Ntuc Motor Insurance Application Form

Friday, December 15, 2023

Edit

How to Apply for NTUC Motor Insurance

Are you looking for a great way to protect your vehicle from unexpected mishaps? NTUC Motor Insurance is a great option for you. This type of insurance provides coverage for both accidental and mechanical damage to your vehicle. It also covers you for medical and hospital expenses, in case you get injured in an accident.

What is NTUC Motor Insurance?

NTUC Motor Insurance is a comprehensive motor insurance solution. It is designed to provide you with the peace of mind that comes with knowing that you are protected against any unforeseen circumstances. It covers you for any damage to your vehicle caused by accident, theft, fire, or any other unfortunate event. It also covers you for any medical expenses incurred in the event of an accident.

Why Should You Get NTUC Motor Insurance?

NTUC Motor Insurance provides you with a range of benefits. It covers you for any accidental damage or mechanical breakdown of your vehicle. It also provides you with coverage for medical and hospital expenses in case of an accident. Furthermore, it provides you with a 24-hour emergency service in the event of an accident.

How to Apply For NTUC Motor Insurance?

Applying for NTUC Motor Insurance is a relatively easy process. All you need to do is to fill out the Motor Insurance Application Form. This form can be accessed on the NTUC website. Once you fill out the form, you need to submit it with all the necessary documents such as your driving license, vehicle registration, and insurance policy details. After submitting the form, you will receive a confirmation email or SMS with the details of your application.

What are the Benefits of NTUC Motor Insurance?

NTUC Motor Insurance provides you with a range of benefits. It covers you for any accidental damage or mechanical breakdown of your vehicle. It also provides you with coverage for medical and hospital expenses in case of an accident. Additionally, it also offers a 24-hour emergency service in the event of an accident. Moreover, it also offers a wide range of optional benefits such as windscreen coverage and car rental reimbursement.

How Much Does NTUC Motor Insurance Cost?

The cost of NTUC Motor Insurance depends on the type of coverage that you choose. It also depends on the value of your vehicle and the type of vehicle you own. Generally, the cost of the policy is determined by a number of factors such as the type of vehicle, the age of the vehicle, the geographical location, and the level of coverage you choose.

Conclusion

NTUC Motor Insurance is a comprehensive motor insurance solution that is designed to provide you with the peace of mind that comes with knowing that you are protected against any unforeseen circumstances. It covers you for any damage to your vehicle caused by accident, theft, fire, or any other unfortunate event. It also provides you with coverage for medical and hospital expenses in case of an accident. Applying for NTUC Motor Insurance is a simple process and the cost of the policy depends on the type of coverage chosen.

Insurance Letter Of Guarantee - audreybraun

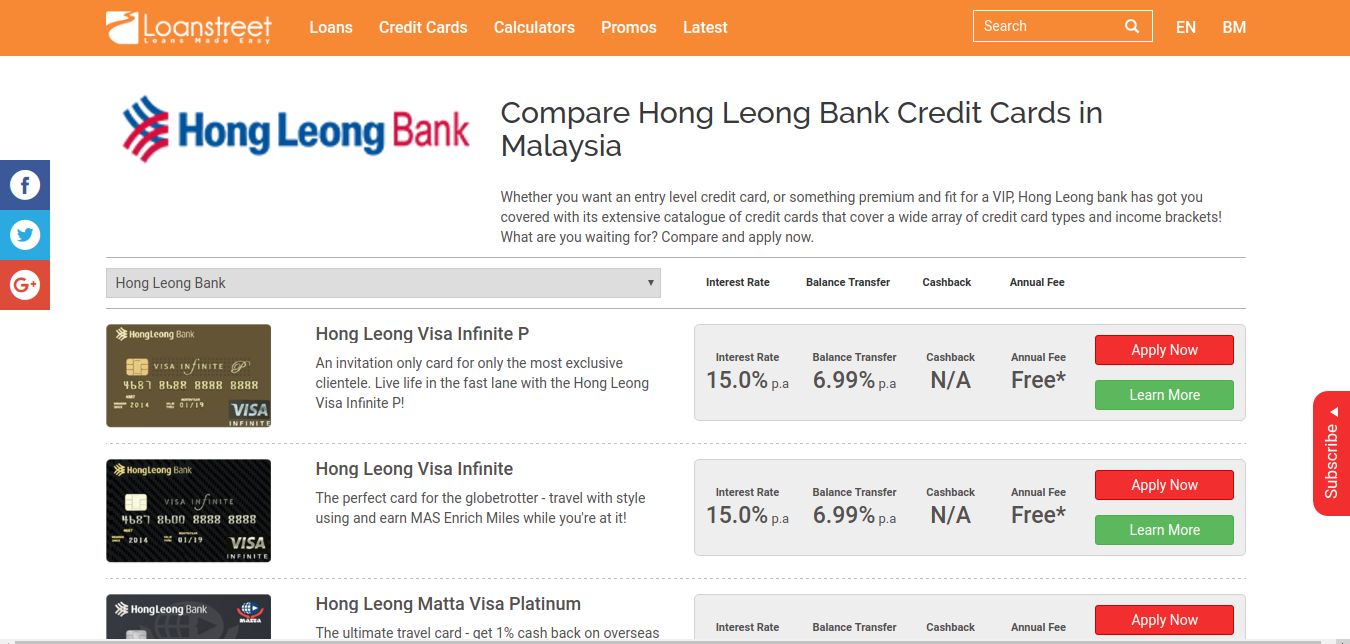

Hong Leong Finance Home Loan Application Form

Car Accident: Ntuc Car Accident

Foreign Worker Bond | Commercial Insurance | NTUC Income