Icici Motor Insurance Policy Download

Icici Motor Insurance Policy Download: All You Need To Know

Understanding Motor Insurance

Motor insurance is a type of insurance that protects you against financial losses in the event of an accident involving your vehicle. It is also known as auto insurance, car insurance or vehicle insurance. It is a contract between you and the insurance company, where you pay a certain amount of premium in exchange for the insurer’s protection against financial losses caused by an accident. It also covers any damage to your vehicle and third-party property caused by an accident.

The policy is designed to provide financial protection against physical damage caused by a variety of risks such as theft, fire, vandalism, and other perils. It also provides coverage for medical expenses incurred due to an accident. The main purpose of motor insurance is to provide financial protection against the losses associated with road accidents.

Motor Insurance from ICICI Lombard

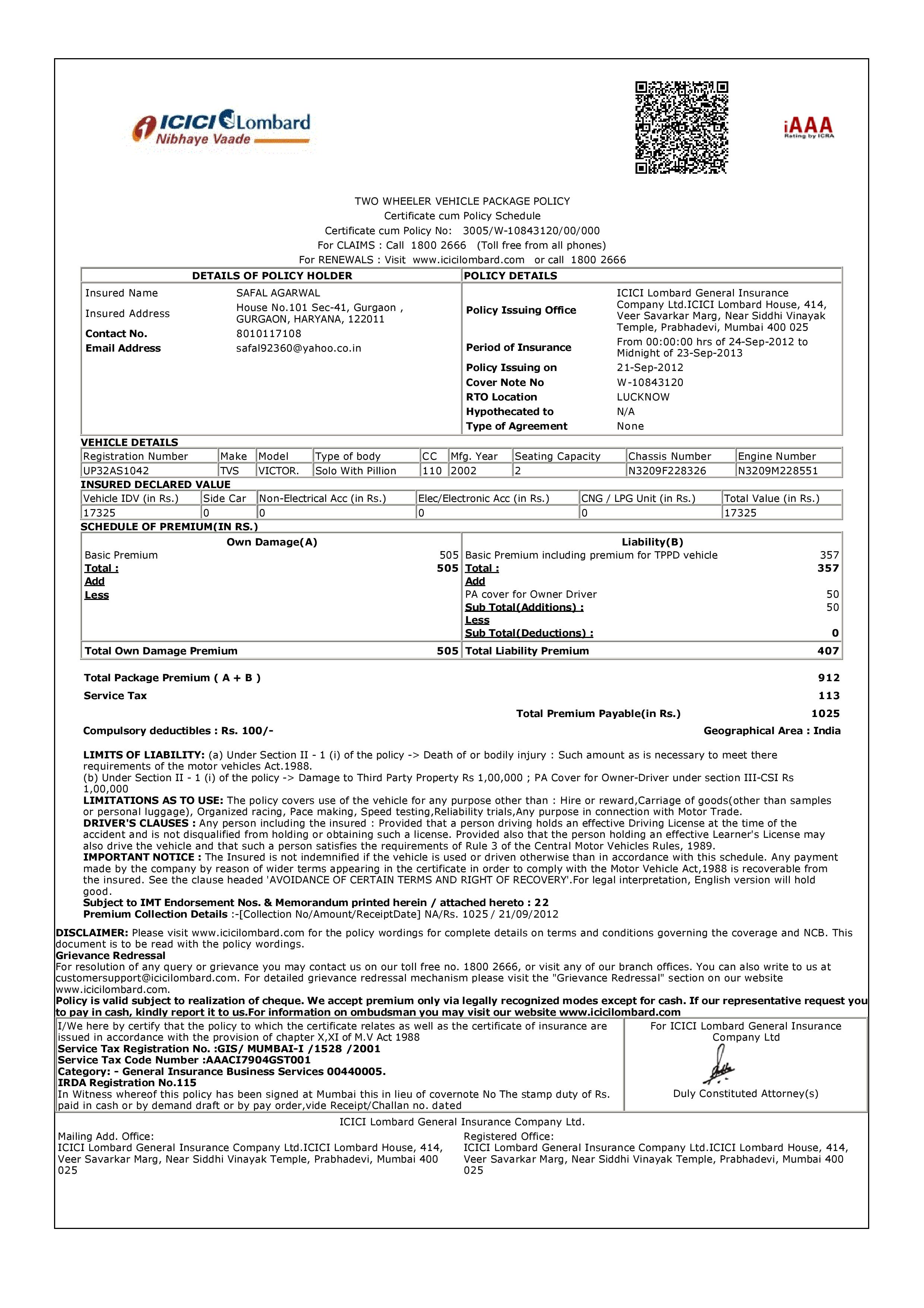

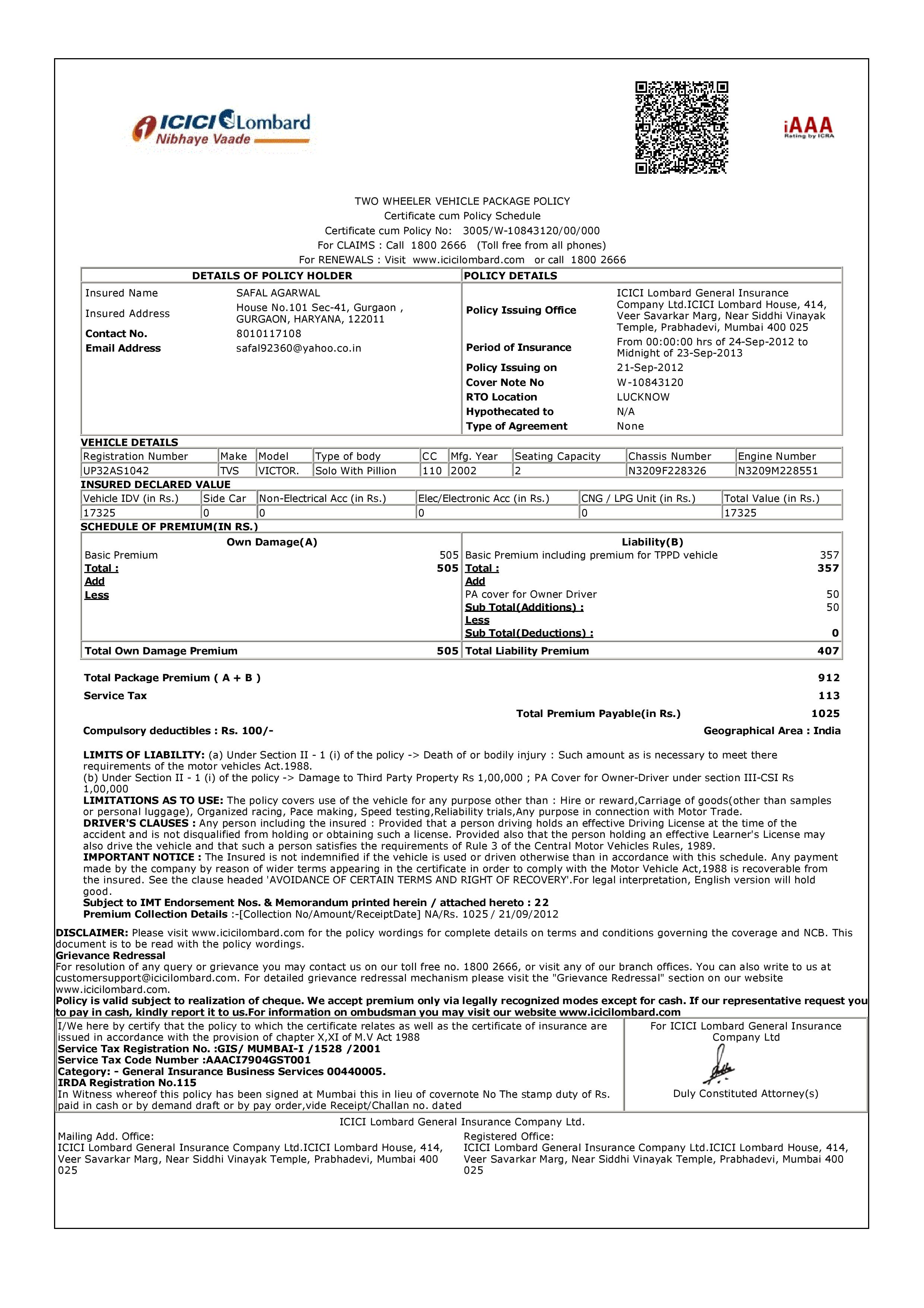

ICICI Lombard is a leading provider of motor insurance in India. The company offers a wide range of insurance policies for cars, two-wheelers, and commercial vehicles. The company provides comprehensive cover that includes personal accident cover, third-party liability cover, and other add-on covers. The company also offers a range of discounts and benefits to policyholders.

The company provides 24/7 customer support and a hassle-free claims process. The policy can be purchased online or through a network of branches and agents. The company also offers a range of add-on covers such as zero depreciation cover, return to invoice cover, engine cover, and accessories cover.

Downloading ICICI Motor Insurance Policy

If you want to purchase a motor insurance policy from ICICI Lombard, you can easily download the policy documents online. All you need to do is visit the company’s website and follow the instructions. Once you have completed the process, you will be able to download the policy documents.

Once you have downloaded the policy documents, you will need to fill them out and submit them to the insurer. The insurer will then process your application and issue the policy documents. It is important to remember that the policy documents should be kept in a safe place, as they are important documents that will be used in the event of a claim.

Conclusion

Motor insurance is an important part of protecting your vehicle and yourself from financial losses in the event of an accident. ICICI Lombard is a leading provider of motor insurance in India and provides comprehensive coverage with add-on covers and discounts. You can easily download the policy documents online and submit them to the insurer for processing.

Icici Lombard Motor Claim Form

[Resolved] Icici Lombard — motor insurance policy

![Icici Motor Insurance Policy Download [Resolved] Icici Lombard — motor insurance policy](https://www.consumercomplaints.in/thumb.php?complaints=2494153&src=78394802.jpg&wmax=900&hmax=900&quality=85&nocrop=1)

Icici Lombard Car Insurance Policy Pdf

Insurance Policy Download By Vehicle Number Icici Lombard

How to Renew Policy ICICI Lombard Motor Insurance Online - YouTube