Auto Owners Life Insurance Forms

Auto Owners Life Insurance Forms: What You Need to Know

Understanding Life Insurance Options

When it comes to life insurance, there are a lot of options to consider for you and your family. It’s important to understand the different types of life insurance available, as well as the various companies that offer them. Auto Owners Life Insurance is one of the top providers in the industry. They offer a variety of life insurance policies and forms that you can use to ensure that your family’s future is protected. In this article, we’ll take a look at Auto Owners Life Insurance forms and what you need to know.

Different Types of Life Insurance

Auto Owners Life Insurance offers several different types of life insurance policies. These include term life insurance, whole life insurance, and universal life insurance. With term life insurance, you are covered for a specific period of time, usually 10, 20, or 30 years. Whole life insurance provides coverage for your entire life, as long as you are paying your premiums. Universal life insurance is a type of permanent life insurance that allows you to adjust your premiums and death benefit as your needs change. No matter what type of policy you choose, Auto Owners Life Insurance has the forms to help you get started.

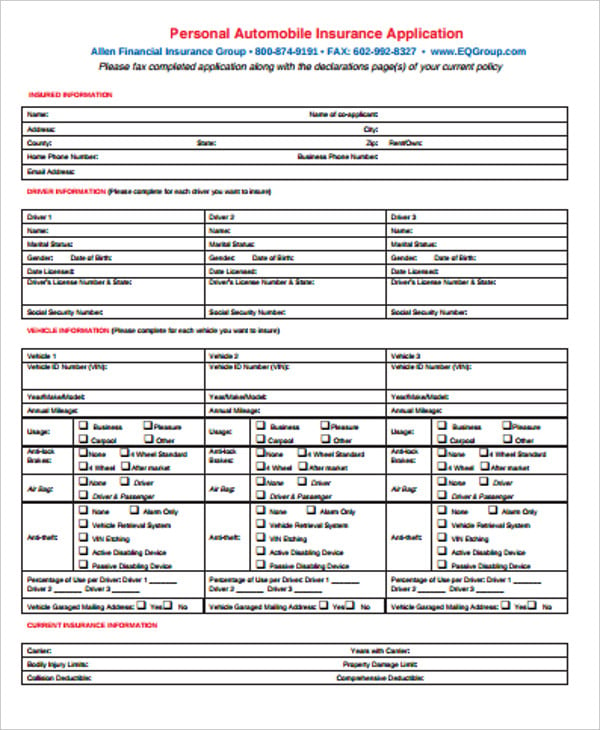

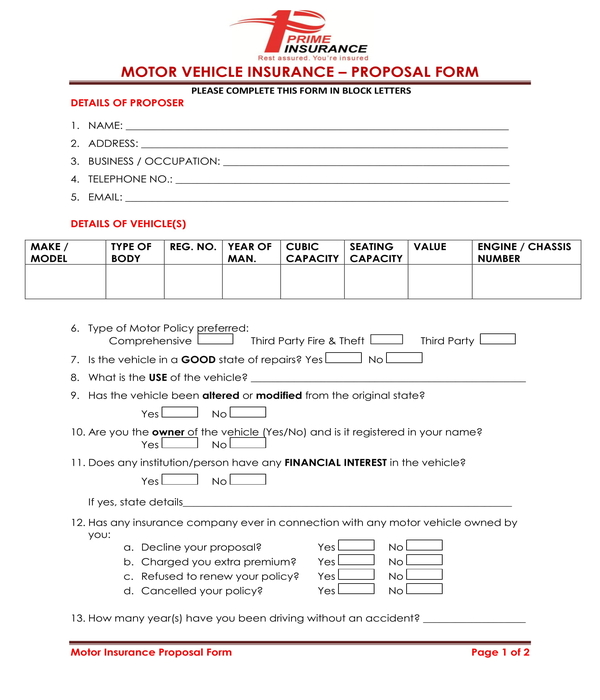

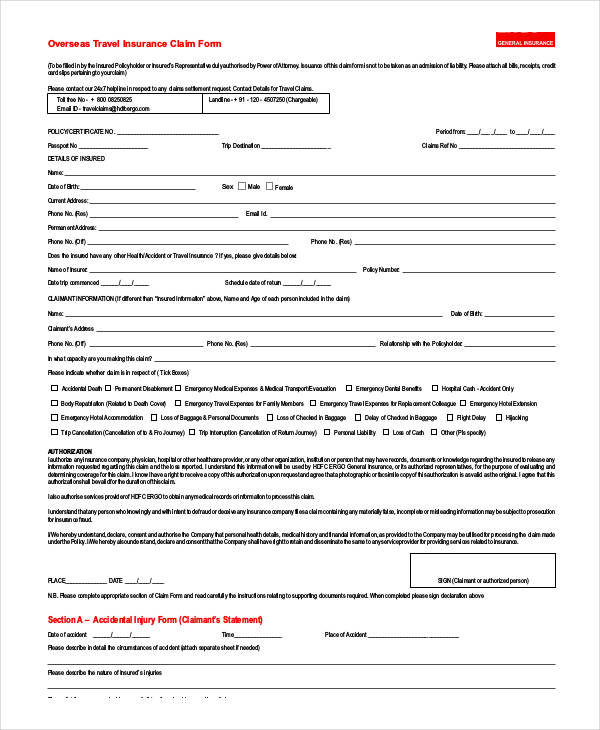

Auto Owners Life Insurance Forms

Auto Owners Life Insurance forms are designed to make the application process as simple and straightforward as possible. The forms are available online or you can request them from your local Auto Owners Life Insurance office. The forms typically include a health questionnaire, which is used to assess your risk and determine your premiums. In addition, you may need to provide information about your finances, such as bank statements, income tax returns, and other financial documents. Once you’ve completed and submitted the forms, you’ll receive a decision within a few weeks.

Choosing the Right Policy

When deciding which type of life insurance policy is right for you, it’s important to consider your age, health, and financial situation. For example, if you’re young and healthy, you may be able to get a lower premium by choosing a term life insurance policy. If you’re older or have health issues, a whole or universal life insurance policy might be a better choice. Your financial advisor can help you determine which type of policy is best for you.

Getting the Most Out of Your Auto Owners Life Insurance

Once you’ve chosen a policy, it’s important to review the terms and conditions to make sure you understand them. It’s also important to make sure that you’re paying your premiums on time and that you’re taking advantage of any discounts or special offers that Auto Owners Life Insurance may have available. With the right policy and the right forms, you can ensure that your family is protected for years to come.

Auto Owners Life Insurance Forms: A Summary

Auto Owners Life Insurance offers a variety of life insurance policies and forms to help you get the protection you need. It’s important to understand the different types of life insurance available and to choose the policy that’s right for you. Auto Owners Life Insurance forms are easy to complete and can help you get the coverage you need quickly and easily. With the right forms and the right policy, you can ensure that your family is protected for years to come.

Auto Owners Insurance: Auto Owners Life Insurance Forms

FREE 14+ Proposal Forms in PDF | MS Word | Excel

California Insurance Code Pdf

Automobile Insurance Claim Form

10+ Insurance Application Forms - PDF | Free & Premium Templates