Average Cost Of Full Coverage Car Insurance In Michigan

Average Cost Of Full Coverage Car Insurance In Michigan

What Is Full Coverage Car Insurance?

Full coverage car insurance is a type of insurance that provides protection for your vehicle in the event of an accident, theft, or other damage. It is the most comprehensive type of insurance available, and it includes liability coverage, collision coverage, personal injury protection, and uninsured motorist coverage. In Michigan, it is mandatory for drivers to have some form of full coverage car insurance in order to be legally allowed to operate a motor vehicle.

What Does Full Coverage Car Insurance Cost?

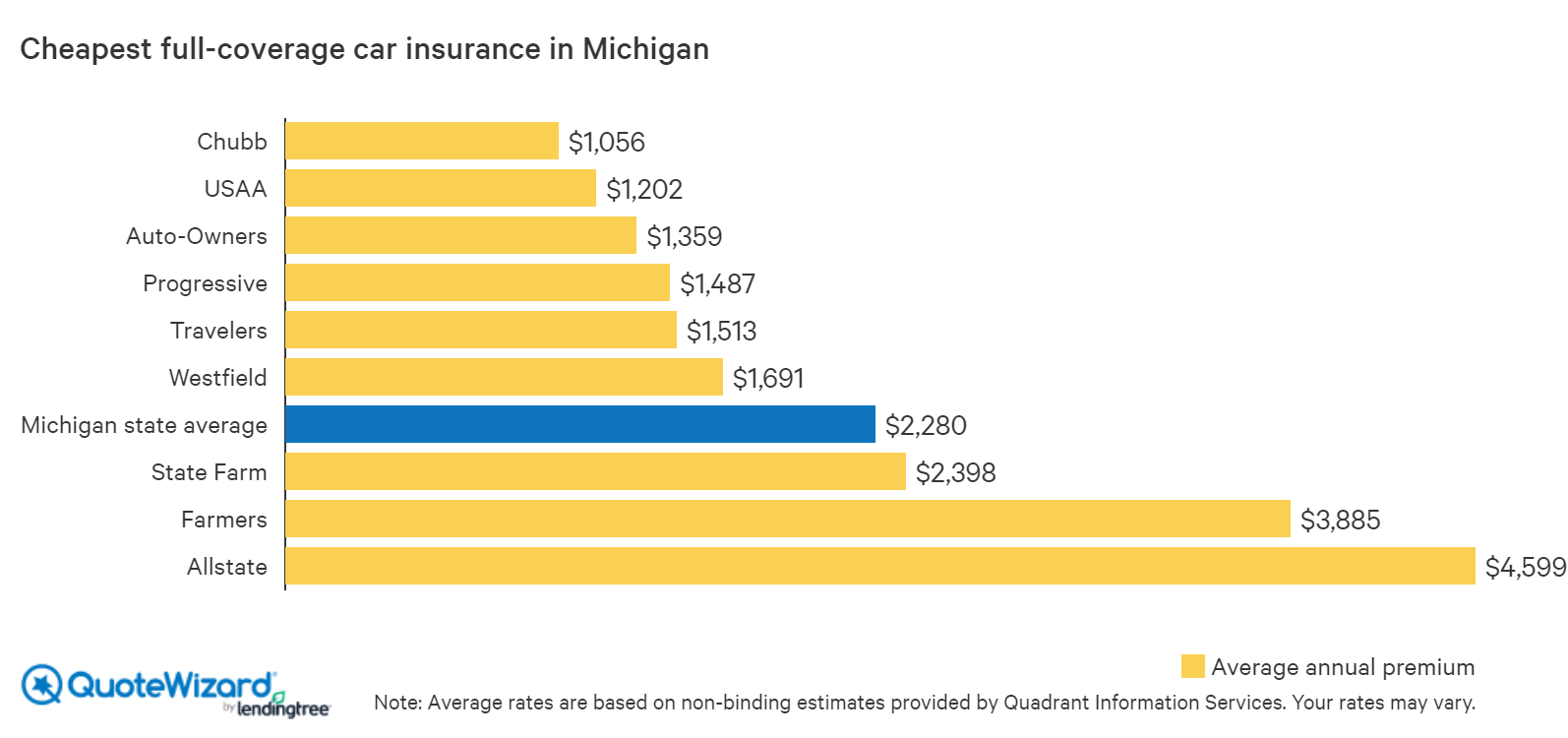

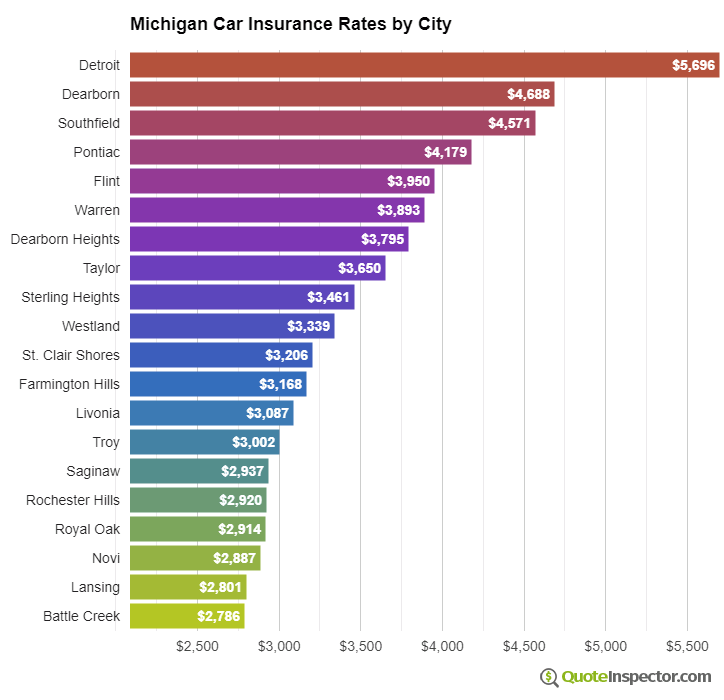

The cost of full coverage car insurance in Michigan is determined by several factors, including the type of vehicle you drive, your driving record, the amount of coverage you need, and your age. Generally speaking, the average cost of full coverage car insurance in Michigan is about $2,200 per year, although this can vary greatly depending on the factors mentioned above. However, it is important to note that this is only an average cost and that your actual cost may be significantly different.

How Can I Lower My Car Insurance Costs?

There are several ways to lower your car insurance costs in Michigan. One of the most effective ways is to compare rates from different insurance companies. This will allow you to find the best rates available. Additionally, you can also look for discounts such as good driver discounts, multi-policy discounts, and low-mileage discounts. Additionally, you can also consider raising your deductible, which can significantly lower your premiums.

What Is No-Fault Insurance?

No-fault insurance is a type of car insurance that is required in Michigan. This type of insurance is designed to provide coverage for medical bills and lost wages for the driver and passengers in the event of an accident, regardless of who is at fault. It is important to note that no-fault insurance does not cover damage to vehicles.

Conclusion

The cost of full coverage car insurance in Michigan can vary widely depending on several factors, including the type of vehicle you drive, your driving record, the amount of coverage you need, and your age. Additionally, there are several ways to lower your car insurance costs, including comparing rates from different companies, looking for discounts, and raising your deductible. Finally, it is important to note that no-fault insurance is required in Michigan and provides coverage for medical bills and lost wages in the event of an accident.

Find Out Which States Have the Most Expensive Car Insurance Rates in 2018

Cheapest Car Insurance in Michigan | QuoteWizard

Michigan Car Insurance Information

Average Full Coverage Car Insurance For 20 Year Old

Best Car Insurance In Michigan / Best Cheap Car Insurance Companies