Does Auto Insurance Cover The Car Or The Person

Does Auto Insurance Cover The Car Or The Person?

What is Auto Insurance?

Auto insurance is an agreement between a driver and an insurance company. It is an important tool for protection against financial loss in the event of an accident. Auto insurance typically covers medical expenses incurred due to an accident, as well as legal costs associated with the accident. It also covers the cost of repairs to any vehicles involved in the accident, as well as the cost of replacing or repairing any property that was damaged in the accident.

Does Auto Insurance Cover The Car or The Person?

The answer to this question depends on the type of auto insurance policy that is purchased. Generally speaking, auto insurance will cover the vehicle and any damage done to it in the event of an accident. This includes damage to the vehicle itself, as well as any medical expenses incurred by the driver or passengers of the vehicle. Additionally, auto insurance can also cover the cost of repair or replacement of any property that was damaged in the accident.

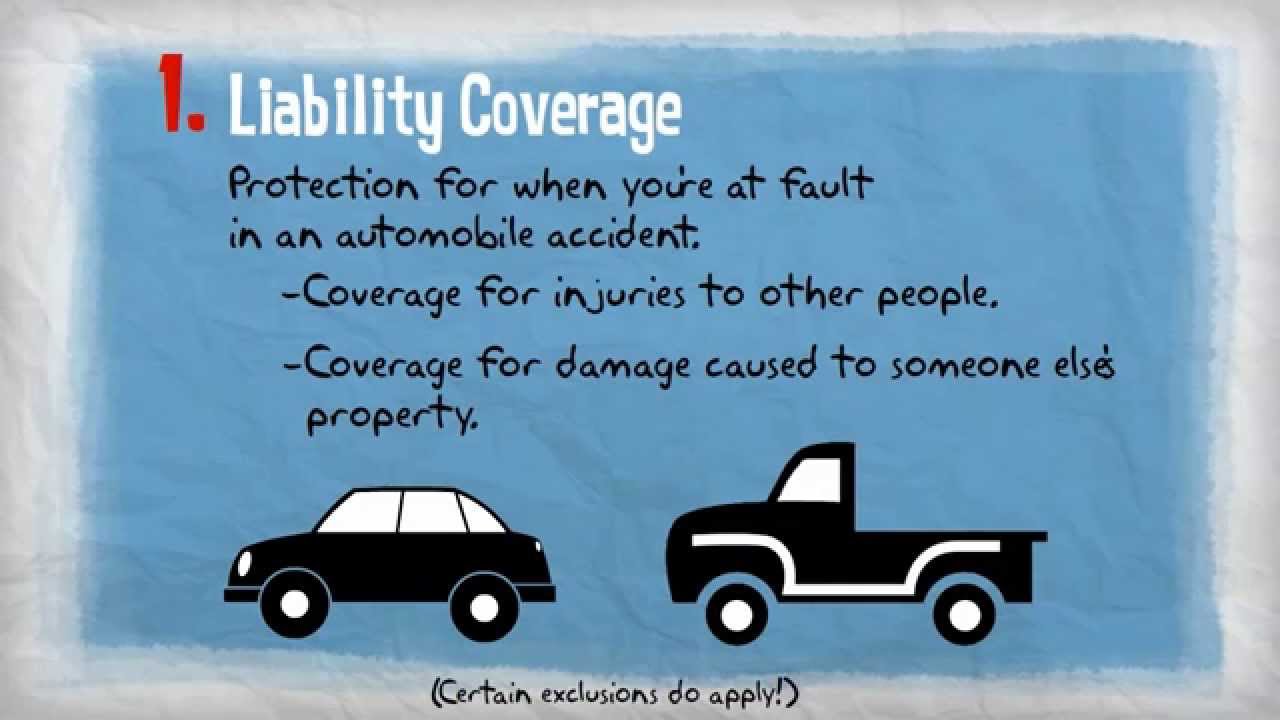

What Is Liability Insurance?

Liability insurance is a type of auto insurance coverage that is designed to protect the driver and their passengers in the event of an accident. Liability insurance will cover any medical expenses or legal costs that are incurred as a result of an accident. Additionally, liability insurance can cover any damage done to the property of another person or entity, such as another vehicle or structure. Liability insurance also covers any damages that are caused by the driver’s negligence.

Do I Need Collision Insurance?

Collision insurance is not a required type of auto insurance coverage. However, it is highly recommended for those who drive a newer or more expensive vehicle. Collision insurance covers the cost of repair or replacement of the driver’s vehicle in the event of an accident. This type of coverage is especially important for those who drive a newer vehicle, as it can help to protect the value of the vehicle.

What Are Uninsured/Underinsured Motorist Coverage?

Uninsured/underinsured motorist coverage is a type of auto insurance that helps to protect the driver and their passengers in the event of an accident caused by an uninsured or underinsured motorist. This type of coverage can help to cover the costs of medical expenses, legal costs, and property damage that are incurred as a result of the accident. This type of coverage is especially important for those who live in areas where uninsured or underinsured motorists are common.

In Conclusion

Auto insurance is an important tool for protecting drivers and their vehicles in the event of an accident. The type of coverage that is purchased will determine what type of protection is provided. Generally speaking, auto insurance will cover the vehicle and any damage done to it in the event of an accident. Additionally, liability insurance and uninsured/underinsured motorist coverage can provide additional protection for drivers. Lastly, collision insurance is highly recommended for those who drive newer or more expensive vehicles.

Simple, Cars and Home insurance on Pinterest

Does Auto Insurance Cover the Car or the Driver? - Bill Quickel's

Car insurance infographic | 20 Miles North Web Design

Cover your car with insurance or just keep it covered

Insurance 101 - Personal Auto Coverages - YouTube