Sbi General Accident Insurance Policy

SBI General Insurance - Comprehensive Accident Insurance Policy

Accidents are an unforeseen event in everyone's life and no one can predict when they might happen. To protect oneself from the financial impact of any accidents, SBI General Insurance offers an all-round accident insurance policy that provides coverage against medical expenses, accidental death, and disability due to an accident. This comprehensive accident insurance policy offers comprehensive protection for individuals as well as their family members.

Benefits of SBI General Insurance Accident Insurance Policy

The SBI General Insurance Accident Insurance Policy offers several benefits, such as:

- The policy provides coverage for death, disability and medical expenses due to an accident.

- The policy also provides coverage for loss of income due to disability due to an accident.

- The policy also provides coverage for permanent or temporary disability due to an accident.

- The policy also provides coverage for accidental hospitalization expenses.

- The policy also provides coverage for repatriation of mortal remains due to an accident.

Coverage and Features of SBI General Insurance Accident Insurance Policy

The SBI General Insurance Accident Insurance Policy provides the following coverage and features:

- The policy covers death due to an accident.

- The policy also provides coverage for permanent or temporary disability due to an accident.

- The policy also provides coverage for loss of income due to disability due to an accident.

- The policy also provides coverage for medical expenses due to an accident.

- The policy also provides coverage for accidental hospitalization expenses.

- The policy also provides coverage for repatriation of mortal remains due to an accident.

- The policy also offers a wide range of optional covers, such as personal accident rider, accidental death rider, and accidental disability rider.

Eligibility Criteria for SBI General Insurance Accident Insurance Policy

The following are the eligibility criteria for the SBI General Insurance Accident Insurance Policy:

- The policy is available for individuals between the age of 18-65 years.

- The policy is available for a minimum sum insured of Rs. 1 lakh and a maximum sum insured of up to Rs. 5 lakhs.

- The policy is available for a tenure of 1 year.

- The policy can be availed by both individuals and families.

Conclusion

The SBI General Insurance Accident Insurance Policy is a comprehensive policy that provides protection against death, disability and medical expenses due to an accident. It also provides coverage for loss of income due to disability due to an accident. The policy is available for individuals between the age of 18-65 years and can be availed by both individuals and families. The policy also offers a wide range of optional covers, such as personal accident rider, accidental death rider and accidental disability rider, which can be availed at an additional cost.

SBI General Group Personal Accident Insurance Policy – A Detailed

HOW TO||Fill SBI accident general insurance policy form||SBI insurance

Sbi 100 Rs Insurance Policy Form 2019 2020 2021 Mba

Sbi Claim Form | Traffic Collision | Insurance

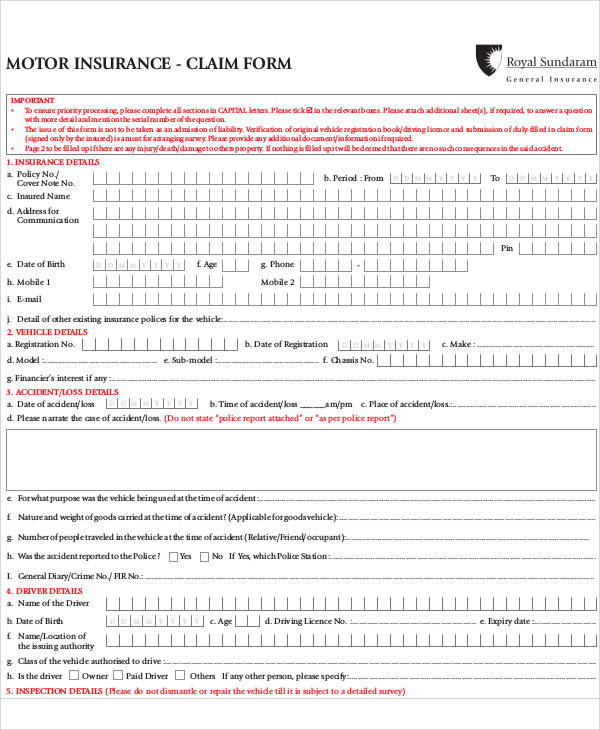

Sbi Car Insurance Claim Form