Business Car Insurance Vs Personal

Business Car Insurance Vs Personal

What Is Business Car Insurance?

Business car insurance is a type of insurance policy that covers vehicles used for business purposes. This type of policy typically covers the costs of repairing or replacing a vehicle in the event of an accident, theft, or other damage. It also typically covers liability, meaning that if a person or property is injured or damaged due to the negligence of the driver, the policy will pay for the damages. Business car insurance is different from personal car insurance, which is designed to cover the costs of repairing or replacing a vehicle used for personal purposes.

What Does Business Car Insurance Cover?

Business car insurance typically covers the costs of repairing or replacing a vehicle in the event of an accident, theft, or other damage. It also typically covers liability, meaning that if a person or property is injured or damaged due to the negligence of the driver, the policy will pay for the damages. Business car insurance policies may also cover additional expenses, such as medical bills, legal fees, and rental car costs. In addition, some policies may provide coverage for towing and roadside assistance.

What Does Personal Car Insurance Cover?

Personal car insurance is designed to cover the costs of repairing or replacing a vehicle used for personal purposes. It typically covers liability, meaning that if a person or property is injured or damaged due to the negligence of the driver, the policy will pay for the damages. Personal car insurance policies may also cover additional expenses, such as medical bills, legal fees, and rental car costs. In addition, some policies may provide coverage for towing and roadside assistance.

Differences Between Business Car Insurance and Personal Car Insurance

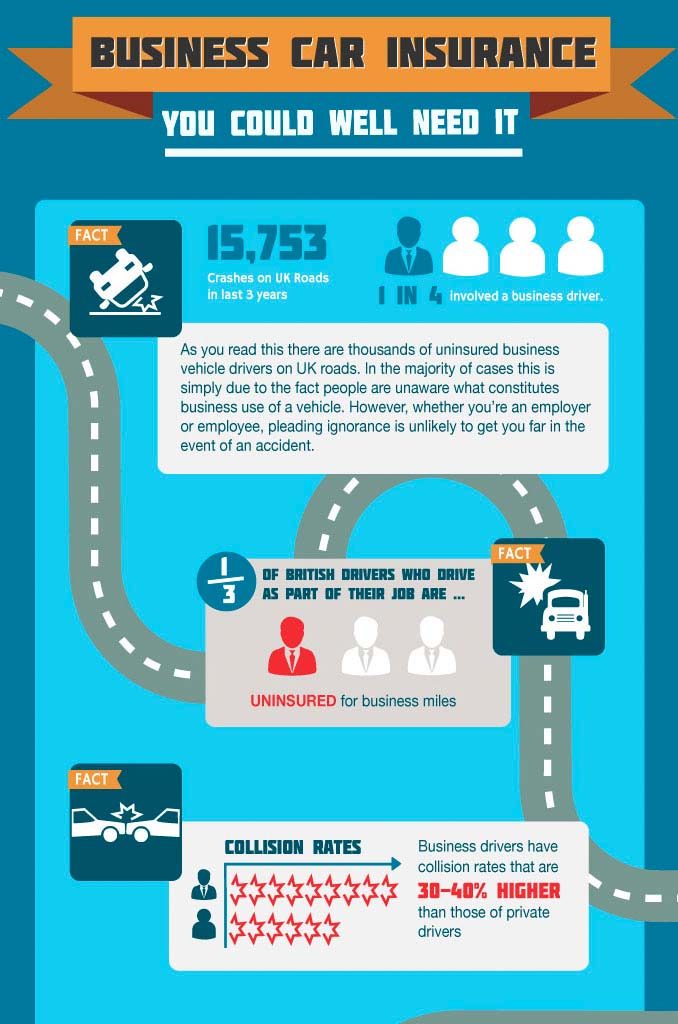

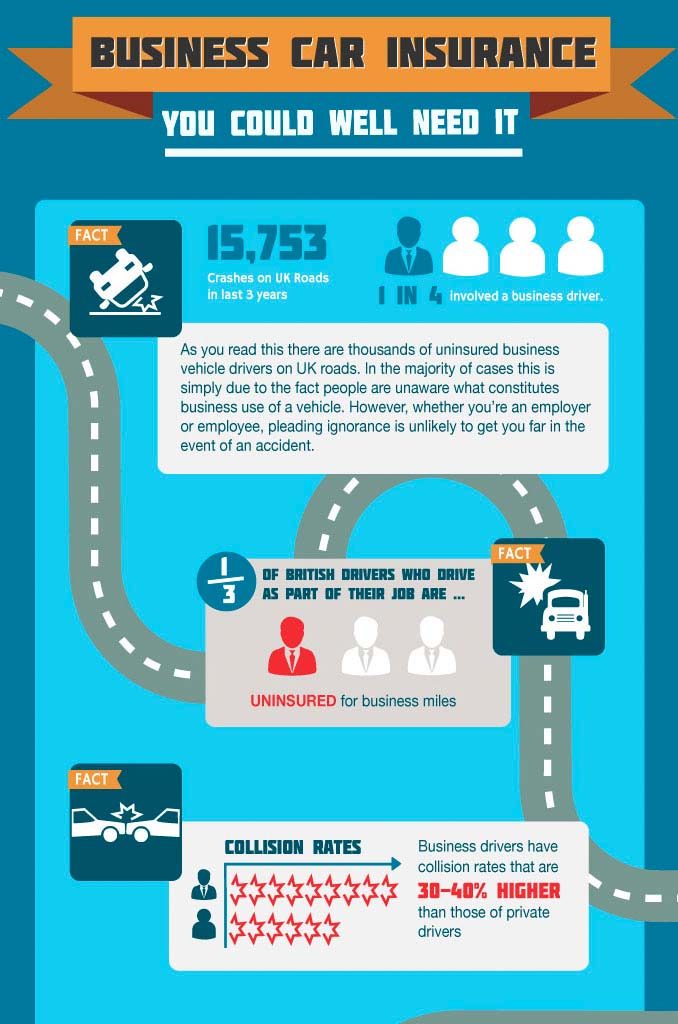

The main difference between business car insurance and personal car insurance is the purpose for which the vehicle is used. Business car insurance is designed for vehicles used for business purposes, while personal car insurance is designed for vehicles used for personal purposes. Additionally, business car insurance policies may provide additional coverage for business-related activities, such as transporting goods or services, or for business-related travel. Personal car insurance policies, on the other hand, typically do not provide this type of additional coverage.

Which Type of Insurance Is Right for You?

The type of car insurance you should purchase depends on the type of vehicle you are driving and its intended use. If you are driving a vehicle for business purposes, it is important to purchase business car insurance in order to protect yourself and your business from any potential liability. On the other hand, if you are driving a vehicle for personal purposes, it is important to purchase personal car insurance in order to protect yourself and your property. Ultimately, it is important to compare the different types of car insurance policies available in order to determine which one best meets your needs.

Conclusion

Business car insurance and personal car insurance are two different types of insurance policies designed to cover the costs of repairing or replacing a vehicle in the event of an accident, theft, or other damage. Business car insurance is designed for vehicles used for business purposes, while personal car insurance is designed for vehicles used for personal purposes. When deciding which type of car insurance to purchase, it is important to consider the type of vehicle being driven and its intended use. Comparing different types of car insurance policies is the best way to determine which policy best meets your needs.

What is Business Car Insurance? | Business Insurance

Business car insurance - do you need it? - Company Bug

Temporary Business Car Insurance | Company Car Insurance | Dayinsure

What is Business Car Insurance? | Business Insurance

All You Need To Know About Business Car Insurance