When Should You Switch To Liability Only Car Insurance

When Should You Switch To Liability Only Car Insurance

If you own a car, you know that it is important to have car insurance. Car insurance helps protect your vehicle and covers you in the event of an accident. However, not all car insurance policies are created equal. One type of car insurance that is becoming increasingly popular is liability only car insurance. In this article, we will discuss when you should switch to liability only car insurance and what it offers.

What Is Liability Only Car Insurance?

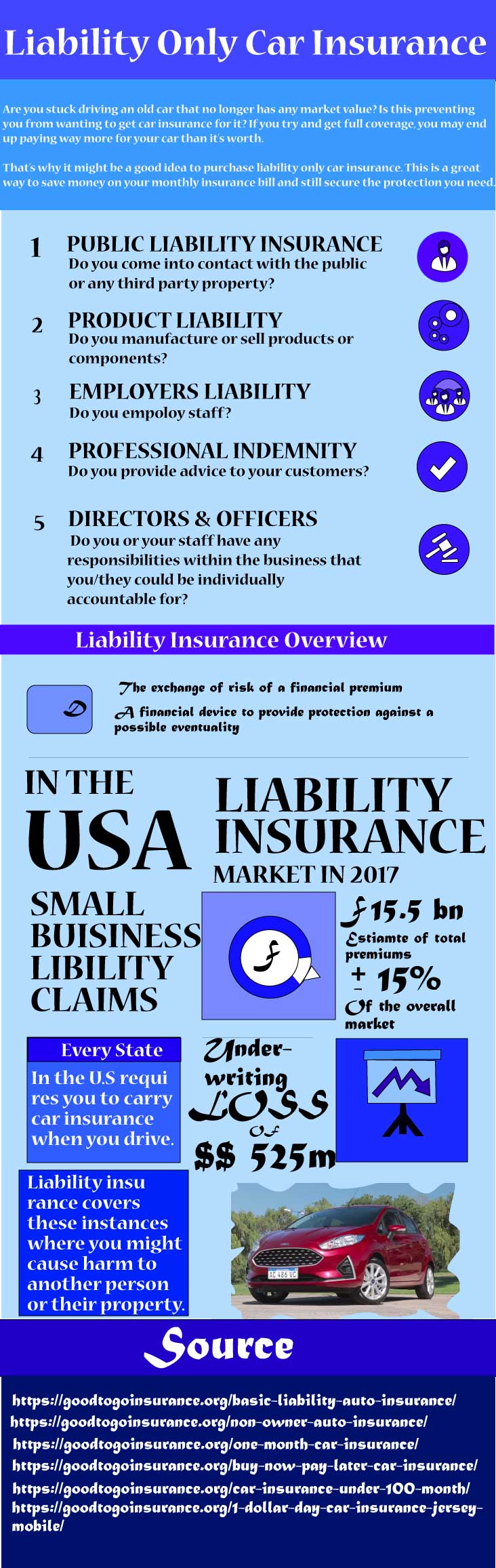

Liability only car insurance is a type of car insurance policy that is designed to provide coverage for third-party property damage and bodily injury. This type of policy does not provide coverage for your vehicle or your medical expenses. It only covers the expenses of the other person involved in an accident that you are deemed to be at fault for.

When Should You Switch To Liability Only Car Insurance?

When deciding whether or not to switch to liability only car insurance, there are several factors to consider. One factor is the age of your vehicle. If your vehicle is more than 10 years old, then switching to liability only car insurance may make sense. This is because the cost of repairing a 10-year-old vehicle may be greater than the cost of the insurance premiums. Another factor to consider is the cost of comprehensive and collision coverage for your vehicle. If the cost of these two types of coverage is more than 10% of the value of your vehicle, then switching to liability only car insurance may also make sense.

What Are The Benefits Of Liability Only Car Insurance?

There are several benefits of liability only car insurance. One benefit is that it is usually less expensive than comprehensive and collision coverage. This can be especially beneficial if you have an older vehicle. Another benefit is that you don’t have to worry about protecting your own vehicle. This can be a relief if your vehicle is older and not worth a lot of money. Finally, liability only car insurance can provide peace of mind knowing that you are covered in the event of an accident.

What Are The Drawbacks Of Liability Only Car Insurance?

The main drawback of liability only car insurance is that it does not provide coverage for your own vehicle. This means that if you are involved in an accident and your vehicle is damaged, you will have to pay for the repairs out of your own pocket. Additionally, it does not provide coverage for your medical expenses. This means that if you are injured in an accident, you will have to pay for your medical bills out of your own pocket.

Conclusion

Liability only car insurance is a great option for those who own an older vehicle and want to save money on car insurance premiums. However, it is important to understand the drawbacks of this type of insurance before making the switch. It is best to weigh the pros and cons of liability only car insurance and decide if it is the right choice for you.

What Does Liability Only For Auto Insurance Cover? - YouTube

Car Insurance Coverage: Let's Dig In A Little Deep | Star Nsurance Tampa

Liability Only Car Insurance | Liability goodtogo car insurance

Commercial Auto Insurance: Do I Have To Have Commercial Auto Insurance

What Is Car Insurance Liability? | Visual.ly