Auto Collision Insurance Waiver Of Deductible Applies

Auto Collision Insurance Waiver of Deductible Explained

Auto collision insurance, or “collision coverage”, is an add-on to your basic car insurance policy that pays for repairs to your own car if it is damaged in a collision. Typically, collision coverage includes a deductible, which is the amount you must pay out of pocket before your insurance will kick in and cover the rest of the repair costs. However, many car insurance companies offer a waiver of deductible, which means that you do not have to pay the deductible.

What is an Auto Collision Insurance Waiver of Deductible?

A waiver of deductible is an optional add-on to your auto collision insurance policy that waives the deductible in the event of a collision. This means that if you have an accident, you do not have to pay the deductible amount before your insurance kicks in and pays for the rest of the repair costs. This can be a helpful option for those who want to maximize their coverage but don't want to pay the upfront cost of the deductible.

Is an Auto Collision Insurance Waiver of Deductible Worth It?

Whether or not an auto collision insurance waiver of deductible is worth it depends on your individual circumstances. If you are a safe driver with a good driving record, you may not need the extra coverage of a waiver of deductible. On the other hand, if you are a more risky driver or have a history of accidents, then a waiver of deductible may be a good option for you. It is important to consider your individual circumstances and speak with an insurance agent to determine if a waiver of deductible is the right choice for you.

How Much Does an Auto Collision Insurance Waiver of Deductible Cost?

The cost of an auto collision insurance waiver of deductible varies depending on your provider and the details of your policy. Generally, the cost is a small percentage of your overall premium, and can range from a few dollars to a few hundred dollars per year. It is important to speak with your insurance provider to determine the exact cost of the waiver of deductible and how it will affect your overall premium.

What If I Already Have a Deductible?

If you already have a deductible on your auto collision insurance policy, you may be able to switch to a waiver of deductible. Depending on your provider, you may be able to switch to a waiver of deductible without having to pay any additional fees or change your policy terms. However, it is important to speak with your insurance provider to determine if this is an option for you.

What Other Options Do I Have?

If you are interested in maximizing your coverage but do not want to purchase a waiver of deductible, there are other options available. You may be able to increase your deductible or purchase an umbrella or excess liability policy in order to get additional coverage. Additionally, you may be able to purchase additional coverage such as gap insurance or rental car insurance. It is important to speak with your insurance provider to determine the best option for you.

Collision Centre Specials - Oxford Dodge Chrysler

What Does Collision Damage Waiver Insurance Cover - Collision Damage

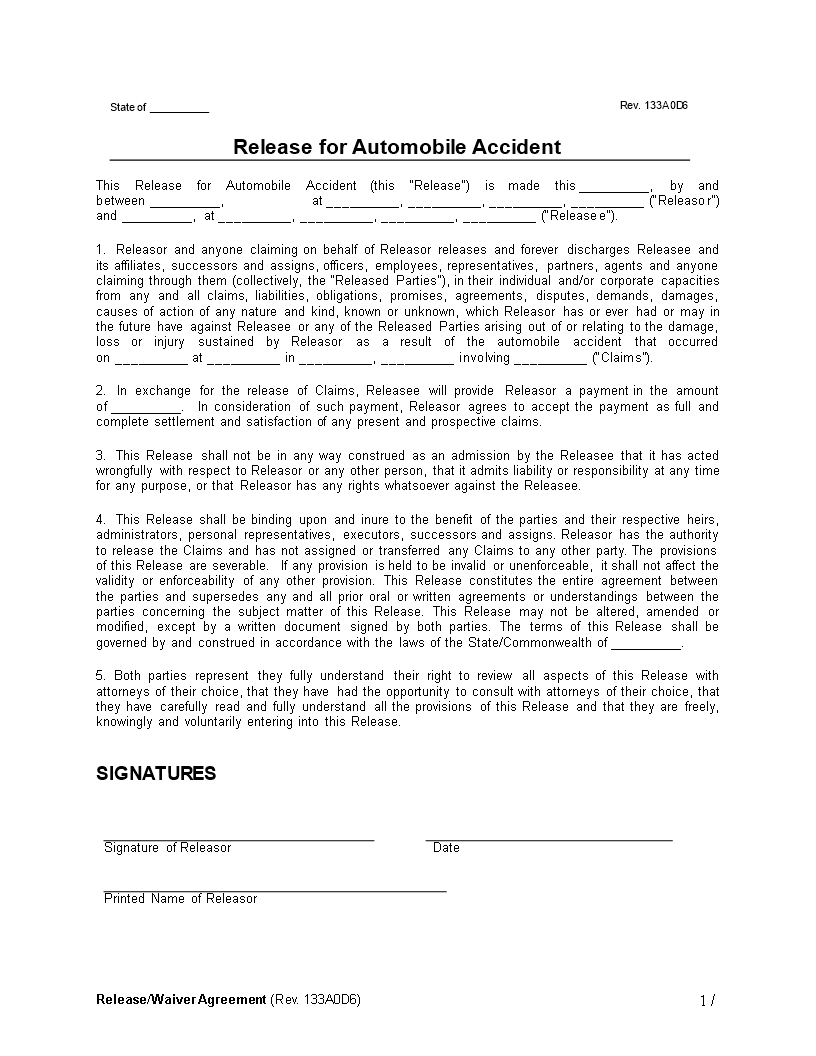

Auto Accident Release Waiver Agreement | Templates at

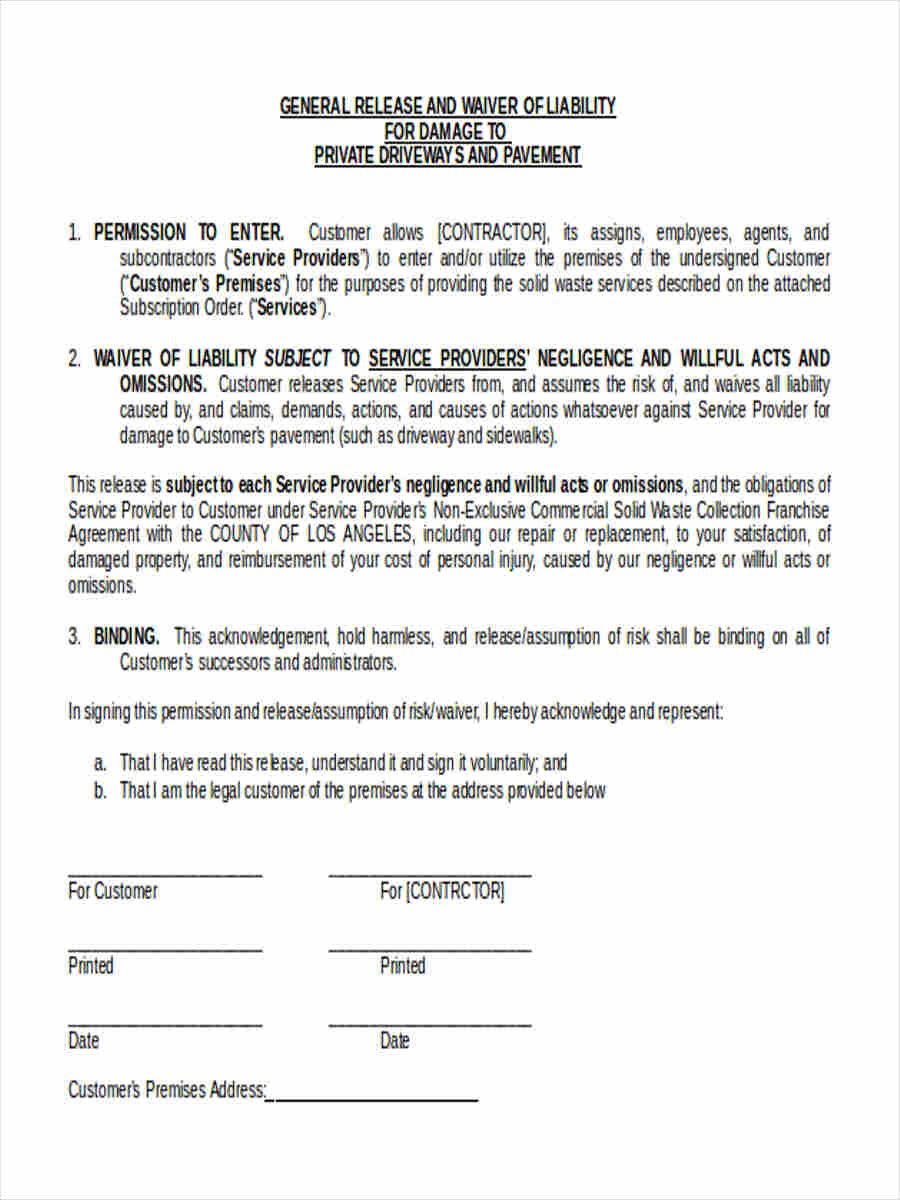

Private Settlement form Inspirational 14 Legal Waiver forms Pdf Doc in

Free Car Accident Release Of Liability Form Settlement Damage Release