Benefits Of Telematics Car Insurance

Benefits Of Telematics Car Insurance

What is Telematics Car Insurance?

Telematics car insurance is a type of insurance policy that is based on the way a driver drives, rather than the traditional rating factors of age and postcode. Telematics or ‘Black Box’ insurance policies use the data that is collected from a ‘Black Box’ to determine the risk profile of the driver and the premium they will pay. The ‘Black Box’ is fitted to the driver’s car and collects data such as speed, acceleration, braking, cornering and time of day driven, which is then used to calculate the premiums.

Benefits of Telematics Car Insurance

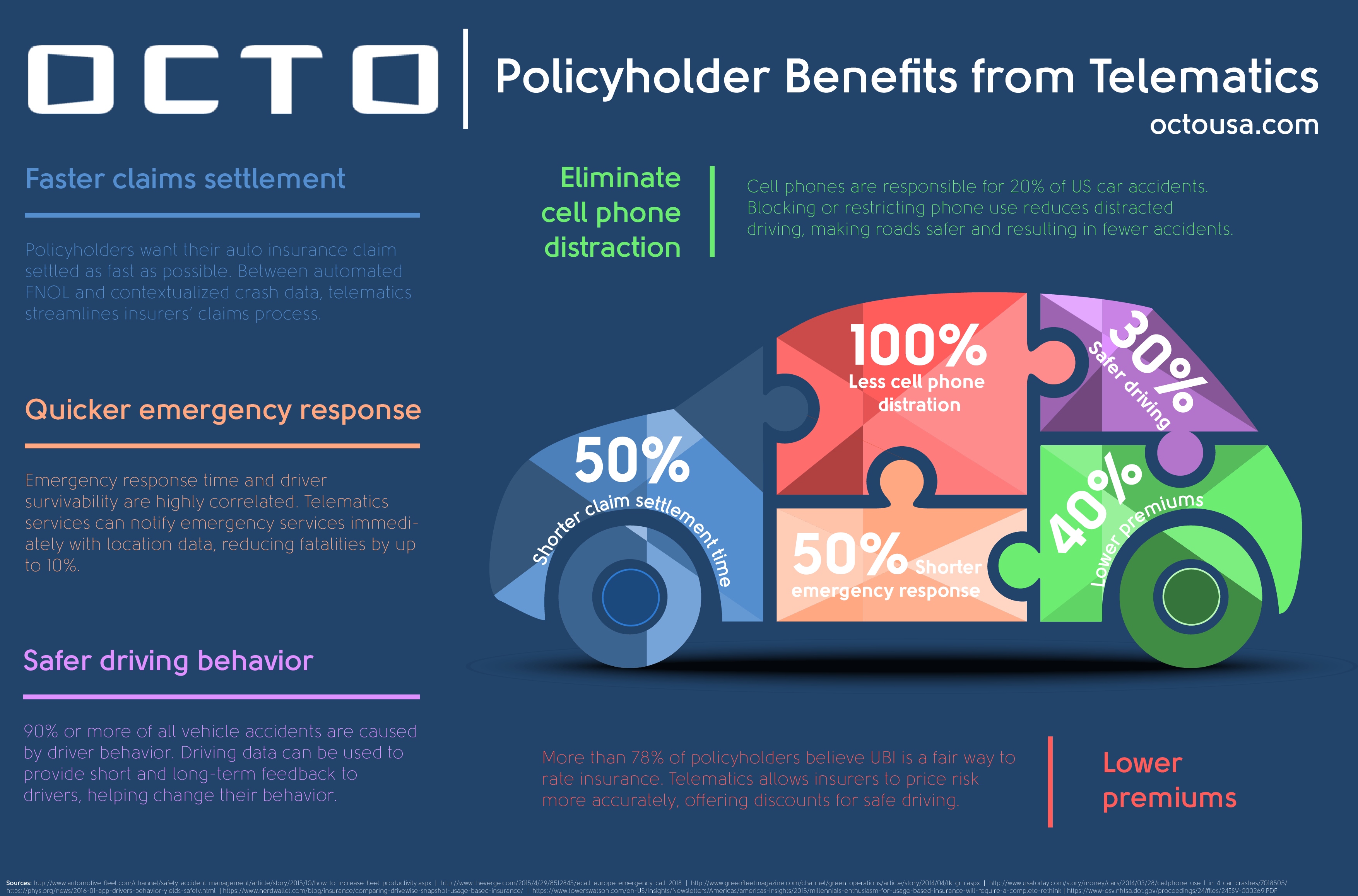

Telematics car insurance offers a number of benefits for drivers. Firstly, the premiums that are calculated by the ‘Black Box’ are based entirely on the individual driver’s habits, rather than their age and postcode. This means that more experienced drivers, who may be penalised by traditional insurance policies, can benefit from lower premiums if they are found to be safer drivers. Additionally, the data collected by the ‘Black Box’ is used to provide feedback to the driver, which can help to improve their driving, leading to further reduced premiums.

Personalised feedback

Telematics car insurance policies can provide personalised feedback to the driver, which can be used to improve their driving and help them become a safer driver. This feedback can be in the form of an app or a web-based dashboard that allows the driver to monitor their driving habits and receives advice on how to improve their driving. This feedback can help reduce premiums by helping the driver to become a safer driver.

Discounts for safe driving

As well as providing feedback to the driver, telematics car insurance policies can also provide discounts for safe driving. This means that the driver can be rewarded for driving safely, which can lead to further reductions in their premiums. For example, some telematics car insurance policies may offer a discount if the driver is found to have driven safely over a certain period of time.

Real-time monitoring

Telematics car insurance policies also provide real-time monitoring of the car, which can be useful in the event of an accident. This real-time monitoring can provide important information about the circumstances of the accident, which can be used to help the driver make a claim. This real-time monitoring can also help to reduce premiums by helping the insurer to identify risky driving habits and address them.

Lower premiums

Overall, telematics car insurance offers a number of benefits for drivers, but the main benefit is the potential for lower premiums. By using the data collected by the ‘Black Box’ to calculate premiums, drivers can potentially benefit from lower premiums than they would with a traditional insurance policy. Additionally, the feedback provided by the ‘Black Box’ can help the driver to improve their driving and potentially reduce their premiums even further.

Telematics Insurance Data - Telematics.com

why young drivers are adopting telematics insurance | Visual.ly

Willis Towers Watson Selling Telematics Tech to Octo; Both Will Jointly

A guide to learn how Insurance Telematics can be a powerful tool to

Benefits telematics - Market Motion