Auto Insurance Providers In Massachusetts

Auto Insurance Providers In Massachusetts

Finding the Right Auto Insurance Provider in Massachusetts

Finding the right auto insurance provider in Massachusetts can be a difficult task. With so many providers out there competing for your business, it can be hard to know which one is right for you. The good news is, there are some tips you can follow that will help you find the best auto insurance provider in Massachusetts that fits your needs and budget. Here are some things to consider when looking for the perfect auto insurance provider in Massachusetts.

Consider Your Coverage Needs

Before you start shopping for auto insurance, it’s important to determine what kind of coverage you need. Do you need liability coverage for property damage or bodily injury liability? Do you need comprehensive coverage for theft or fire? Do you need uninsured motorist coverage? Knowing what kind of coverage you need will help you narrow down your search and find the best auto insurance provider in Massachusetts for your needs.

Compare Rates and Coverage Options

Once you know what kind of coverage you need, the next step is to shop around and compare rates and coverage options. There are many auto insurance providers in Massachusetts that offer different levels of coverage and different prices. Take the time to compare the different providers, so you can find the best coverage at the best price. Be sure to check out reviews of the providers, as well, so you can get a better idea of their customer service and reliability.

Check Out Discounts

Another great way to save money on auto insurance is to look for discounts. Many auto insurance providers in Massachusetts offer discounts for safe drivers, good students, and other factors. Be sure to ask the provider about any discounts they may offer, or check their website to see what discounts they provide. Also, ask about other discounts you may be eligible for, such as multi-policy discounts or discounts for members of certain organizations.

Ask About Service and Support

Finally, it’s important to make sure you are getting the best service and support from your auto insurance provider. Ask about their customer service policies and how they handle claims. Check to see how easy it is to file a claim and how quickly they respond to inquiries. Also, ask about their reputation in the industry and how long they have been providing auto insurance in Massachusetts.

Conclusion

Finding the right auto insurance provider in Massachusetts doesn’t have to be a daunting task. By considering your coverage needs, comparing rates and coverage options, looking for discounts, and making sure you are getting the best service and support, you can find the perfect auto insurance provider that fits your needs and budget. Good luck!

Who Has the Cheapest Auto Insurance Quotes in Massachusetts?

Cheap Car Insurance in Massachusetts 2019

AASP/MA Member Speaks Out Against Auto Insurance Practices | AASP MA

Massachusetts Auto Insurance | Cheap Auto Insurance - Auto Insurance

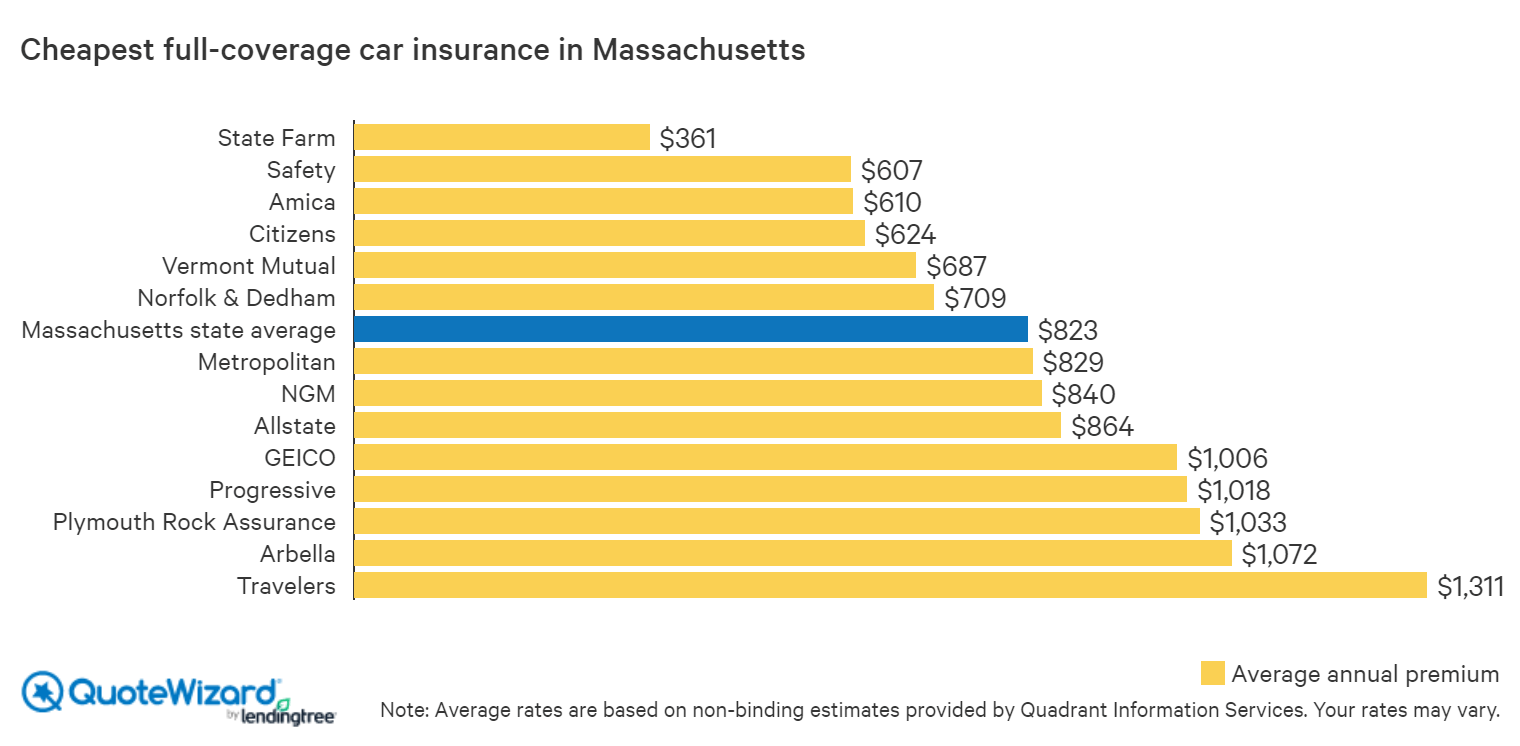

Cheapest Car Insurance in Massachusetts | QuoteWizard