Average Car Insurance Cost Monthly

Average Car Insurance Cost Monthly

What is the Average Car Insurance Cost Monthly?

When looking to purchase car insurance, one of the most important factors to consider is the cost. Knowing the average car insurance cost monthly can help you plan your budget and decide which type of coverage you need. Depending on the state you live in, the type of vehicle you drive, and the type of coverage you select, the cost of car insurance can vary significantly.

Factors That Impact the Average Car Insurance Cost Monthly

The cost of car insurance is impacted by a variety of factors. These include the type of vehicle you drive, your driving record, the area you live in, and the type of coverage you choose. Insurance companies also consider your age, gender, and marital status when determining your premiums. All of these factors can affect the cost of your car insurance.

Type of Vehicle

The type of vehicle you drive can have a major impact on the cost of your car insurance. Generally, the more expensive the vehicle, the higher the cost of insurance. This is because luxury vehicles are often more expensive to repair or replace if they are damaged in an accident. Additionally, car insurance companies may consider certain makes and models of vehicles to be more risky than others, which could affect the cost of your premiums.

Driving Record

Your driving record is one of the most important factors that can affect the cost of your car insurance. If you have had any traffic violations or accidents, your insurance premiums may be higher than those with a clean driving record. Additionally, insurance companies may offer discounts for drivers with a proven track record of safe driving. Keeping a clean driving record is a great way to save money on car insurance.

Area You Live In

The area you live in can also have an impact on the cost of your car insurance. Insurance companies consider the population density, crime rate, and overall safety of an area when determining premiums. Generally, the higher the population density and crime rate, the higher the cost of insurance. Additionally, if you live in an area that is prone to natural disasters such as floods or earthquakes, your premiums may also be higher.

Type of Coverage

The type of coverage you select can also have an impact on the cost of your car insurance. Generally, the more extensive the coverage, the higher the cost. For example, if you choose to add comprehensive coverage, the cost of your premiums may be higher than if you choose a basic liability policy. Additionally, some insurance companies offer discounts for certain types of coverage, so it is important to shop around to find the best deal.

Conclusion

The average car insurance cost monthly can vary significantly depending on the state you live in, the type of vehicle you drive, and the type of coverage you choose. Additionally, your driving record, age, gender, and marital status can all have an impact on the cost of your premiums. It is important to do your research and shop around to find the best deal on car insurance.

The Best Average Cost Of Car Insurance 2022 - Dakwah Islami

ALL You Need to Know About the Average Car Insurance Cost

Average Price Of Car Insurance Per Month - designby4d

Average Cost of Car Insurance (2019) | Average Cost of Insurance

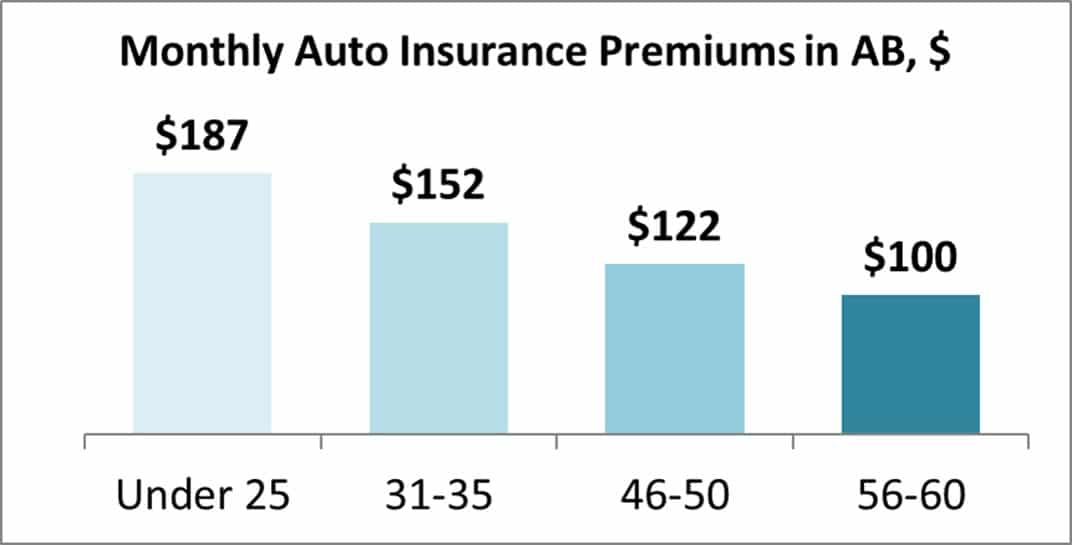

Alberta Car Insurance Costs Canadians on Average $122/month