Capital One Auto Loan Deferment Policy

Capital One Auto Loan Deferment Policy

What Is an Auto Loan Deferment?

An auto loan deferment is a form of financial relief that allows borrowers to temporarily postpone making payments on their auto loans. This type of deferment is generally used by borrowers who are experiencing financial hardship or who simply cannot afford to make their scheduled payments. In most cases, the deferment period will be determined by the lender and will usually only last for a few months. During this time, the borrower is not required to make any payments on their auto loan.

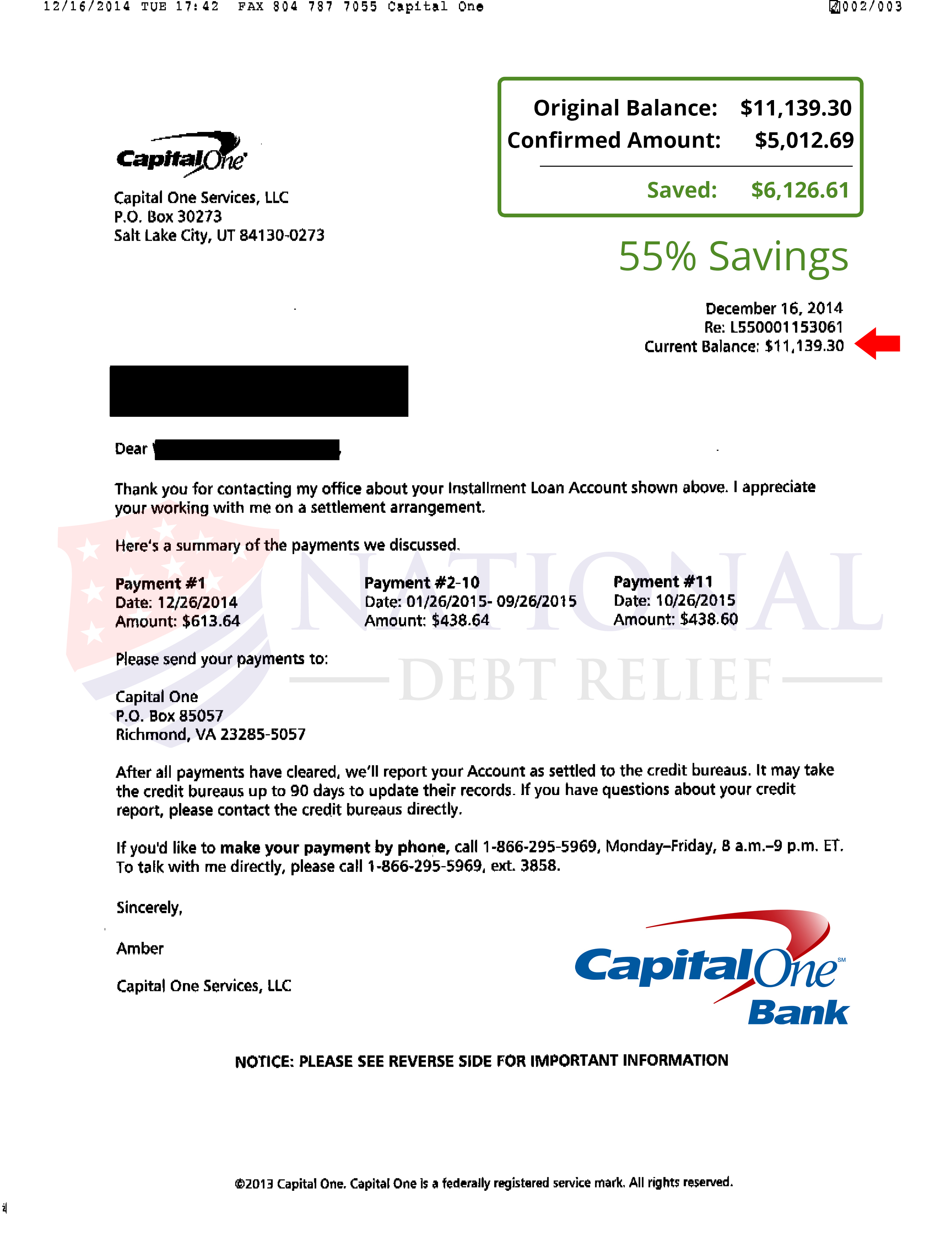

Capital One Auto Loan Deferment Policy

Capital One offers auto loan deferment to its customers who are experiencing financial difficulties. The deferment period is typically three months, although it can be extended up to six months in some cases. During the deferment period, no payments are required on the auto loan and borrowers will not incur any additional fees or interest charges. However, borrowers are still responsible for any late fees that may have been assessed prior to the deferment. Additionally, to be eligible for deferment, borrowers must be current on all of their other loan payments.

How to Apply for Capital One Auto Loan Deferment?

If you are a Capital One customer who is experiencing financial difficulty, you can apply for an auto loan deferment. To do so, you will need to contact the Capital One customer service team and explain your situation. The customer service team will then review your application and may request additional information to determine if you are eligible for deferment. Once your application is approved, the deferment period will begin and you will not be required to make any payments on your loan during this time.

What Happens After the Deferment Period?

Once the deferment period ends, the borrower will be responsible for resuming their auto loan payments. This typically means making larger payments than usual to make up for the missed payments. In some cases, the lender may also extend the loan term to make the payments more manageable. Additionally, depending on the lender’s policies, late fees and interest charges may be waived during the deferment period.

What Are the Benefits of Capital One Auto Loan Deferment?

The primary benefit of Capital One’s auto loan deferment policy is that it provides borrowers with much-needed financial relief during difficult times. It allows borrowers to postpone their loan payments for a short period of time, allowing them to focus on other financial matters. Additionally, since no interest or fees are charged during the deferment period, borrowers can save money by avoiding these charges.

Conclusion

Capital One’s auto loan deferment policy is a great way for borrowers to get temporary financial relief during difficult times. The deferment period is typically three months, although it can be extended to six months in some cases. During this time, no payments are required and borrowers can save money by avoiding interest and late fees. However, borrowers are still responsible for resuming their payments after the deferment period and may incur additional charges.

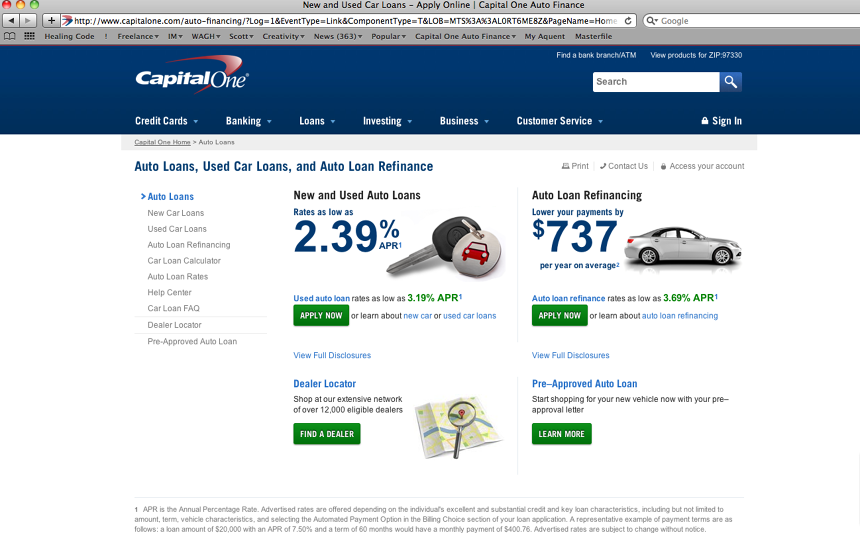

Capital One Auto Finance: In-Depth Review For 2020 | SuperMoney!

Take Over Payment Cars No Credit Check: Capital One Auto Finance

jadedesigntech: Capital One Auto Finance Contact Number

Capital One Auto Finance Pre Approval

Capital One Auto Finance - scott mcdougal copywriting portfolio