How Does Gap Insurance Work On A Used Car

Understanding How Gap Insurance Works On A Used Car

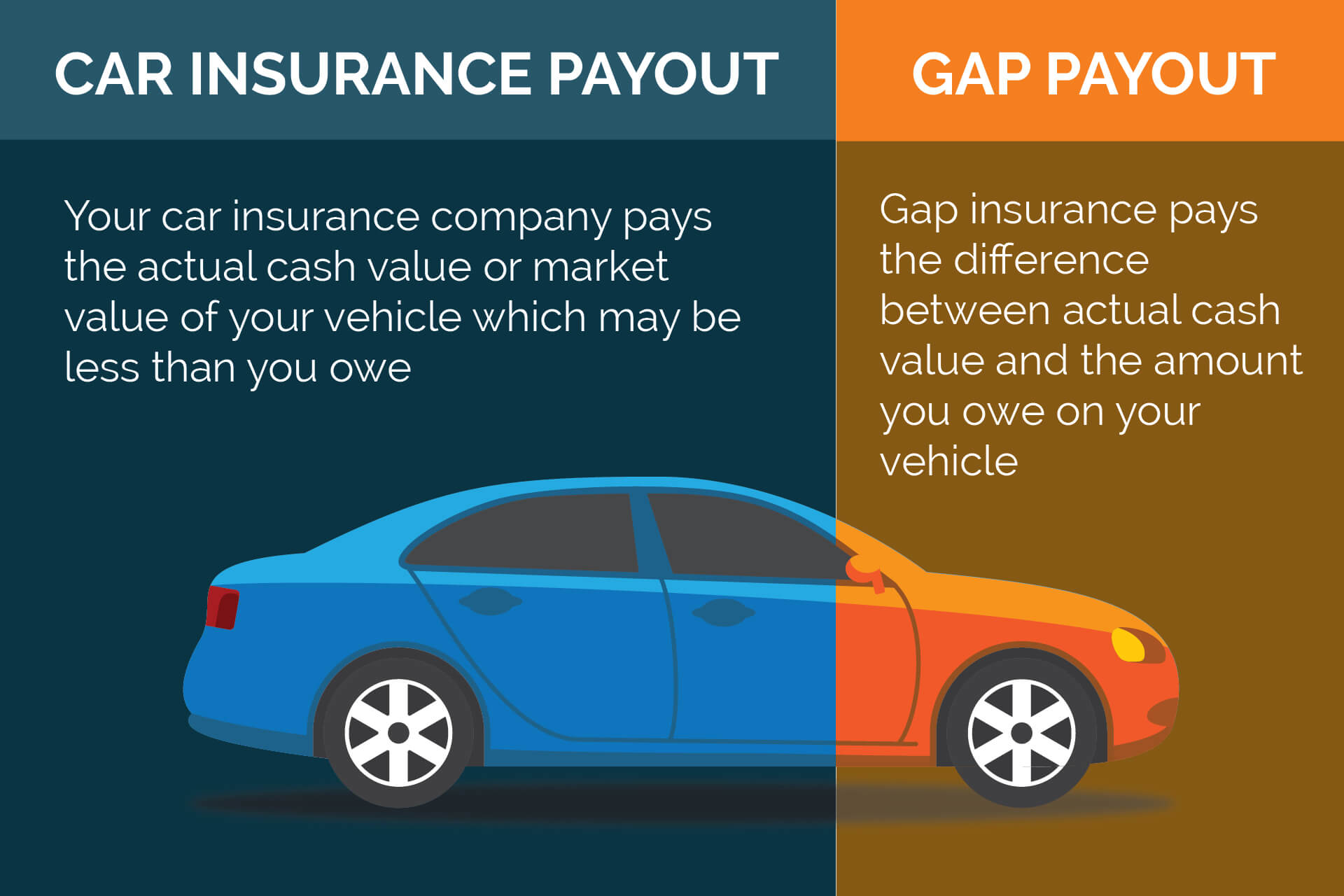

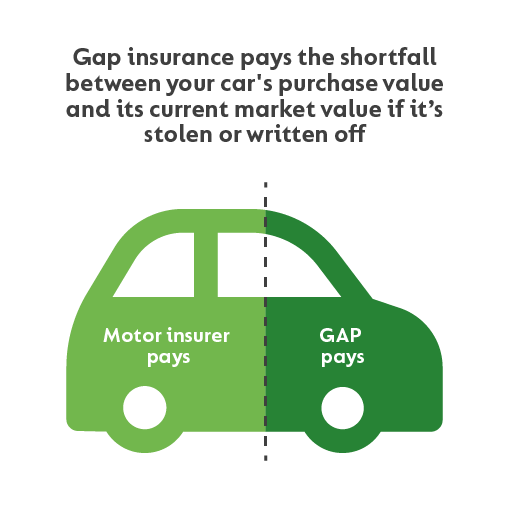

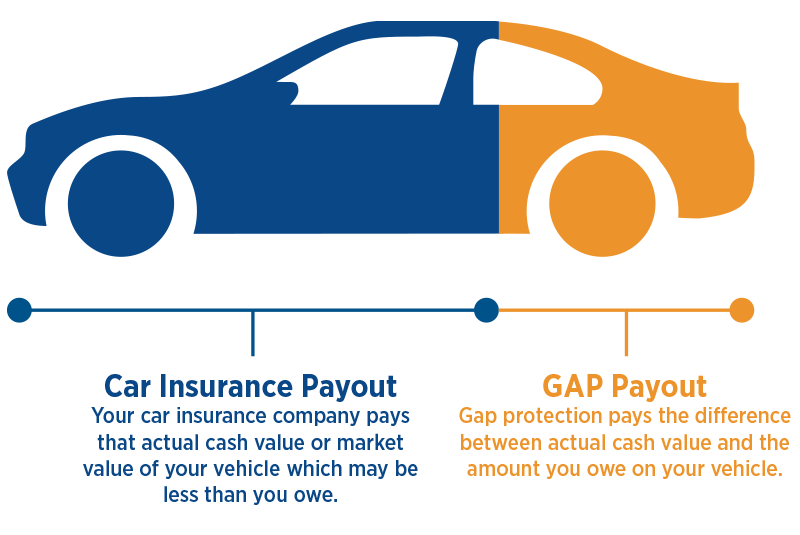

Gap insurance is a type of coverage that pays the difference between the amount you owe on a vehicle loan and the current market value of the vehicle. It's important to understand how gap insurance works on a used car before you make the purchase. It may save you from financial hardship if you ever end up in an accident.

What is Gap Insurance?

Gap insurance is short for "Guaranteed Auto Protection." It is a type of insurance that covers the difference between the amount you owe on a vehicle loan and the current market value of the vehicle. This coverage is typically purchased when you purchase a new or used vehicle. It is important to understand how gap insurance works on a used car before making the purchase.

How Does it Work?

Gap insurance works on a used car in the event of a total loss. If your car is totaled in an accident, your insurance company will usually only pay out the actual cash value of the car. This can be much lower than the amount you owe on the loan, and you may be stuck with a significant balance. Gap insurance will cover the difference between the actual cash value and the loan amount.

Who Should Purchase Gap Insurance?

Gap insurance is typically recommended for people who purchase a vehicle with a loan, especially if they are financing a used car. It is also recommended for people who lease a vehicle, as the leasing company may require the lessee to purchase gap insurance. It is important to check with the leasing company to determine if gap insurance is required.

What Type of Coverage Does it Provide?

Gap insurance typically covers the difference between the actual cash value of the vehicle and the remaining loan balance. It may also cover other costs associated with the loan, such as taxes and fees. In some cases, gap insurance may even cover the cost of a replacement vehicle if the original is totaled.

How Much Does Gap Insurance Cost?

The cost of gap insurance varies depending on the vehicle, the loan amount, and the type of coverage you select. Generally, gap insurance will cost between 2-5% of the loan amount. For example, if you take out a loan for $20,000, you can expect to pay between $400 and $1,000 for gap insurance.

Bottom Line

Gap insurance is a beneficial type of coverage that can help protect you in the event of a total loss. It is important to understand how gap insurance works on a used car so you can decide if you need it. The cost of gap insurance is relatively low and could save you from a significant amount of financial hardship if you ever find yourself in an accident.

How Does Gap Insurance Work? | RamseySolutions.com

Page for individual images • Quoteinspector.com

Gap Insurance at GoCompare | What is Gap Insurance and How Does it Work?

Guaranteed Asset Protection | Texas Car GAP Insurance | CRCU

What exactly is GAP insurance? | RoadLoans