Average Cost Of Insurance For Tesla Model 3

Monday, January 22, 2024

Edit

Average Cost of Insurance for Tesla Model 3

What is the Tesla Model 3?

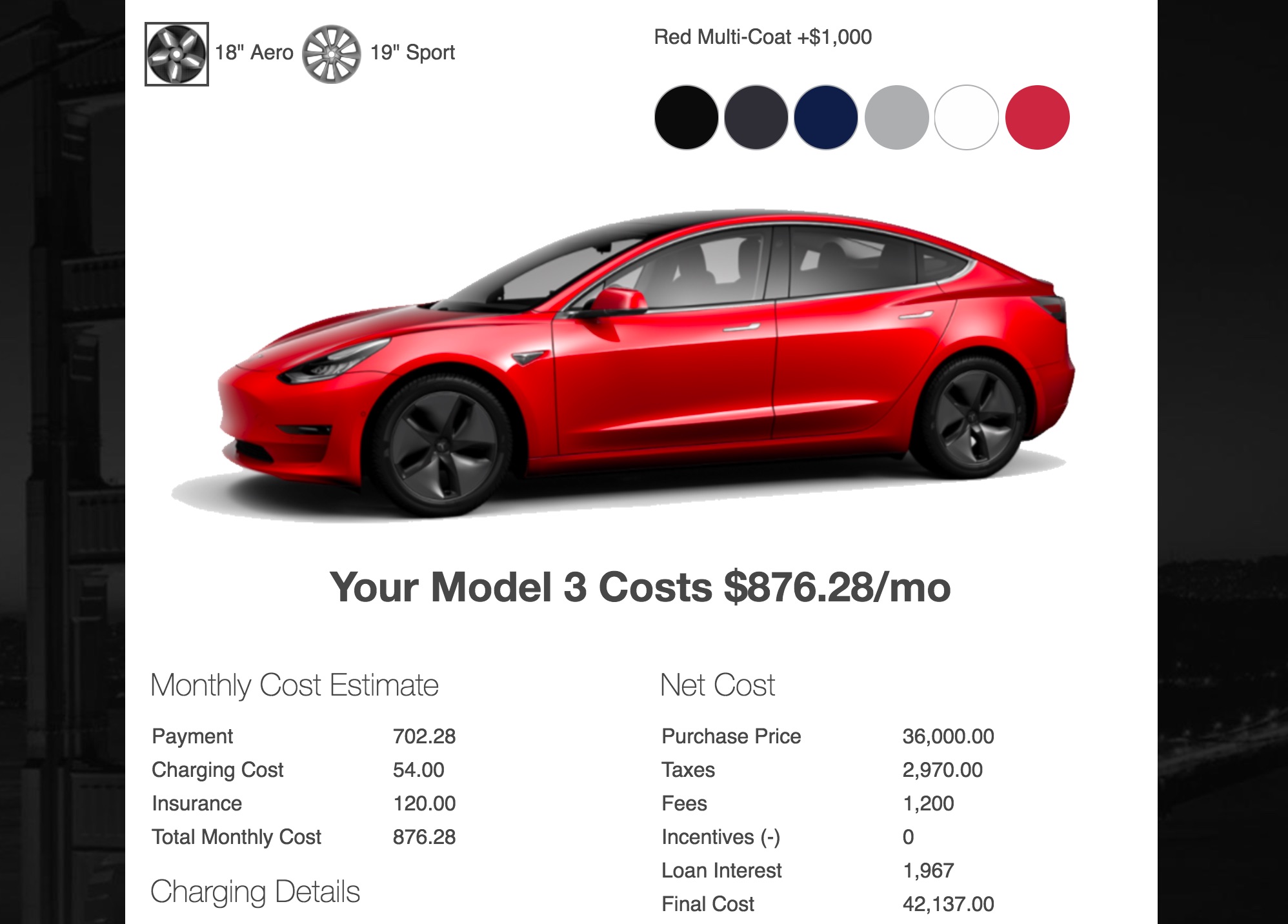

The Tesla Model 3 is a mid-sized, all-electric, four-door sedan. It was first released in July 2017 and has quickly become one of the most popular electric cars on the market. The Model 3 is the most affordable Tesla, with a starting price of just over $35,000. It has a range of up to 310 miles on a single charge, and a top speed of 145 mph. The Model 3 also has a number of advanced features, such as Autopilot driver assistance, a 15-inch touchscreen control center, and an all-glass roof.

What is the Average Cost of Insurance for a Tesla Model 3?

The average cost of insurance for a Tesla Model 3 is about $1,500 to $2,000 a year, depending on where you live and the type of coverage you get. The cost of insurance for a Tesla Model 3 is higher than for other vehicles in the same class because of the car’s high price tag and the cost of repairing its advanced technology. Additionally, electric cars are generally more expensive to insure than gas-powered vehicles.

Factors That Affect the Cost of Insurance for a Tesla Model 3

There are several factors that can affect the cost of insurance for a Tesla Model 3. These include your age, driving record, where you live, and the type of coverage you purchase. Your age is a major factor in determining your insurance rate. Generally, younger drivers will pay more for insurance than older drivers. Your driving record can also have a big impact on your insurance rate. Drivers with a history of traffic violations or accidents will typically pay more for insurance.

Where you live can also affect the cost of insurance. Insurance rates tend to be higher in cities with higher population densities than in rural areas. Additionally, some states require drivers to purchase certain types of coverage, such as comprehensive or collision, which can increase your insurance costs.

Tips for Saving on Insurance for a Tesla Model 3

There are several ways to save money on insurance for a Tesla Model 3. One of the best ways to save money is to shop around for the best rates. Different insurance companies offer different rates, so it’s important to compare quotes from multiple companies. Additionally, you may be able to get a discount if you buy multiple policies from the same insurer.

You can also save money by increasing your deductible. A higher deductible means you’ll have to pay more out of pocket if you need to make a claim, but it can also lead to lower premiums. Lastly, consider bundling your home and auto insurance policies. Many insurance companies offer discounts for bundling policies, so you may be able to save money by purchasing both policies from the same insurer.

Conclusion

The average cost of insurance for a Tesla Model 3 is higher than for other vehicles in the same class. However, there are several ways to save money on insurance for your Tesla. Shopping around for the best rates, increasing your deductible, and bundling your policies can all help you save money on insurance for your Tesla Model 3.

Here's How Tesla Model 3 Is Cheaper To Own Than Toyota Camry

how much does it cost to fill a tesla model 3 - www.summafinance.com

Tesla Model 3 Insurance Cost for 2021 [Rates + Free Comparison Quotes]

![Average Cost Of Insurance For Tesla Model 3 Tesla Model 3 Insurance Cost for 2021 [Rates + Free Comparison Quotes]](https://mk0insuravizcom0fmqo.kinstacdn.com/wp-content/uploads/dataviz/model-3-insurance-summary-cid81837.png)

Does It Cost More to Insure a Tesla Model 3 Than a Gasoline Car

Tesla Insurance: Information Arbitrage To Save You Money