Bank Of Scotland Car Insurance Cooling Off Period

Everything You Need to Know About Bank of Scotland Car Insurance Cooling Off Period

What is the Bank of Scotland Car Insurance Cooling Off Period?

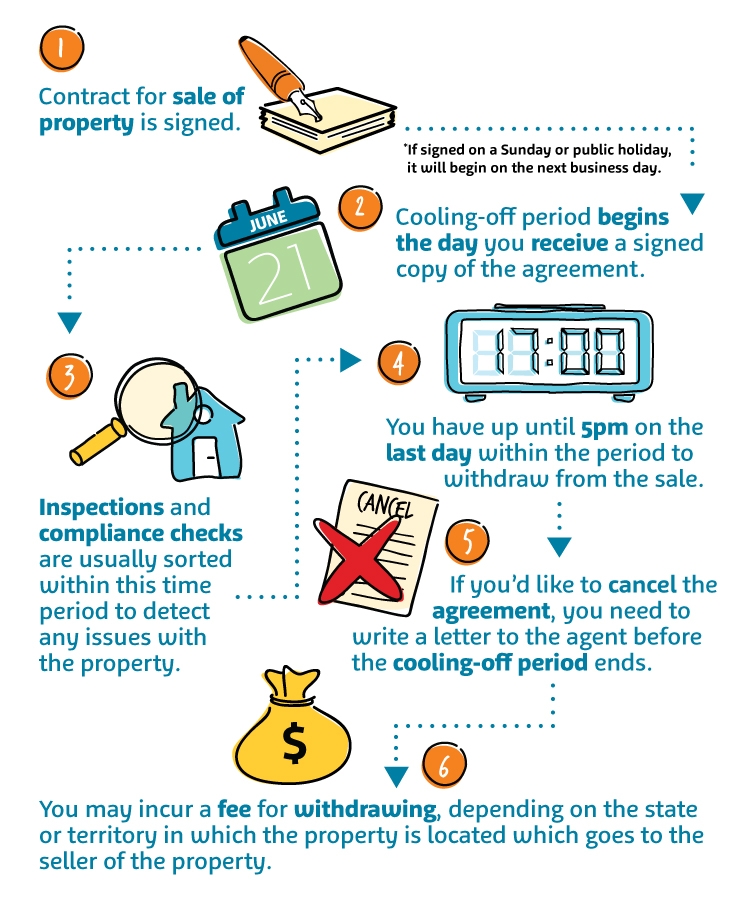

The Bank of Scotland Car Insurance Cooling Off Period is a set amount of time after the purchase of your car insurance policy in which you can cancel the policy and receive a refund of your premiums. This cooling off period is provided by the Financial Conduct Authority (FCA) to ensure that customers have the right to cancel their policy if they feel that the policy is not right for them. The cooling off period allows customers to review their policy and make sure that they are happy with it before committing to the policy.

The cooling off period is 14 days from the date of purchase, so you have 14 days from the date of purchase to decide if the policy is right for you. If you decide to cancel your policy within the cooling off period then you will be entitled to a full refund of the premiums that you have paid.

What Happens After the Bank of Scotland Car Insurance Cooling Off Period?

Once the Bank of Scotland Car Insurance Cooling Off Period has expired, you will no longer be able to cancel your policy and receive a full refund of your premiums. However, you may still be able to cancel your policy and receive a partial refund of your premiums. This will depend on the terms and conditions of your policy and the amount of time that has passed since the policy was purchased.

If you do decide to cancel your policy after the cooling off period has expired then you should contact the Bank of Scotland as soon as possible to find out what your options are. You may also be able to transfer your policy to another provider if you are unhappy with the terms and conditions of your policy.

What Should I Do Before the Bank of Scotland Car Insurance Cooling Off Period Expires?

Before the Bank of Scotland Car Insurance Cooling Off Period expires, it is important that you read through the terms and conditions of your policy carefully. Make sure that you are happy with all of the terms and conditions of the policy and that you understand what is covered and what is not covered. It is also important to make sure that you are aware of any excesses or restrictions that may apply to your policy.

It is also important to make sure that you are aware of the cooling off period and when it expires. You should make a note of the date so that you know when to review your policy and make sure that it is still suitable for you. If you are not happy with the policy then you should consider cancelling it during the cooling off period.

Can I Make Changes to My Bank of Scotland Car Insurance Policy During the Cooling Off Period?

Yes, you can make changes to your Bank of Scotland Car Insurance Policy during the cooling off period. This includes changing the cover or the amount of cover that you have, or changing the excess or the payment terms. It is important to note that any changes that you make to your policy during the cooling off period may affect the amount of refund that you are entitled to if you decide to cancel your policy.

It is also important to remember that you can only make changes to your policy during the cooling off period. Once the cooling off period has expired you will not be able to make any changes to your policy unless you cancel it and take out a new policy.

What Should I Do if I Have Any Questions About My Bank of Scotland Car Insurance Policy?

If you have any questions about your Bank of Scotland Car Insurance Policy then you should contact the Bank of Scotland as soon as possible. The Bank of Scotland has a dedicated customer service team who will be able to answer any questions that you may have about your policy. They will also be able to help you with any changes or cancellations that you may need to make.

It is important to remember that the Bank of Scotland Car Insurance Cooling Off Period is a set amount of time in which you can cancel your policy and receive a refund of your premiums. You should make sure that you are happy with the policy before the cooling off period expires, as after this time you will be unable to cancel your policy and receive a full refund of your premiums.

Cooling Off Period Sign | BPI Dealer Supplies

What happens in the cooling-off period? - Mortgage Choice

Postal Worker Union Proposes 30-Day Cooling Off Period

Bank of Scotland damned by Judge as 'unconscionable' after it 'double

Bank of Scotland releases AI virtual assistant for its mobile app