Car Insurance Quotes Over 50s

Comparing Car Insurance Quotes Over 50s

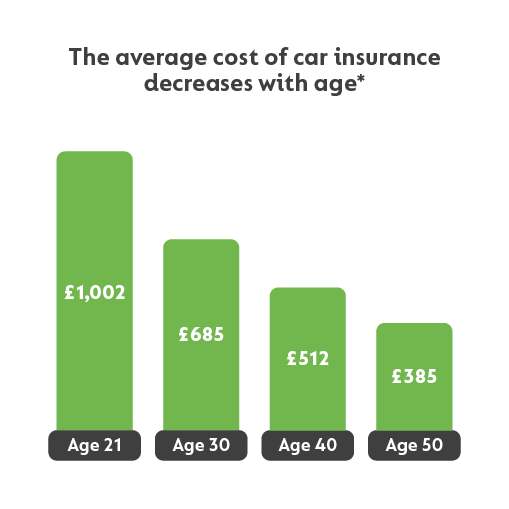

When it comes to car insurance, drivers over the age of 50 can often find they are eligible for a discounted rate. Many companies offer car insurance quotes over 50s, as they recognize that drivers over this age have gained a wealth of experience on the roads over the years and are therefore less likely to be involved in road traffic accidents. However, with so many companies offering car insurance for over 50s, how can you make sure that you get the best deal?

Shop Around for the Best Price

When looking for car insurance quotes over 50s, it is important to shop around to make sure you get the best deal. Don’t just settle for the first quote you come across, as there is likely to be better deals available if you take the time to compare. It is also important to bear in mind that the cheapest quote isn’t necessarily the best, as you need to make sure the policy covers you adequately in the event of an accident.

Decide on the Level of Cover You Need

When looking for car insurance over 50s, it is important to decide on the level of cover you need. Third party only is the minimum level of insurance required by law, however this type of policy only covers damage to other vehicles, not your own. If you want your vehicle to be covered, you need to look at third party, fire and theft policies or comprehensive cover. The more cover you opt for, the more expensive the policy will be, so it is important to weigh up the cost against the level of cover.

Check for Additional Benefits

When looking for car insurance over 50s, it is worth checking for any additional benefits that you may be eligible for. Many companies offer extra benefits to their over 50s customers, such as courtesy cars, breakdown cover and legal protection. These additional benefits can add to the cost of the policy, but they can also provide peace of mind in the event of an accident.

Provide Accurate Information

When applying for car insurance over 50s, it is important to provide accurate information about your vehicle and your driving experience. Providing incorrect or false information can invalidate your policy, so it is vital that you are honest about your vehicle and your driving history. If you have been involved in any accidents or traffic offences, you should make sure that you declare these to your insurer, as failure to do so could lead to your policy being cancelled.

Keep a Look Out for Discounts

When looking for car insurance quotes over 50s, it is worth keeping an eye out for any discounts that may be available. Many companies offer discounts for drivers over 50 who have held a full driving licence for a certain number of years. It is also worth checking to see if you are eligible for any other discounts, such as those for people who have taken a defensive driving course or fitted an approved security system to their vehicles.

Getting the right car insurance over 50s can be a tricky process, but if you shop around and compare quotes you should be able to find a policy that suits your needs and budget. Keep an eye out for any discounts that may be available, and make sure that you provide accurate information when applying for a policy, as this will help to ensure that you get the best deal.

30 Lovely Car Insurance Quotes for Over 50s

Compare Over 50s Car Insurance Quotes at GoCompare

Car Insurance for the Elderly and Over 50's

20 Life Insurance Quotes Over 50 With Photos | QuotesBae

Pin on Auto