Louisiana State Minimum Car Insurance

What Is Louisiana State Minimum Car Insurance?

Louisiana drivers are required to carry a minimum amount of car insurance coverage in order to legally drive on public roads and highways. The minimum coverage is outlined by the Louisiana Department of Insurance, and is meant to provide basic protection for drivers and their vehicles in the event of an accident or other incident. When choosing car insurance, it’s important to understand what the state minimums are and how they apply to you.

What Are the Louisiana State Minimums?

The Louisiana state minimums are as follows: bodily injury liability coverage of $15,000 per person and $30,000 per incident, property damage liability coverage of $25,000, and uninsured/underinsured motorist coverage of $15,000 per person and $30,000 per incident. In addition, drivers must carry personal injury protection (PIP) coverage of $2,000, and uninsured/underinsured motorist property damage coverage of $25,000. Personal injury protection coverage is required in addition to the other coverage types, and provides protection for medical care and other expenses incurred due to an accident.

What Do These Minimums Cover?

The state minimum car insurance coverage in Louisiana is designed to provide basic protection in the event of an accident or other incident. Bodily injury liability coverage pays for medical expenses and other costs incurred by the other party in an accident in which you are at fault. Property damage liability coverage pays for repairs to the other party’s vehicle or property damaged in an accident in which you are at fault. Uninsured/underinsured motorist coverage pays for medical expenses, lost wages, and other costs incurred by you or your passengers in an accident in which the other party is at fault but does not have adequate insurance coverage. Personal injury protection coverage pays for medical expenses, lost wages, and other costs incurred by you or your passengers in an accident, regardless of fault.

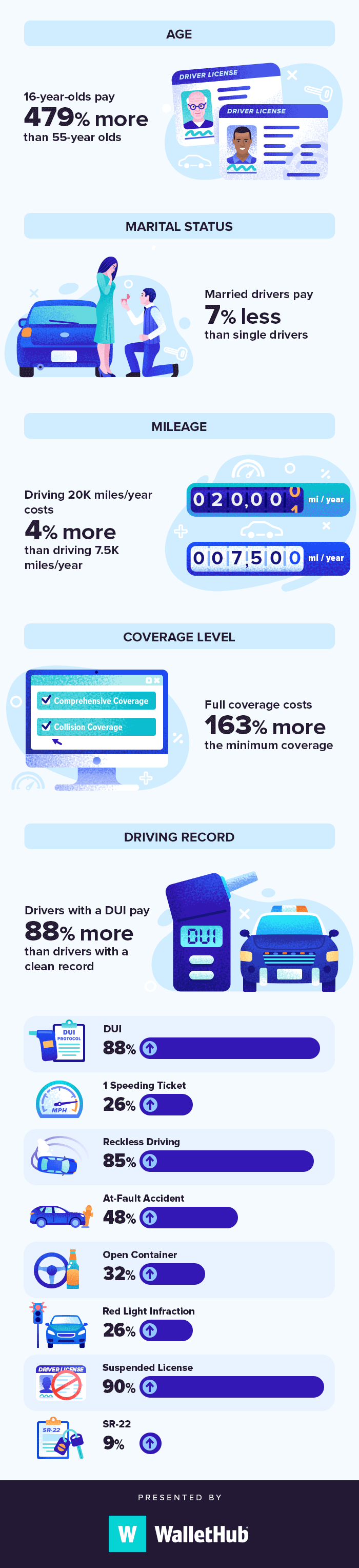

Do I Need to Purchase More Than the State Minimums?

The Louisiana state minimums are the minimum amount of coverage you must carry in order to legally drive in the state. However, you may want to purchase additional coverage for greater protection. Depending on your individual circumstances, you may want to purchase higher limits of coverage, such as higher bodily injury liability limits or higher uninsured/underinsured motorist coverage limits. You may also want to consider purchasing additional coverage types, such as comprehensive coverage, collision coverage, and rental car reimbursement coverage.

Where Can I Get Louisiana State Minimum Car Insurance?

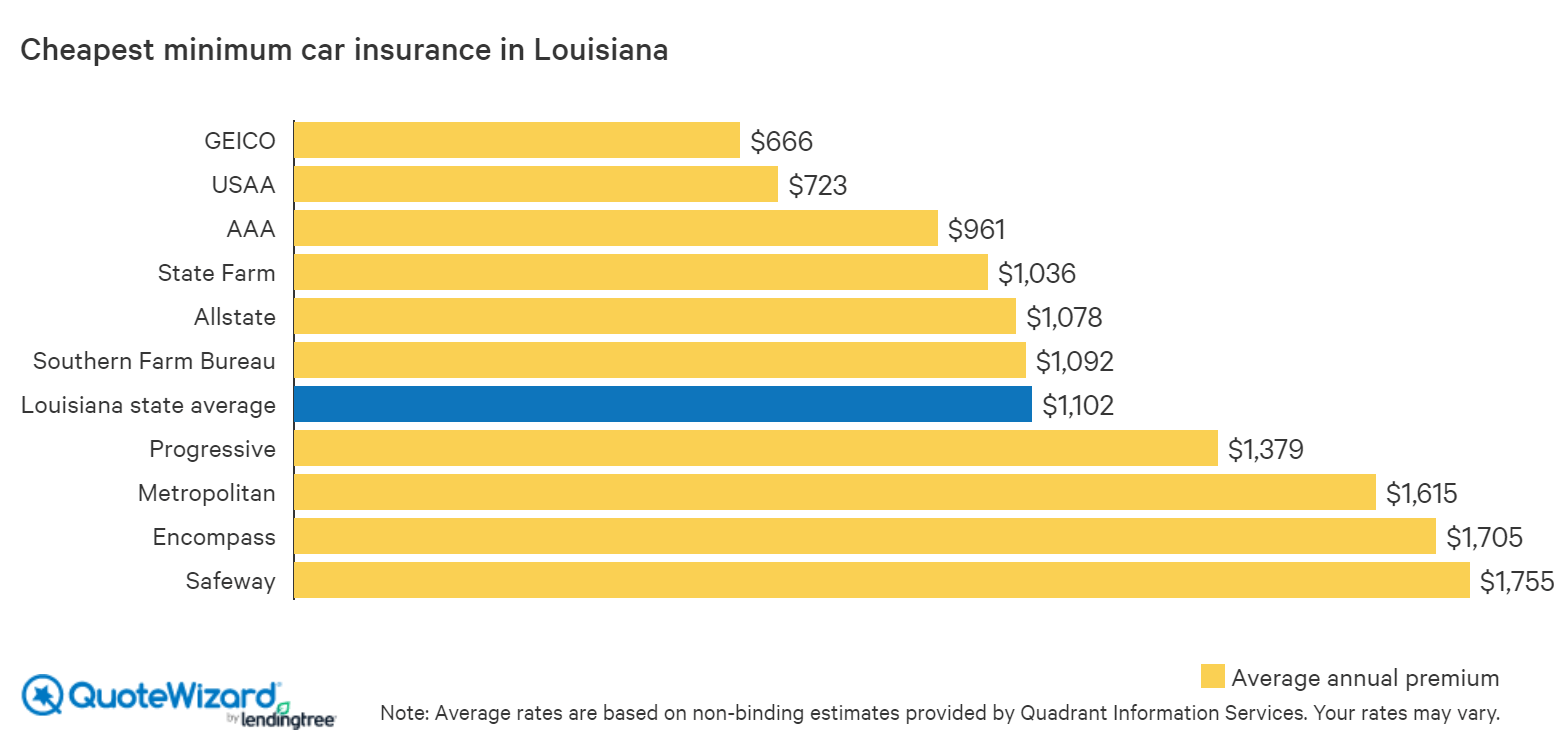

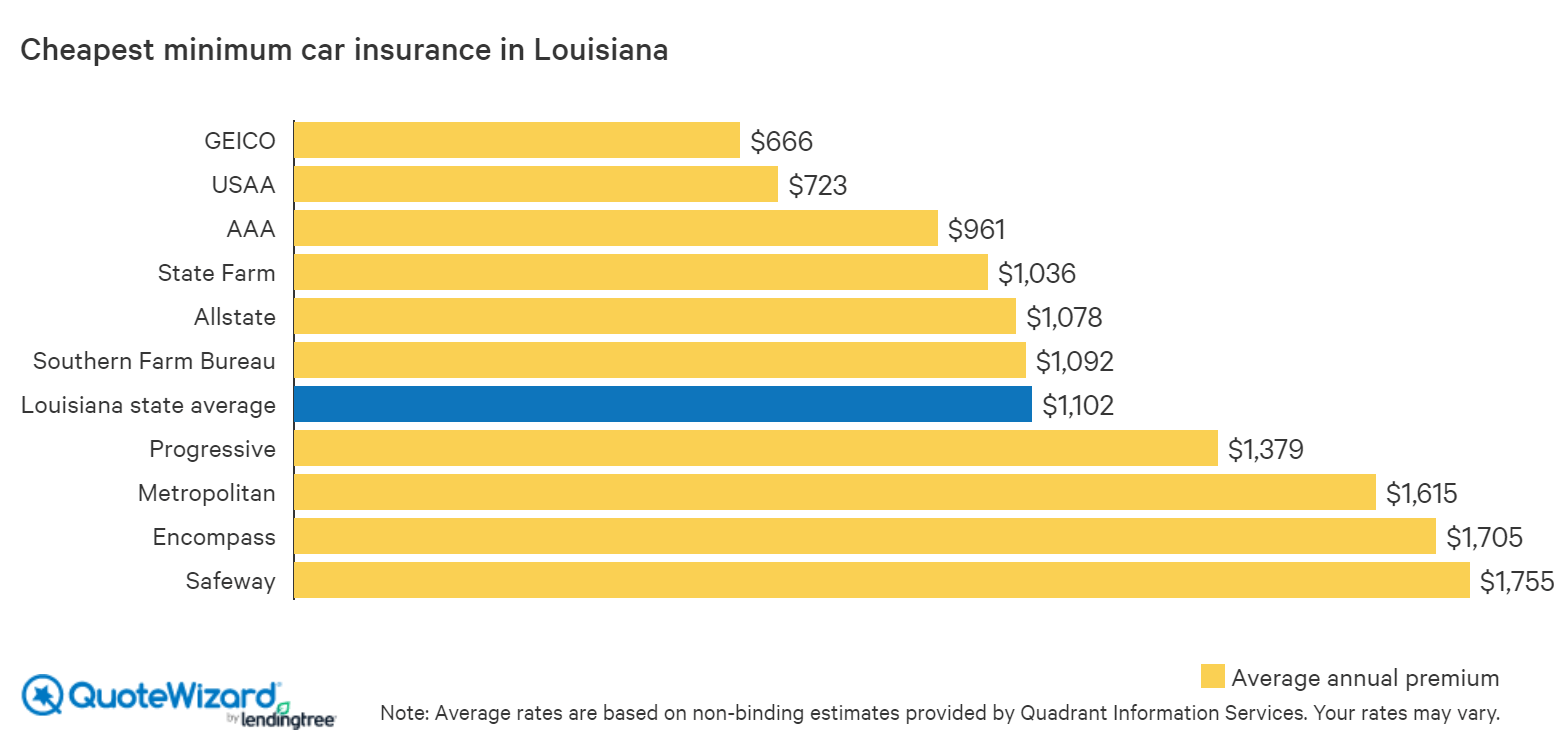

If you are looking for Louisiana state minimum car insurance, you can get a quote from a local insurance company or an online provider. Be sure to compare quotes from multiple providers in order to get the best rate. Also, be sure to read the terms and conditions of the policy carefully, as they will outline the coverage types, limits, and other important information.

Find Cheap Car Insurance in Louisiana | QuoteWizard

Minimum Car Insurance Requirements in Louisiana | LA State Regulations

Cheap Car Insurance in Louisiana 2019

Understanding the Minimum Car Insurance Requirements by State - Quote

Cheapest Car Insurance in Louisiana (November 2022) - WalletHub | Cheap