Who Offers New Car Replacement Insurance

Tuesday, November 14, 2023

Edit

Who Offers New Car Replacement Insurance?

What is New Car Replacement Insurance?

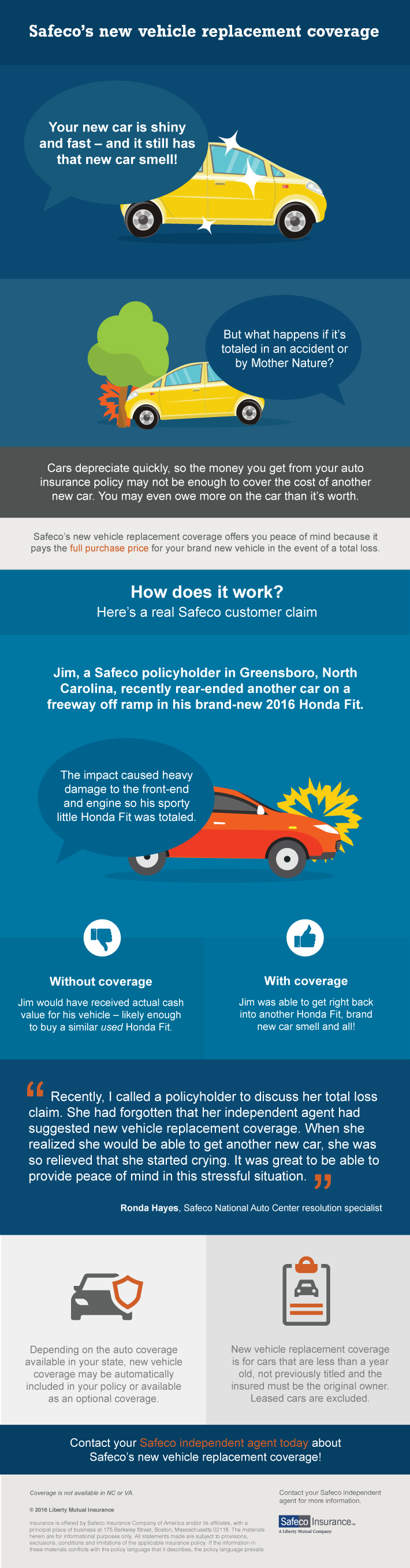

New car replacement insurance is a type of auto insurance coverage that, if you have an accident and your car is totaled, you may be eligible to receive the same model of a new car as a replacement. This insurance is an optional coverage and not all insurance companies offer it.

New car replacement insurance is beneficial because it covers the difference between what you owe on the car and what your insurance company pays out. If you have the coverage, you won't have to pay out of pocket for the cost of replacing the car.

Which Insurance Companies Offer New Car Replacement Insurance?

Most major auto insurance companies offer new car replacement insurance as an optional coverage. Some of these companies include Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, and State Farm.

When shopping for auto insurance, it's important to compare policies and coverage levels from different companies to ensure you're getting the best deal. This is especially true for new car replacement insurance, as the coverage levels, cost, and other features may vary from one company to the next.

What Does New Car Replacement Insurance Cost?

The cost of new car replacement insurance will vary depending on the company you purchase it from, your car, and other factors. Generally, the coverage is relatively inexpensive and typically costs between $30 and $60 per year.

In some cases, your car may be eligible for a "gap" policy. This type of coverage is typically less expensive and covers the difference between what you owe on the car and what your insurance company pays out if your car is totaled.

What is Covered By New Car Replacement Insurance?

New car replacement insurance covers the cost of replacing your car if it is totaled in an accident. The coverage typically pays for a new car of the same make and model that you had prior to the accident.

The coverage may also cover other costs, such as sales tax and registration fees. Some policies may also cover the cost of any additional accessories that were installed on the car at the time of the accident.

When Does New Car Replacement Insurance Take Effect?

New car replacement insurance typically takes effect the day after you purchase the policy. In some cases, the coverage may only be valid for a certain period of time, such as one or two years, depending on the policy.

It's important to read the fine print of any policy you purchase to make sure you understand when the coverage takes effect and when it expires.

Conclusion

New car replacement insurance is a type of auto insurance coverage that can be beneficial if you have an accident and your car is totaled. Most major auto insurance companies offer the coverage, though the cost and coverage levels vary from one company to the next.

It's important to compare policies and coverage levels from different companies to ensure you're getting the best deal. It's also important to read the fine print of any policy you purchase to make sure you understand when the coverage takes effect and when it expires.

48+ Who Offers New Car Replacement Insurance | Hutomo

Et Insure Save Upto 60% On Your Car Insurance Ad - Advert Gallery

New Car Replacement Is Where It's At! - Outcalt Kerns Insurance, LLC

All About New Vehicle Replacement Coverage

Does Aaa Auto Insurance Cover Windshield Replacement - lasopacapital