Carrot Car Insurance Black Box Review

Carrot Car Insurance Black Box Review - What You Need to Know

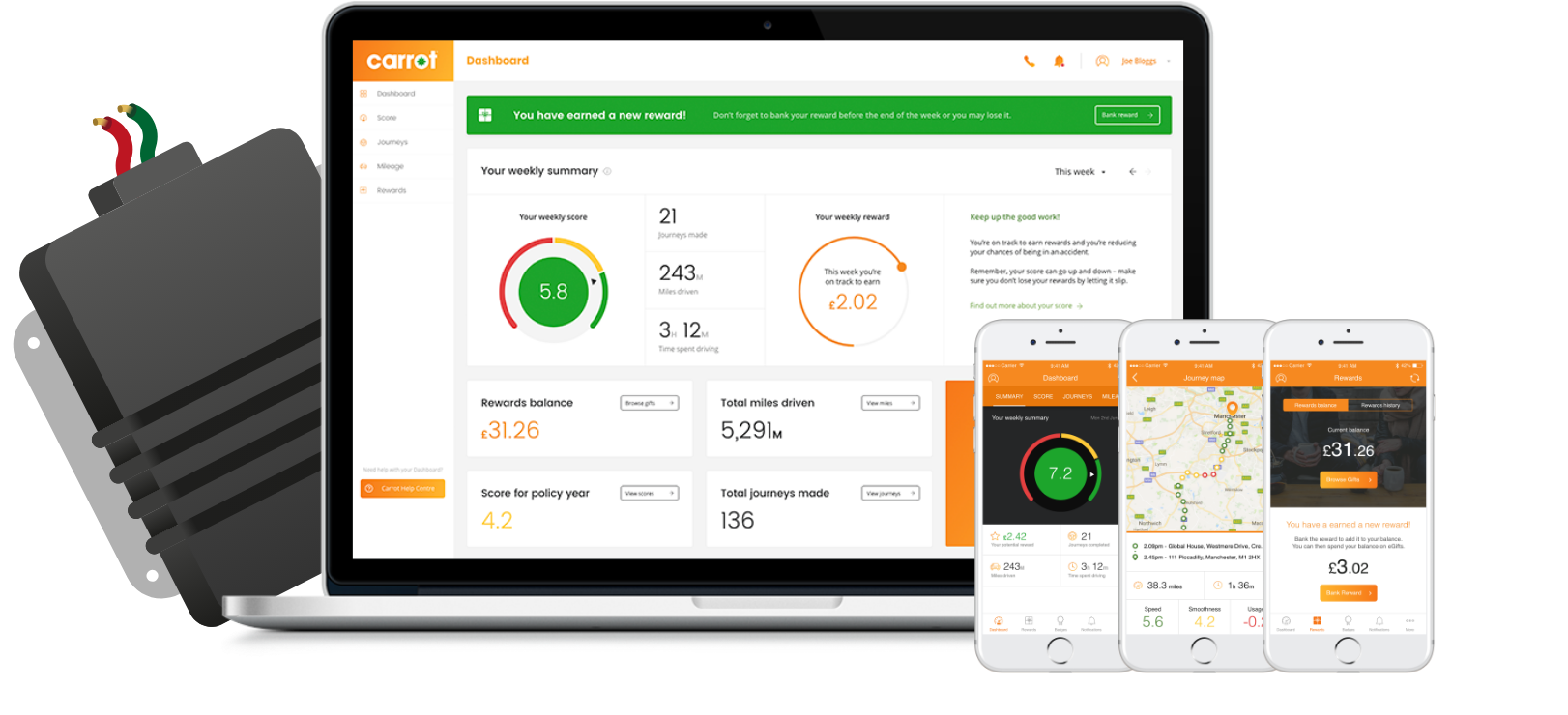

Carrot Car Insurance is a new type of car insurance that is gaining popularity in the UK. This type of insurance uses a black box to measure your driving behaviour, which is then used to determine the premiums that you pay. In this article, we'll take a closer look at Carrot Car Insurance and how the black box works.

Carrot Car Insurance is a pay-as-you-drive insurance policy which means that the premiums you pay are based on your actual driving behaviour. The black box, which is fitted in your vehicle, measures your speed, braking, cornering, and acceleration. The data is then used to determine your premiums, with safer drivers paying less.

Pros of Carrot Car Insurance

There are several advantages to choosing Carrot Car Insurance. Firstly, it rewards safe driving behaviour, so if you are a careful driver you can save money on your premiums. Secondly, it is a flexible policy, so you can adjust your premiums as your driving behaviour changes. Finally, it is suitable for younger drivers, as it can help them to get on the road at an affordable price.

Cons of Carrot Car Insurance

The main disadvantage of Carrot Car Insurance is that if you are a more experienced driver, you may find that your premiums are higher than with a more traditional policy. Additionally, it is important to note that the black box can be inaccurate and can lead to incorrect premiums being charged. Finally, it may be difficult to switch to a different insurer if you are unhappy with the service.

Verdict

Carrot Car Insurance is a good option for younger drivers who want to get on the road at an affordable price. However, for more experienced and safer drivers, it may be worth looking at other insurance options. Ultimately, it is important to do your research and compare different policies before making a decision.

What is a New Driver black box policy? - Carrot Insurance

Carrot Insurance - a more rewarding type of car insurance

An in-car black box could reduce your insurance premium... | Practical

Best Insurance for New Drivers: 4 Key Points to Remember