Named Driver On Insurance Policy

Friday, December 22, 2023

Edit

Named Driver On Insurance Policy

What is Named Driver on an Insurance Policy?

A named driver policy is a type of insurance policy often used by drivers who are not the main driver of a vehicle but are occasionally allowed to drive it. It is an add-on to the main policy taken out by the driver who uses the vehicle most frequently. When a named driver policy is taken out, the person taking out the policy is the only person named on the policy. This means that only they are legally allowed to drive the vehicle, and if any other person is found to be driving it, the policy will be invalidated.

Who Should Take Out a Named Driver Policy?

Named driver policies are most often taken out by people who do not use a vehicle regularly, such as parents who want to allow their children to drive the family car or business owners who want to allow their employees to use company vehicles. It can also be taken out by drivers who already have a policy but want to add an additional driver to their policy – though doing this can often be cheaper than taking out a separate policy.

What Are the Benefits of a Named Driver Policy?

The main benefit of a named driver policy is that it can be cheaper than taking out a full policy. This is because the insurer is only taking on the risk of the named driver, rather than the risk of any other driver who might use the vehicle. It also means that if the named driver has a good driving record and no claims, their premiums can be lower than if they had taken out a full policy.

Are there Any Downsides to a Named Driver Policy?

The main downside to a named driver policy is that it does not provide full cover for the vehicle. This means that if the named driver is involved in an accident, the insurer may not pay out as much as they would with a full policy. It also means that if the vehicle is stolen or damaged in any way, the named driver will not be covered.

How Can I Get the Best Deal on a Named Driver Policy?

The best way to get the best deal on a named driver policy is to shop around and compare different policies from different insurers. It is also important to make sure that you are honest when providing information to the insurer – if you provide incorrect or incomplete information, this could invalidate the policy. It is also worth considering taking out a full policy instead of a named driver policy, as this may be cheaper in the long run.

In Conclusion

A named driver policy can be a good option for drivers who do not use a vehicle regularly, or for people who want to add an additional driver to their policy. While it can be cheaper than taking out a full policy, it is important to remember that it does not provide full cover for the vehicle and that the named driver may not be covered in certain circumstances. It is therefore important to shop around and compare different policies before taking out a named driver policy.

Named driver car insurance in Singapore

Named Insured Drivers Explained - What Is a Named Insured Driver?

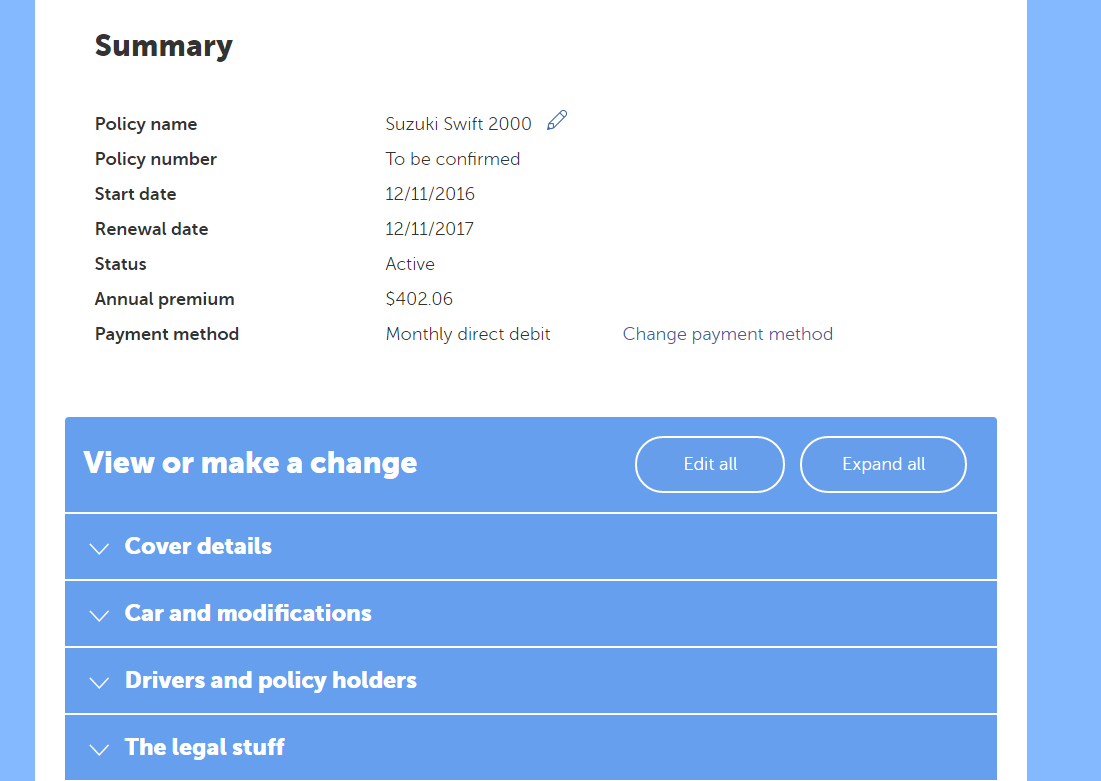

How to add a named driver – Help Centre

What is a Named Driver Only Policy? - YouTube

Insurance | Driving | Insurance