Average Insurance Cost For A Sports Car

Saturday, February 3, 2024

Edit

Average Insurance Cost For A Sports Car: Everything You Need to Know

What is the Average Insurance Cost For A Sports Car?

Are you thinking of buying a sports car? If so, you need to factor in insurance costs as part of your budget. The average cost for insurance for a sports car can be higher than for other types of vehicles due to their higher risk of theft and accidents. But, how much does it cost to insure a sports car?

The exact cost of insurance for a sports car depends on the make and model, the driver’s history, and the policy and coverage purchased. Generally, insurance companies calculate premiums based on the risk of insuring a vehicle. Sports cars are often seen as riskier than other types of cars, so they can have higher premiums.

What Factors Determine the Cost of Sports Car Insurance?

There are several factors that can affect the cost of insurance for a sports car. Some of these include the following:

Car Make and Model

The make and model of a sports car can affect the cost of insurance. If a car is considered more expensive to repair because of its parts, it will generally be more expensive to insure.

Driver Profile

A driver’s age, gender, driving record, and insurance history are all important factors in determining the cost of insurance. A driver with a poor driving record or a history of making insurance claims will likely pay more for sports car insurance.

Coverage and Policy

The type of coverage and policy purchased can affect the cost of sports car insurance. A policy with more comprehensive coverage, such as liability, collision, and comprehensive coverage, will usually have a higher premium than a policy with just liability coverage.

How Can I Save on Sports Car Insurance?

There are several ways to save on sports car insurance. Some of these include the following:

Increase Your Deductible

Increasing your deductible is one of the most effective ways to reduce your sports car insurance costs. By increasing your deductible, you can significantly reduce your premium payments. However, it is important to make sure you can afford the higher deductible if you do need to make a claim.

Choose a Higher Risk Vehicle

Another way to save on sports car insurance is to choose a higher risk vehicle. Many sports cars are considered higher risk than other types of cars, so they may have higher premiums. By choosing a higher risk vehicle, you may be able to save on your insurance costs.

Shop Around

Shopping around for the best rates is another way to save on sports car insurance. Different insurance companies offer different rates, so it is important to compare prices and coverage options to find the best deal.

Conclusion

The average cost for insurance for a sports car can vary depending on the make and model, the driver’s history, and the coverage and policy purchased. There are several ways to save on sports car insurance, such as increasing your deductible, choosing a higher risk vehicle, and shopping around for the best rates.

It is important to carefully consider all of your insurance options when buying a sports car, as the cost of insurance can be a significant part of your overall budget. With the right coverage and policy, you can save money on sports car insurance and enjoy your new car without worrying about the cost of insurance.

Lexus LC 500 Insurance Rates [2021 Cost + Sports Car Comparisons]

![Average Insurance Cost For A Sports Car Lexus LC 500 Insurance Rates [2021 Cost + Sports Car Comparisons]](https://mk0insuravizcom0fmqo.kinstacdn.com/wp-content/uploads/dataviz/lc-500-vs-sports-cars-insurance-tid54328.png)

How Much Does Car Insurance Cost for a Subaru BRZ? - ValuePenguin

Average Truck Insurance Cost Per Month : Average Cost of Dog Insurance

Who Has the Cheapest Car Insurance in New Jersey? - ValuePenguin

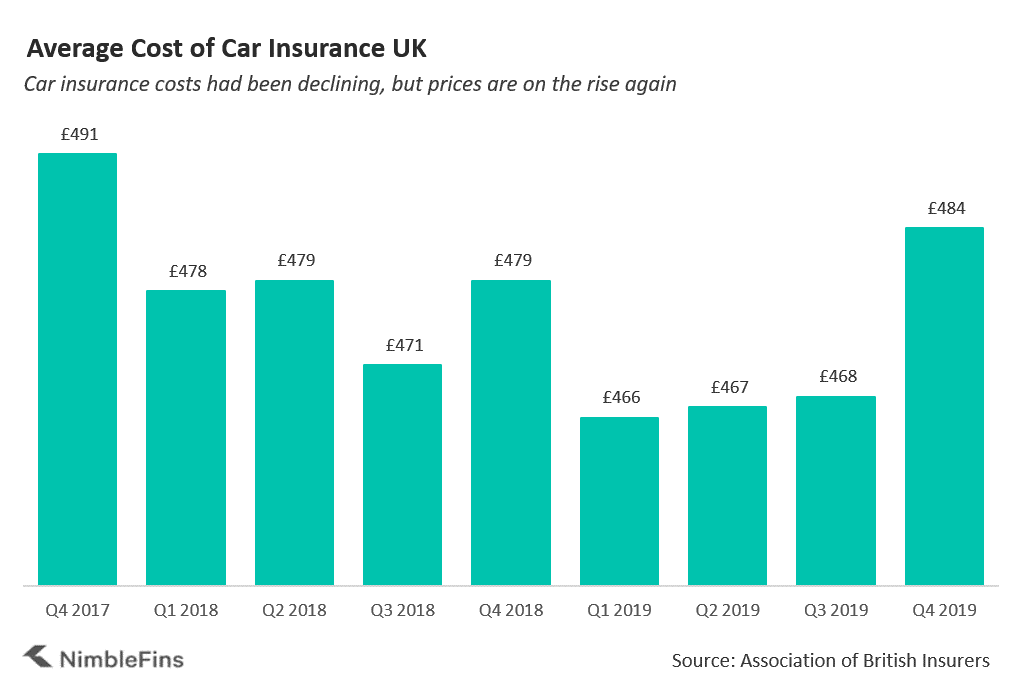

Average Cost of Car Insurance UK 2020 | NimbleFins