1st 2nd 3rd Party Insurance

What is 1st, 2nd and 3rd Party Insurance?

When it comes to insurance, there are a few terms that are often thrown around, such as 1st, 2nd and 3rd Party Insurance. These terms refer to the parties involved in an insurance policy, and understanding them can help you know what kind of coverage you are getting from your insurer. In this article, we’ll explain what 1st, 2nd and 3rd Party Insurance is, and how they work.

1st Party Insurance

1st Party Insurance is when the insured person is the only party involved in the insurance policy. This means the insurer (the 1st party) agrees to pay out a certain amount of money in the event of a claim being made. This type of insurance is often used to cover the insured person’s car, home, or health. The insurer agrees to cover the costs of repair or replacement if something happens to the insured property or person.

2nd Party Insurance

2nd Party Insurance is when two parties are involved in the insurance policy. This means the insurer (the 1st party) agrees to pay out a certain amount of money in the event of a claim being made by the other party (the 2nd party). This type of insurance is often used to cover the costs of an accident or damage to another person’s property. The insurer agrees to cover the costs of repair or replacement if something happens to the other person’s property due to the actions of the insured person.

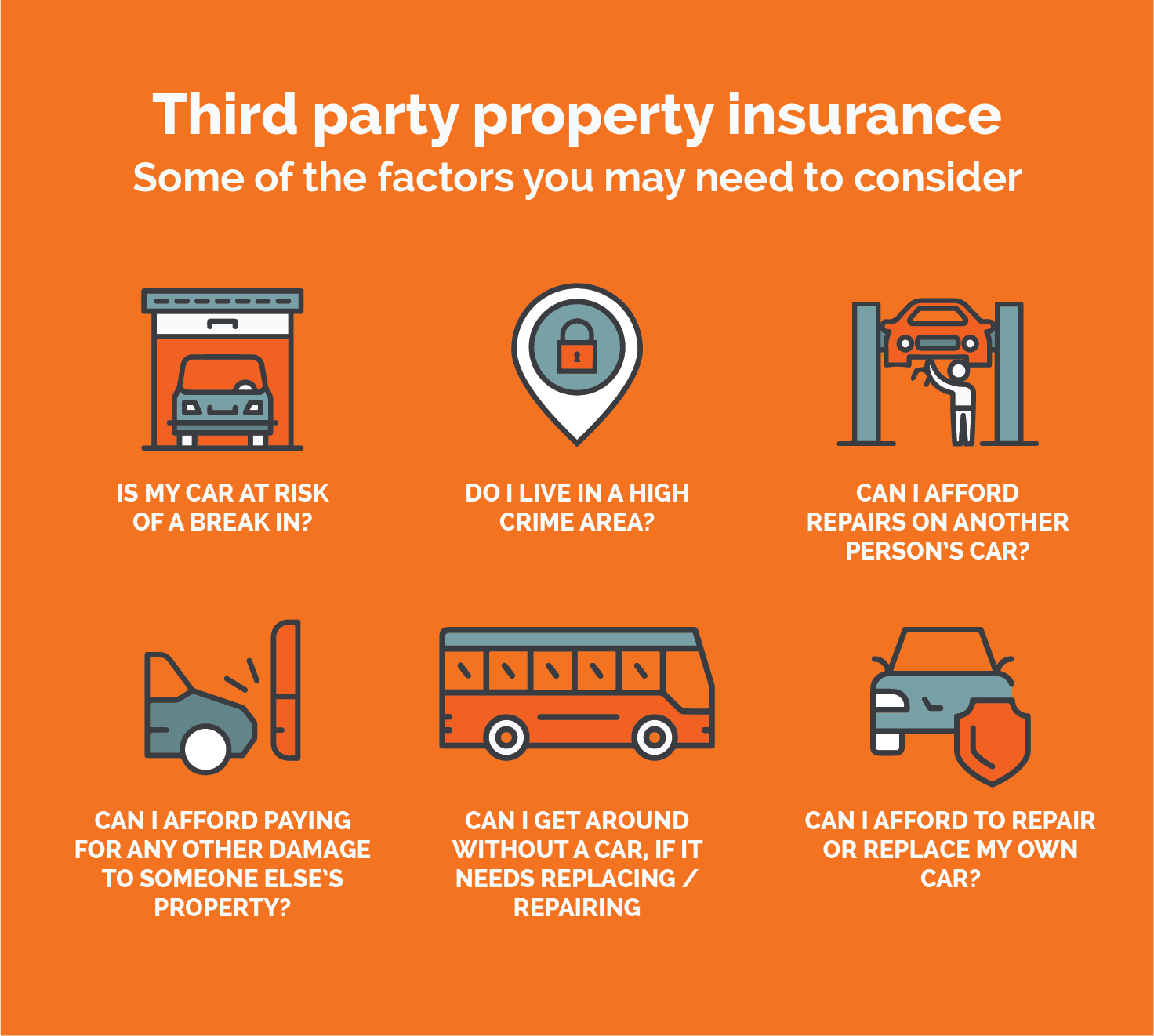

3rd Party Insurance

3rd Party Insurance is when three parties are involved in the insurance policy. This means the insurer (the 1st party) agrees to pay out a certain amount of money in the event of a claim being made by the other two parties (the 2nd and 3rd parties). This type of insurance is often used to cover the costs of an accident or damage to a third person’s property. The insurer agrees to cover the costs of repair or replacement if something happens to the third person’s property due to the actions of the insured person.

Difference between 1st, 2nd and 3rd Party Insurance

The main difference between 1st, 2nd and 3rd Party Insurance is the number of parties involved in the insurance policy. 1st Party Insurance is when the insured person is the only party involved, 2nd Party Insurance is when two parties are involved, and 3rd Party Insurance is when three parties are involved. The insured person is always the 1st party, and the other parties are the 2nd and 3rd parties.

Conclusion

1st, 2nd and 3rd Party Insurance are important concepts to understand when it comes to insurance. Knowing the difference between them can help you know what kind of coverage you are getting from your insurer. 1st Party Insurance covers the insured person’s property or person, 2nd Party Insurance covers the costs of an accident or damage to another person’s property, and 3rd Party Insurance covers the costs of an accident or damage to a third person’s property. Knowing the difference between these types of insurance can help you make sure you’re getting the right coverage for your needs.

Which Is Better Comprehensive Or Third Party Insurance - noclutter.cloud

The loss your car incurs is not covered by your insurance provider but

What Is Third-party Insurance?

Third Party Vs Comprehensive Car Insurance Policy | Which is Better

Reasons why you should buy third party insurance online in 2020