Average Price In Nh Of Single Car Insurance

What is the Average Price of Single Car Insurance in New Hampshire?

If you are in the market for a new car, you may be wondering how much single car insurance will cost in New Hampshire. The cost of car insurance in the state varies depending on several factors, such as the type of vehicle you own, your driving record, and the type of coverage you select. To determine the average cost of single car insurance in New Hampshire, it is important to understand the factors that affect premiums.

New Hampshire's Insurance Laws

New Hampshire is one of the few states that does not require drivers to carry minimum levels of auto insurance. That being said, if you are financing or leasing a vehicle, your lender may require you to maintain a certain level of coverage. Additionally, if you have been found at fault in an accident, you may be required to carry higher coverage limits. In New Hampshire, motorists can choose to purchase liability-only coverage, or opt for more comprehensive coverage such as collision and comprehensive.

Factors That Affect Premiums

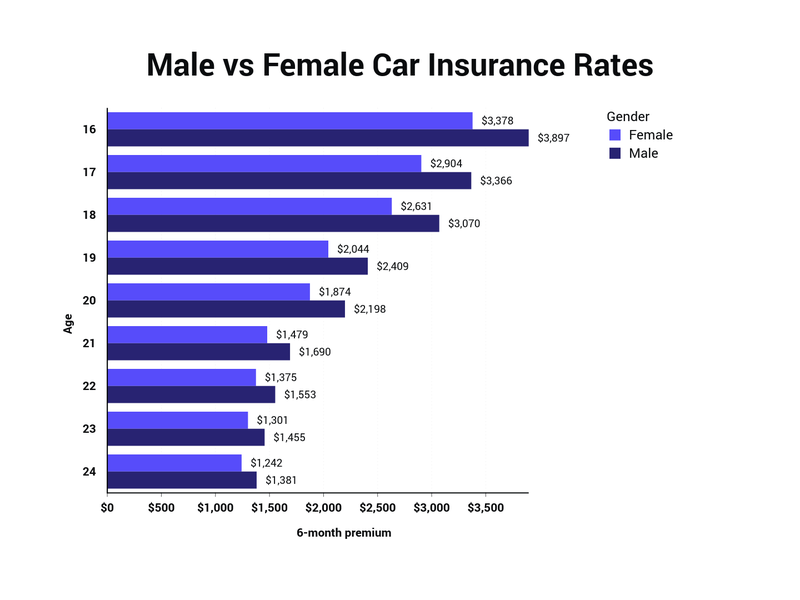

When determining the cost of car insurance in New Hampshire, there are a number of factors that can affect premiums. These include the type of vehicle you own, your age and driving record, the type of coverage you select, and the deductible you choose. The type of vehicle you own can have a significant impact on the cost of your premium, as some vehicles are more expensive to insure than others. Additionally, your age and driving record can also affect your premium, as young drivers and those with a history of accidents or traffic violations can be charged higher premiums.

Average Cost of Single Car Insurance in New Hampshire

The average cost of single car insurance in New Hampshire varies depending on the factors mentioned above. According to the Insurance Information Institute, the average annual premium for liability-only coverage in the state is $478, while the average annual premium for full coverage is $1,179. Drivers who select higher deductibles and add additional coverages, such as rental car reimbursement, can expect to pay more than the average.

Tips to Save on Car Insurance in New Hampshire

There are several ways to save on car insurance in New Hampshire. Many insurers offer discounts for safe drivers, so if you have a clean driving record, you may be eligible for lower premiums. Additionally, you can save money by increasing your deductibles and opting for liability-only coverage if your vehicle is older. You can also bundle multiple policies with one insurer to get a discount. Finally, be sure to shop around and compare quotes from multiple insurers to find the best rate.

ALL You Need to Know About the Average Car Insurance Cost

Average Car Insurance California - What Car Insurance Companies Don't

Average Price Of Car Insurance Per Month - designby4d

Average Car Insurance Rates by Age and Gender Per Month