Temporary Car Insurance 3 Months

Sunday, December 3, 2023

Edit

Temporary Car Insurance 3 Months: What You Need to Know

Introduction

Are you in need of car insurance for a short period of time? If so, you may want to consider a temporary car insurance 3 months policy. Temporary car insurance is a great option if you only need coverage for a short amount of time. It can be used for a variety of situations, like a road trip, a seasonal job, or if you’re borrowing a car. A 3-month car insurance policy can provide coverage for exactly this amount of time. In this article, we’ll discuss what you need to know about temporary car insurance 3 months policies.

What is Temporary Car Insurance 3 Months?

A temporary car insurance 3 months policy provides coverage for a three-month period. This type of policy is typically offered by insurance companies and can be purchased for an amount of time ranging from one day to six months. The duration of the policy depends on the insurance company and the type of coverage you need.

Temporary car insurance is usually more expensive than an annual policy because it is for a shorter period of time. However, it is still a great option if you only need coverage for a limited time. It can be more cost-effective than getting an annual policy if you only need coverage for a few months.

Who is Eligible for Temporary Car Insurance 3 Months?

Most insurance companies offer temporary car insurance 3 months policies to drivers aged 18 and over. You may need to provide proof of identity and address in order to be eligible for a policy. The exact requirements may vary depending on the insurance company.

It’s important to note that some insurance companies may not offer temporary car insurance 3 months policies to drivers with certain types of driving histories. If you have had a DUI or other moving violations, it’s best to check with the insurance company before applying for a policy.

What Is Covered by a Temporary Car Insurance 3 Months Policy?

The type of coverage offered by a temporary car insurance 3 months policy depends on the insurance company. Generally speaking, most policies cover liability, collision, and comprehensive coverage. Liability coverage will protect you if you’re found liable for an accident that causes injury or damage to another person or their property. Collision coverage will pay for repairs if you’re involved in an accident with another vehicle. Comprehensive coverage will pay for repairs if your car is damaged by something other than a collision, like a fire, theft, or vandalism.

What Is Not Covered by a Temporary Car Insurance 3 Months Policy?

Like other types of car insurance, a temporary car insurance 3 months policy does not cover everything. Typically, these policies do not cover rental car coverage, towing and labor coverage, or coverage for custom parts and equipment. It’s important to check with the insurance company for specifics on what is and is not covered.

Conclusion

Temporary car insurance 3 months policies are a great option if you need car insurance for a short period of time. These policies can provide coverage for exactly three months and can be used for a variety of situations. It’s important to understand what is and is not covered by these policies before you purchase one. Be sure to compare different policies and check with the insurance company for specifics on what is covered.

3 Months Only Car Insurance Coverage - RateLab

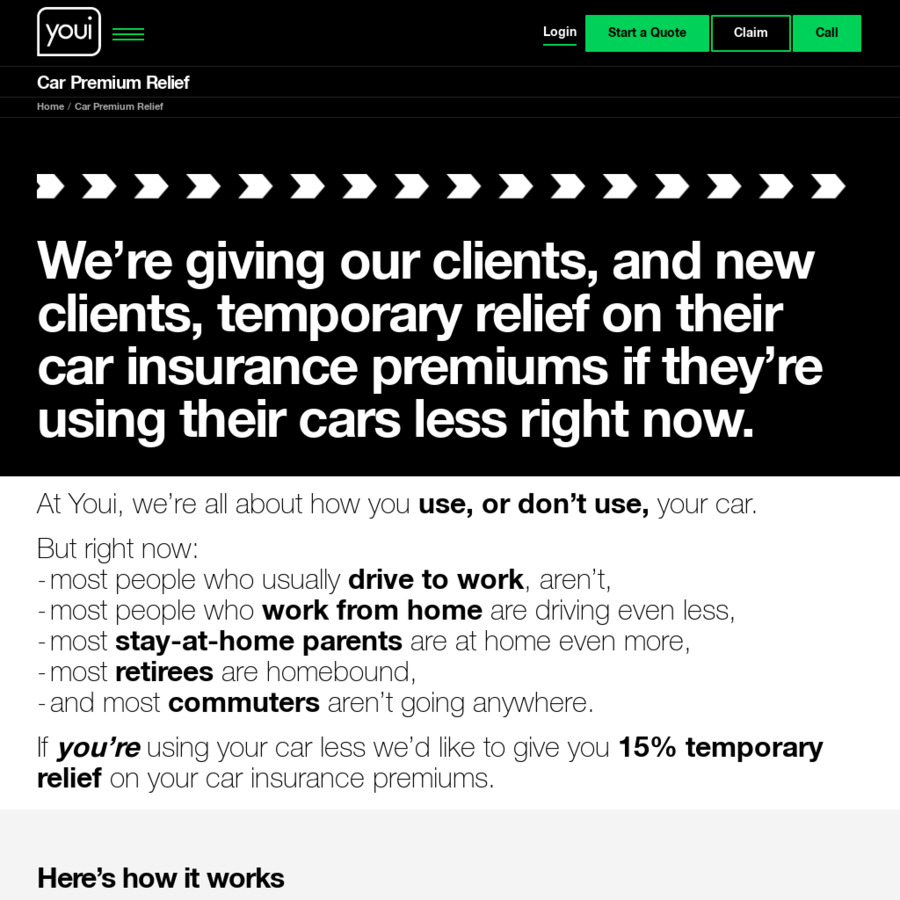

15% Temporary Relief on Your Car Insurance Premiums for 3 Months @ Youi

Reasons For Buying Affordable Car Insurance Policy for 3 Months by

2017 Temporary Car Insurance | A Convenient Way to Get Insured - YouTube

Temporary Car Insurance for New Drivers | Dayinsure