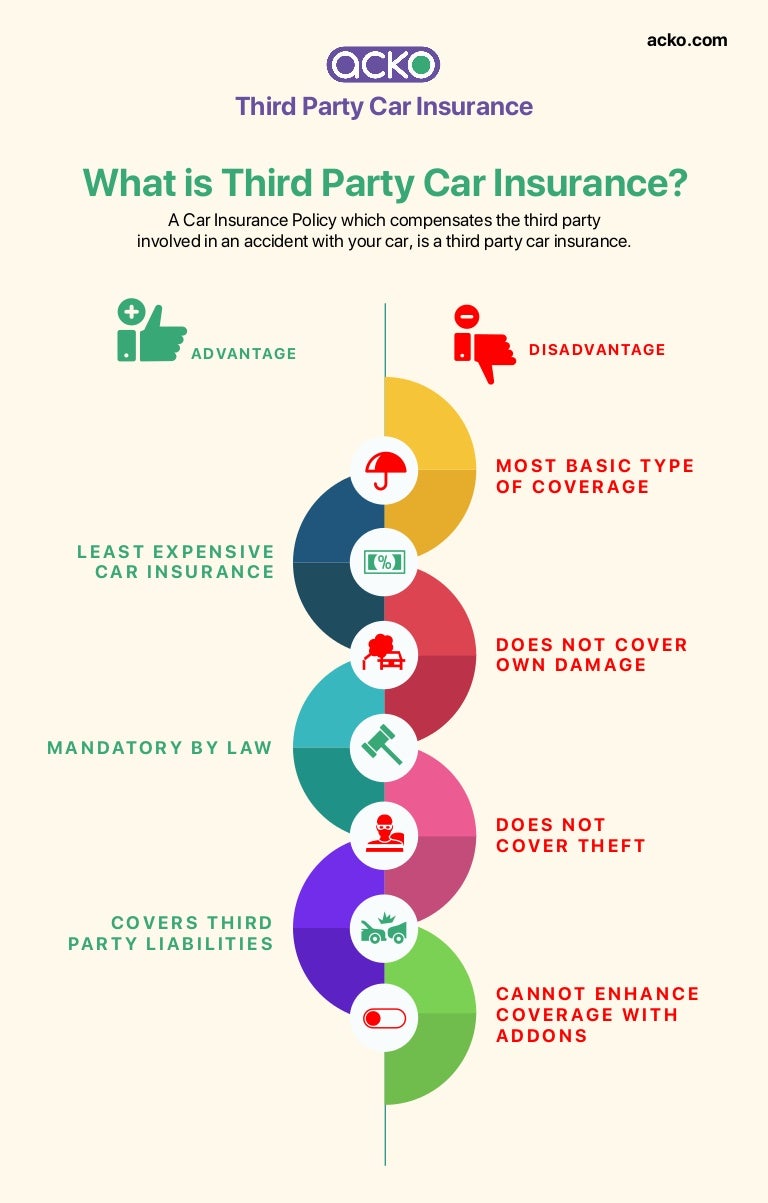

Third-party car insurance is a great way to protect yourself and your car if you’re involved in an accident. It covers a range of different risks and offers a degree of financial protection if something should go wrong. Third-party insurance is usually the most affordable option for drivers, and it is mandatory in most countries. Buying car insurance online is an easy and convenient way to purchase the protection you need.

Third-party car insurance typically covers claims for damages and injuries caused by the insured driver to a third party. This includes damage to another person’s vehicle, property, or even bodily injury. This type of insurance does not cover any damage or injury to the insured driver or their vehicle, however. This is why it is important to understand the different types of coverage and to select the appropriate one for your needs.

Things to Consider When Buying Third-Party Car Insurance

When purchasing third-party car insurance, there are a few things to consider. First, it’s important to understand the different types of coverage available. Third-party liability insurance covers claims made by a third party against the insured driver, while comprehensive coverage covers the insured driver’s own vehicle. It’s also important to understand the different levels of cover, such as third-party only, third-party fire and theft, and fully comprehensive.

It’s also important to understand the excess you will be required to pay. Excess is the amount of money you will be required to pay in the event of a claim. It’s important to select an excess that you are comfortable with and one that you can afford.

How to Buy Third-Party Car Insurance Online

Buying third-party car insurance online is an easy and convenient way to purchase the protection you need. To get started, you will need to provide some basic information about yourself, such as your name, address, and contact details. You will also need to provide information about the vehicle you are insuring and its value.

Once you have submitted your information, you will be presented with a range of quotes from different insurers. It’s important to compare the different quotes to find the one that offers the coverage you need at the best price. You can also use online comparison tools to make the process easier.

Once you have found the right policy for you, you can purchase it online. This is usually a straightforward process and can be completed in just a few minutes.

Save Money on Third-Party Car Insurance

There are a few ways to save money on third-party car insurance. One way is to shop around and compare quotes to find the best deal. You can also take advantage of discounts offered by insurers. For example, some insurers offer discounts for drivers who have taken a defensive driving course or have a good driving record.

Another way to save money is to increase your voluntary excess. This is the amount you are willing to pay in the event of a claim. Increasing your voluntary excess can reduce your premiums, but it is important to make sure you can afford it in the event of a claim.

Finally, it is important to consider the type of coverage you need. If your vehicle is older and not worth much, you may want to opt for third-party only insurance. This will provide the minimum level of protection required by law, but it won’t cover the cost of repairing or replacing your vehicle.

Conclusion

Buying third-party car insurance online is an easy and convenient way to get the protection you need. It’s important to understand the different types of coverage available and to compare quotes to find the best deal. You can also take advantage of discounts and increase your voluntary excess to save money. With the right coverage in place, you can drive with the peace of mind knowing you are protected.

Buy Online Insurance and Renew: Two Wheeler Insurance | Four Wheeler

3Rd Party Auto Insurance – Haibae Insurance Class

What Is The Difference Between Comprehensive Car Insurance And Third

Third Party Car Insurance

How To Buy A Car And Car Insurance? Budget Friendly in 2021