Third Party Liability Insurance Medicaid

Understanding Third Party Liability Insurance Medicaid

Third Party Liability Insurance Medicaid (TPL) is a type of insurance that is designed to protect health care providers in the event that another party is legally responsible for causing an injury or illness. It is typically provided by a liability insurance provider and is often included in health care plans. This type of insurance is important for medical providers as it can help cover any costs associated with an injury or illness that was caused by another party. It is also important for patients as it helps ensure that any medical expenses that are incurred due to a third-party's negligence are covered.

What Does Third Party Liability Insurance Cover?

TPL typically covers any costs that are associated with an injury or illness that was caused by another party. This includes medical bills, lost wages, and other expenses that may have been incurred due to the injury or illness. It is important to note that the coverage is limited to only those costs that were caused by the third-party's negligence. For example, if a patient was injured due to a medical error, the medical provider's TPL coverage would not cover the costs associated with the medical error.

What Is The Difference Between TPL and Health Insurance?

TPL is not the same as health insurance. Health insurance typically covers medical expenses that are incurred due to illness or injury, regardless of who is at fault. TPL, on the other hand, only covers medical expenses that were caused by the negligence of another party. This means that if a patient is injured due to their own negligence, the TPL coverage will not cover the costs associated with the injury.

Who Is Eligible For Third Party Liability Insurance?

Any individual who is enrolled in a health care plan that includes TPL coverage is eligible for TPL coverage. This includes individuals who are enrolled in Medicaid, Medicare, or private health insurance plans. It is important to note that the coverage is limited to those costs that were caused by the third-party's negligence. This means that if a patient was injured due to their own negligence, the TPL coverage will not cover the costs associated with the injury.

What Are The Benefits Of Third Party Liability Insurance?

TPL is beneficial for both medical providers and patients. For medical providers, it can help cover any medical expenses that were caused by a third-party's negligence and can help reduce the financial burden associated with an injury or illness. For patients, it can help ensure that any medical expenses that are incurred due to a third-party's negligence are covered. This can help provide financial security in the event that a patient is injured due to the negligence of another party.

In Conclusion

Third Party Liability Insurance Medicaid (TPL) is a type of insurance that is designed to protect health care providers in the event that another party is legally responsible for causing an injury or illness. It is typically provided by a liability insurance provider and is often included in health care plans. TPL typically covers any costs that are associated with an injury or illness that was caused by another party. Any individual who is enrolled in a health care plan that includes TPL coverage is eligible for TPL coverage. TPL is beneficial for both medical providers and patients as it can help cover any medical expenses that were caused by a third-party's negligence and can help provide financial security in the event that a patient is injured due to the negligence of another party.

How the MMIS Uses Third Party Liability Information

Medicaid Third-Party Liability: Savings Issues and Efforts – Nova

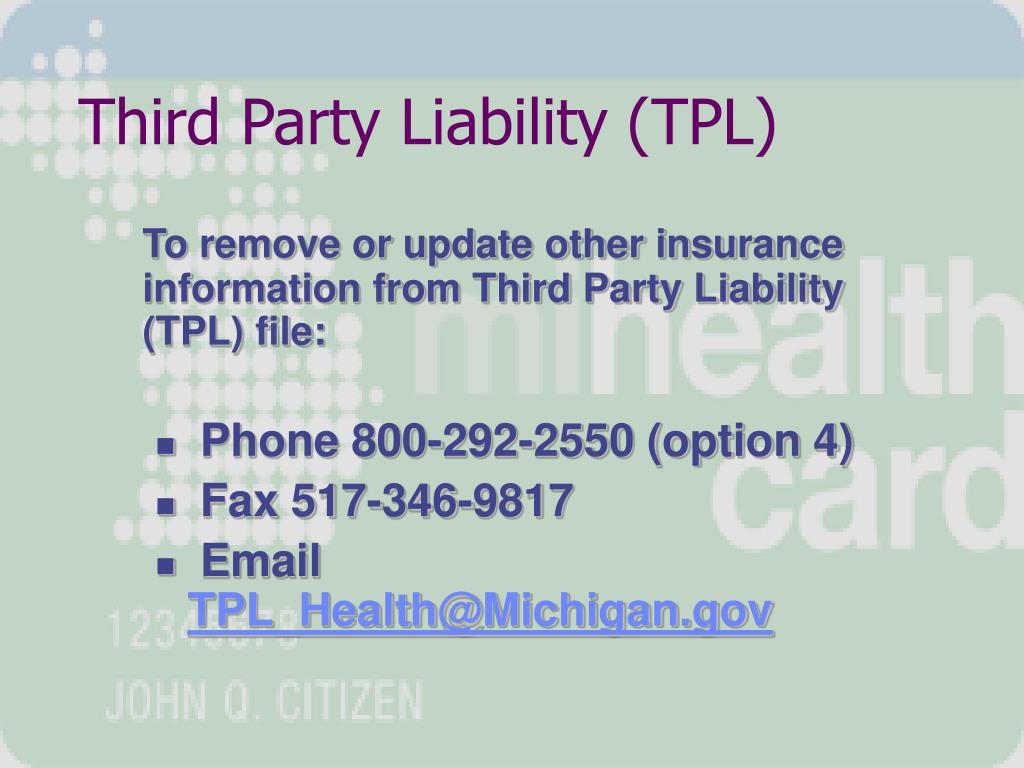

PPT - Medicaid Biller Training PowerPoint Presentation, free download

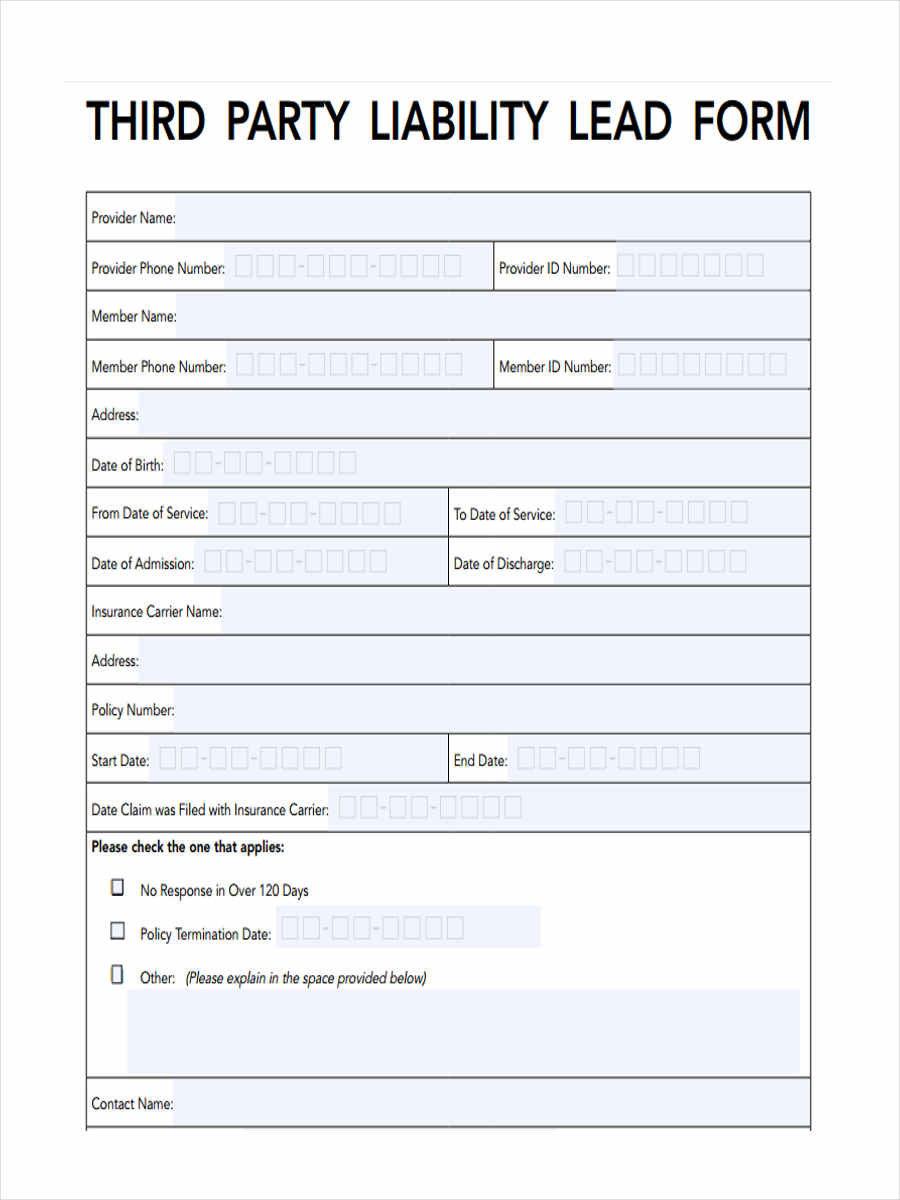

FREE 5+ Third Party Liability Forms in PDF