Cheap Liability Car Insurance In Mississippi

Cheap Liability Car Insurance In Mississippi

What Is Liability Car Insurance?

Liability car insurance is a type of insurance that provides coverage for the legal liabilities of a person in the event of an accident. It covers the cost of property damage and medical bills for other people involved in the accident. Liability coverage is also known as “bodily injury” and “property damage” coverage. It is required by law in most states and is usually included in comprehensive car insurance policies.

Liability car insurance is usually divided into two parts: bodily injury coverage and property damage coverage. Bodily injury coverage pays for medical expenses and lost wages resulting from an accident, while property damage coverage pays for repair or replacement of property damaged in an accident. Both types of coverage are often referred to as “third-party coverage” because they provide coverage to a third party in the event of an accident.

Why Is Liability Insurance Important In Mississippi?

Liability insurance is important in Mississippi for several reasons. First, it is a legal requirement. Mississippi law requires that all drivers carry at least the minimum amount of liability insurance in order to register and drive a motor vehicle. Failure to do so can result in license and registration suspension or revocation, fines, and possible jail time.

Second, liability insurance is important because it can help protect you financially if you are held responsible for an accident. Without liability insurance, you may be liable for any medical bills, lost wages, and property damage resulting from the accident. This can be a financial burden that could put you in a difficult financial situation.

How To Find Cheap Liability Car Insurance In Mississippi

If you are looking for cheap liability car insurance in Mississippi, there are several steps you can take to help you find the best possible rate. First, it is important to shop around and get quotes from several different insurance companies. Comparing rates from different companies can help you find the most affordable policy for your needs.

Second, it is important to make sure that you are aware of any discounts that you may be eligible for. Many insurance companies offer discounts for drivers who have a good driving record, those who drive fewer miles, and those who install safety devices in their vehicles. Be sure to ask your insurance provider about any discounts that may be available.

Finally, it is important to consider raising your deductible. The higher the deductible you choose, the lower your premiums will be. It is important to remember, however, that if you do get into an accident, you will be responsible for the full amount of the deductible.

Why Choose Us For Liability Car Insurance In Mississippi?

At XYZ Insurance, we understand the importance of finding the right liability car insurance for your needs. We are dedicated to providing you with the best possible coverage at an affordable price. Our team of experienced agents will help you find the coverage that is right for you and your budget. We also offer a variety of discounts that can help you save even more on your policy.

In addition, we offer 24-hour customer service and a variety of payment options to make paying for your policy easy. We also offer online tools to help you find the best rate for your policy. No matter what your needs are, we can help you find the right liability car insurance in Mississippi.

Get A Quote Today

If you are looking for liability car insurance in Mississippi, contact us today for a free quote. Our agents are standing by to help you find the coverage you need at a price that fits your budget. Don’t wait – get a quote today and start saving on your liability car insurance.

Cheap Liability Car Insurance In Mississippi

What Is Liability Car Insurance?

Liability car insurance is a type of insurance that provides coverage for the legal liabilities of a person in the event of an accident. It covers the cost of property damage and medical bills for other people involved in the accident. Liability coverage is also known as “bodily injury” and “property damage” coverage. It is required by law in most states and is usually included in comprehensive car insurance policies.

Liability car insurance is usually divided into two parts: bodily injury coverage and property damage coverage. Bodily injury coverage pays for medical expenses and lost wages resulting from an accident, while property damage coverage pays for repair or replacement of property damaged in an accident. Both types of coverage are often referred to as “third-party coverage” because they provide coverage to a third party in the event of an accident.

Why Is Liability Insurance Important In Mississippi?

Liability insurance is important in Mississippi for several reasons. First, it is a legal requirement. Mississippi law requires that all drivers carry at least the minimum amount of liability insurance in order to register and drive a motor vehicle. Failure to do so can result in license and registration suspension or revocation, fines, and possible jail time.

Second, liability insurance is important because it can help protect you financially if you are held responsible for an accident. Without liability insurance, you may be liable for any medical bills, lost wages, and property damage resulting from the accident. This can be a financial burden that could put you in a difficult financial situation.

How To Find Cheap Liability Car Insurance In Mississippi

If you are looking for cheap liability car insurance in Mississippi, there are several steps you can take to help you find the best possible rate. First, it is important to shop around and get quotes from several different insurance companies. Comparing rates from different companies can help you find the most affordable policy for your needs.

Second, it is important to make sure that you are aware of any discounts that you may be eligible for. Many insurance companies offer discounts for drivers who have a good driving record, those who drive fewer miles, and those who install safety devices in their vehicles. Be sure to ask your insurance provider about any discounts that may be available.

Finally, it is important to consider raising your deductible. The higher the deductible you choose, the lower your premiums will be. It is important to remember, however, that if you do get into an accident, you will be responsible for the full amount of the deductible.

Why Choose Us For Liability Car Insurance In Mississippi?

At XYZ Insurance, we understand the importance of finding the right liability car insurance for your needs. We are dedicated to providing you with the best possible coverage at an affordable price. Our team of experienced agents will help you find the coverage that is right for you and your budget. We also offer a variety of discounts that can help you save even more on your policy.

In addition, we offer 24-hour customer service and a variety of payment options to make paying for your policy easy. We also offer online tools to help you find the best rate for your policy. No matter what your needs are, we can help you find the right liability car insurance in Mississippi.

Get A Quote Today

If you are looking for liability car insurance in Mississippi, contact us today for a free quote. Our agents are standing by to help you find the coverage you need at a price that fits your budget. Don’t wait – get a quote today and start saving on your liability car insurance.

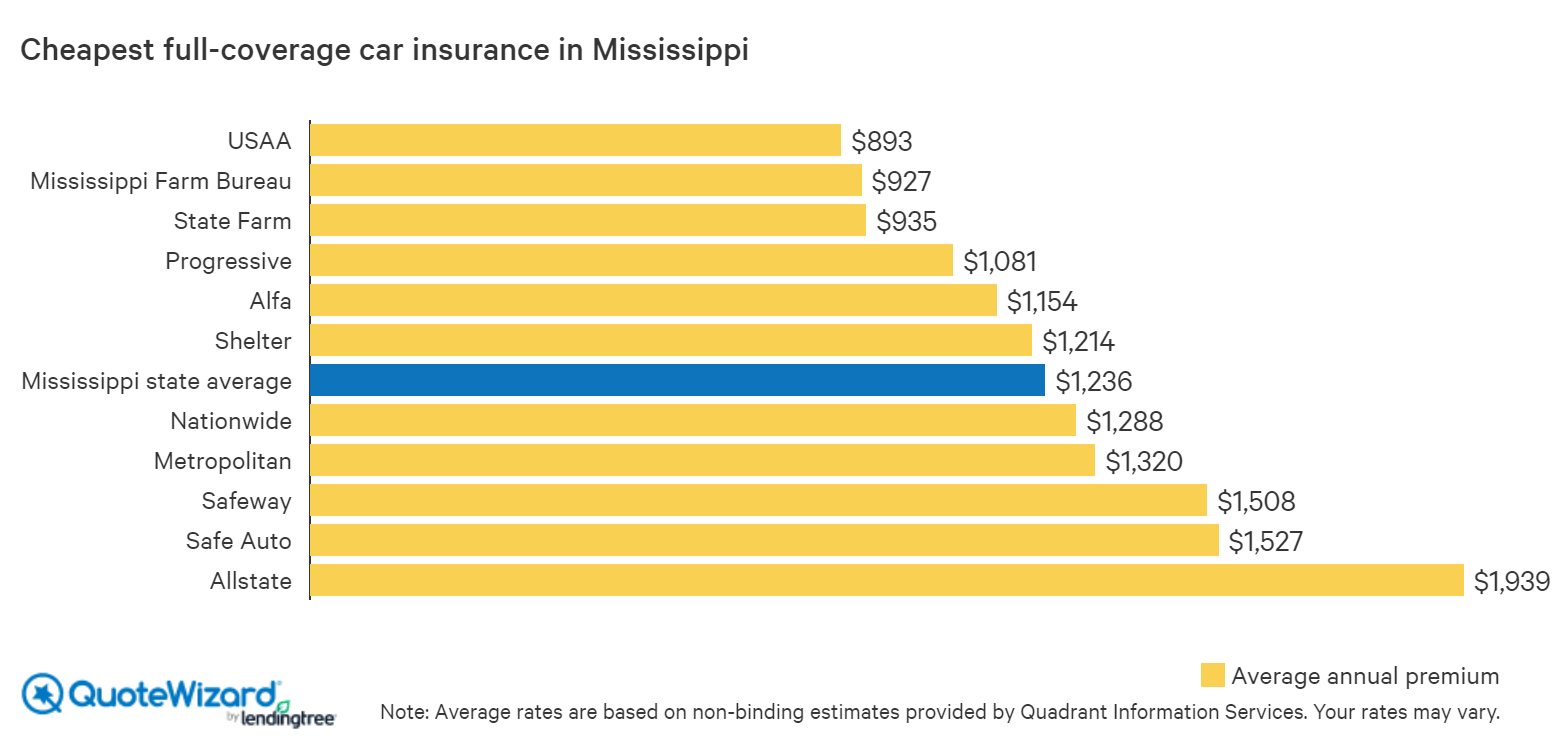

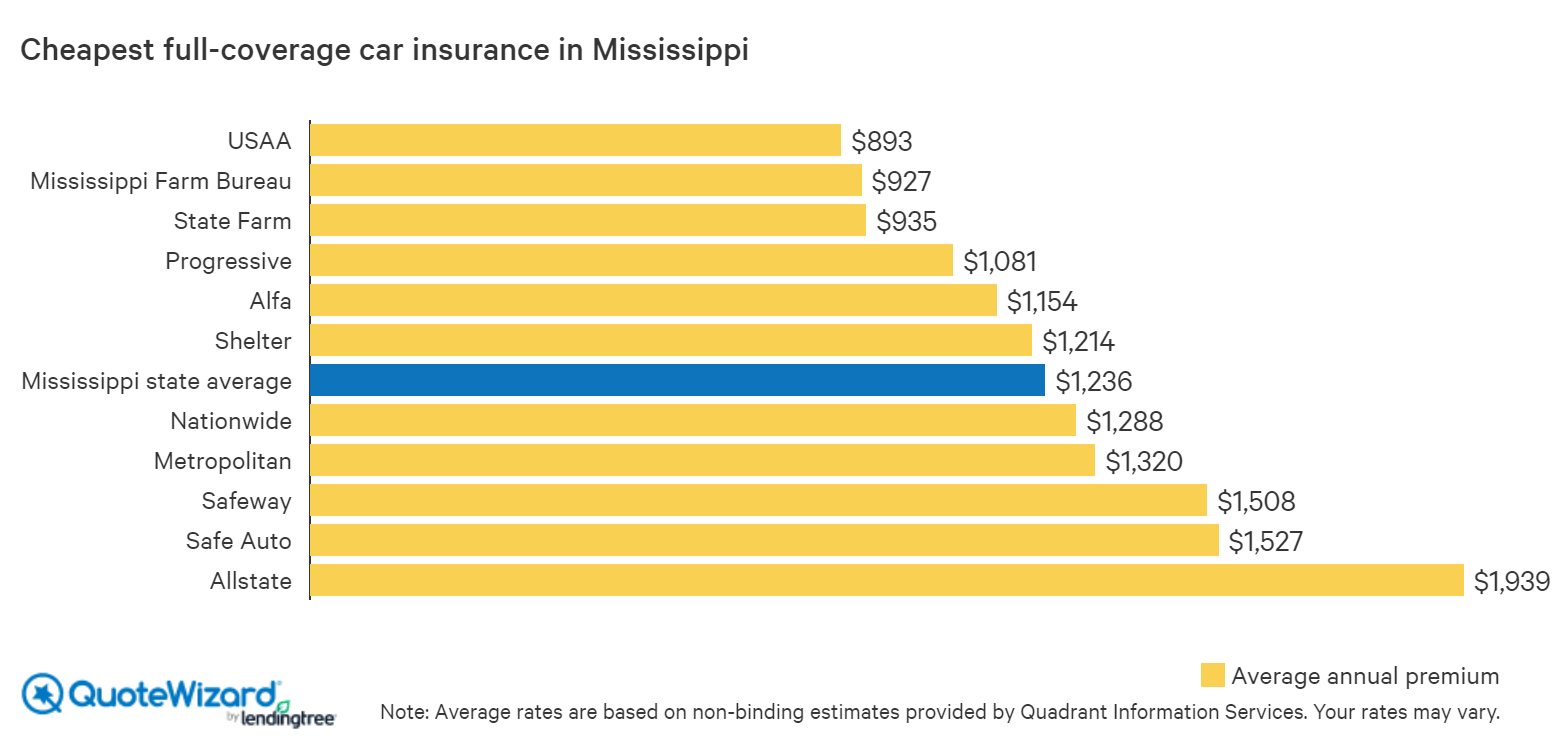

Get Cheap Car Insurance in Mississippi | QuoteWizard

Cheap Car Insurance in Mississippi 2019

Cheap Car Insurance in Mississippi 2019

Territorial Limits Car Insurance

Cheap Liability Car Insurance Ga - blog.pricespin.net