Tesla Model 3 Average Insurance Cost

Tesla Model 3 Average Insurance Cost: An Overview

Insurance is an essential part of owning a car, and the Tesla Model 3 is no exception. The electric vehicle has quickly become a popular choice for many drivers, thanks to its low emissions and high efficiency. But how much does it cost to insure a Tesla Model 3?

The average insurance cost for a Tesla Model 3 depends on a variety of factors, such as the driver’s age, driving record, and where they live. It’s important to remember that insurance premiums are based on the car’s value and the risk associated with insuring it. Tesla’s electric vehicles are generally more expensive to insure than their petrol counterparts, due to their higher value and the risk of an accident. As such, the cost of insurance for the Model 3 is likely to be higher than the average car.

Factors That Influence Tesla Model 3 Insurance Cost

When it comes to Tesla Model 3 insurance, there are several factors that can influence the cost. For example, the age of the driver is an important consideration. Generally, younger drivers are considered to be higher risk and as such, their insurance premiums are typically higher than those of older drivers. Additionally, drivers with a history of accidents and/or traffic violations may pay more for insurance than those with a clean driving record.

Location is another factor that can affect insurance costs. In some areas, the cost of living is higher, meaning insurance companies may charge higher premiums to cover their costs. Additionally, the cost of car repairs may be higher in some areas, which can also increase insurance premiums.

How to Reduce Insurance Costs for Your Tesla Model 3

Insurance costs can be reduced by taking certain steps. For example, selecting a higher deductible can lower the monthly premium. Similarly, selecting a policy with a higher liability limit can reduce the cost of insurance. Other ways to reduce insurance costs include taking a defensive driving course, adding anti-theft devices to the vehicle, and bundling multiple policies.

It’s also important to shop around for the best rates. Insurance companies may offer different rates for the same coverage, so it’s important to compare multiple companies to find the best deal. Additionally, many insurance companies offer discounts for customers who have multiple vehicles or who have a clean driving record.

The Bottom Line

The cost of insuring a Tesla Model 3 can vary greatly, depending on a variety of factors. Generally, younger drivers and those with a history of accidents and/or traffic violations may pay more for insurance than those with a clean driving record. Additionally, the cost of living and car repairs in an area can also affect insurance costs. Fortunately, there are several ways to reduce insurance costs for a Tesla Model 3, such as selecting a higher deductible, taking a defensive driving course, and shopping around for the best rates.

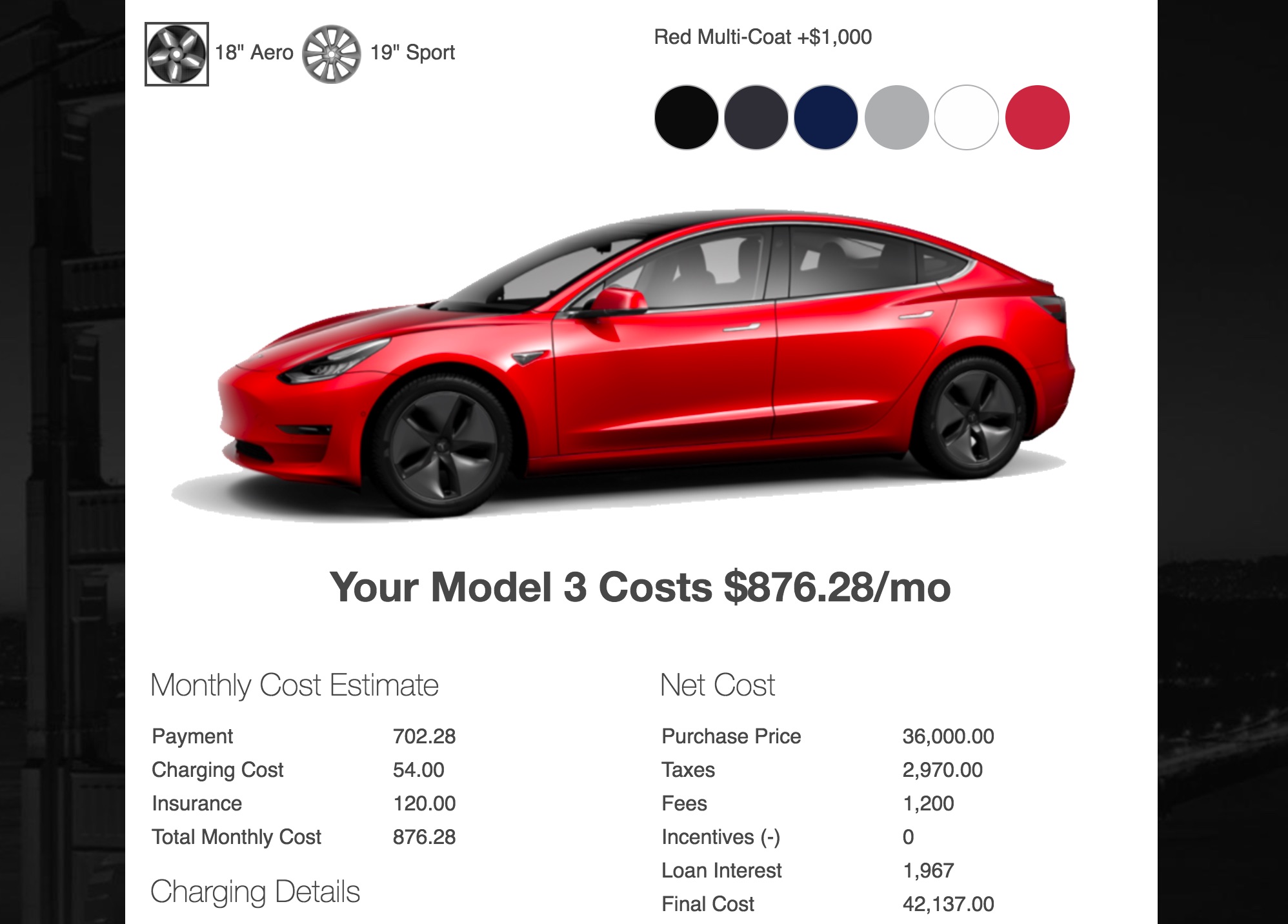

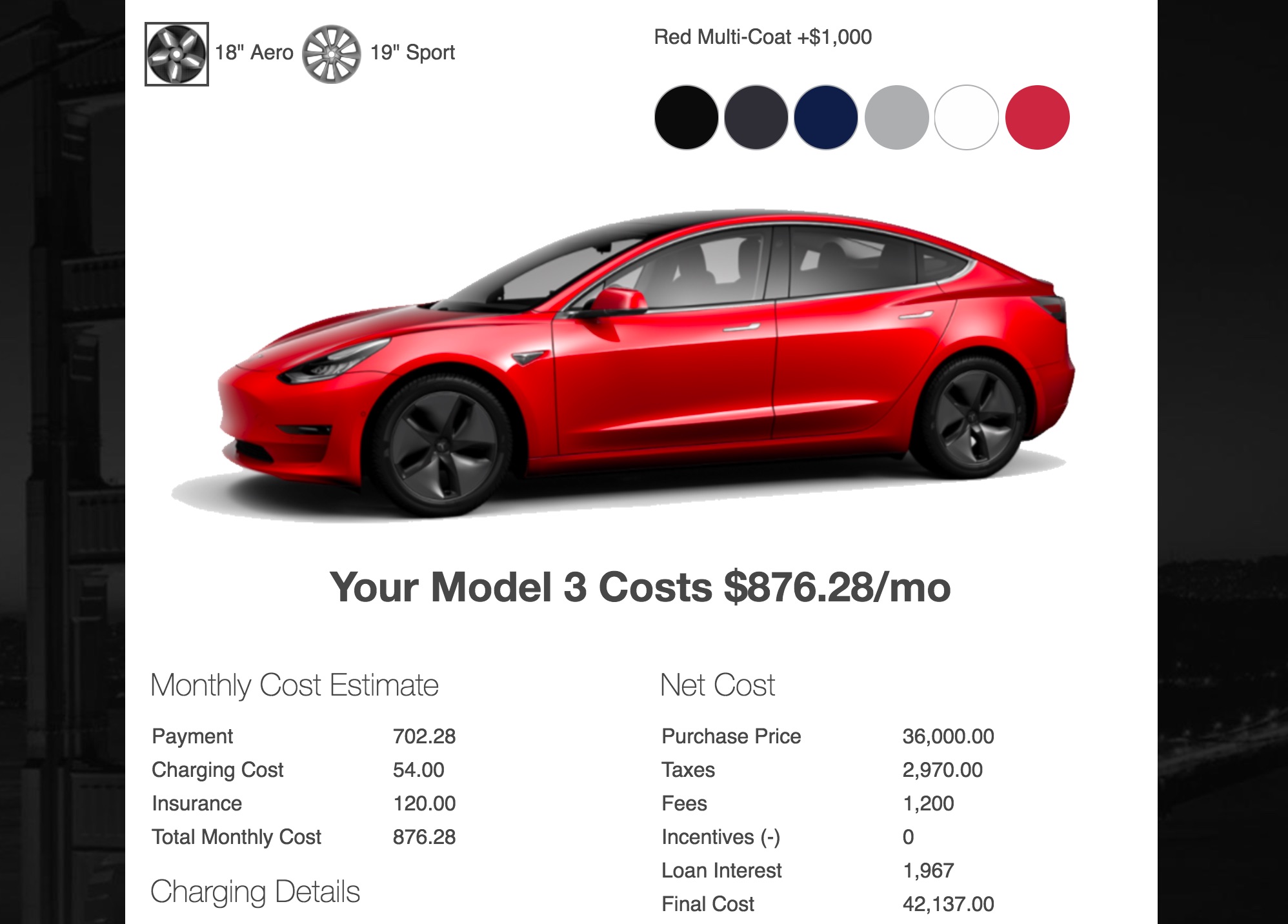

how much does it cost to fill a tesla model 3 - www.summafinance.com

Here's How Tesla Model 3 Is Cheaper To Own Than Toyota Camry

Tesla Model 3 Insurance Cost - Best Tesla Car Insurance Cost To Insure

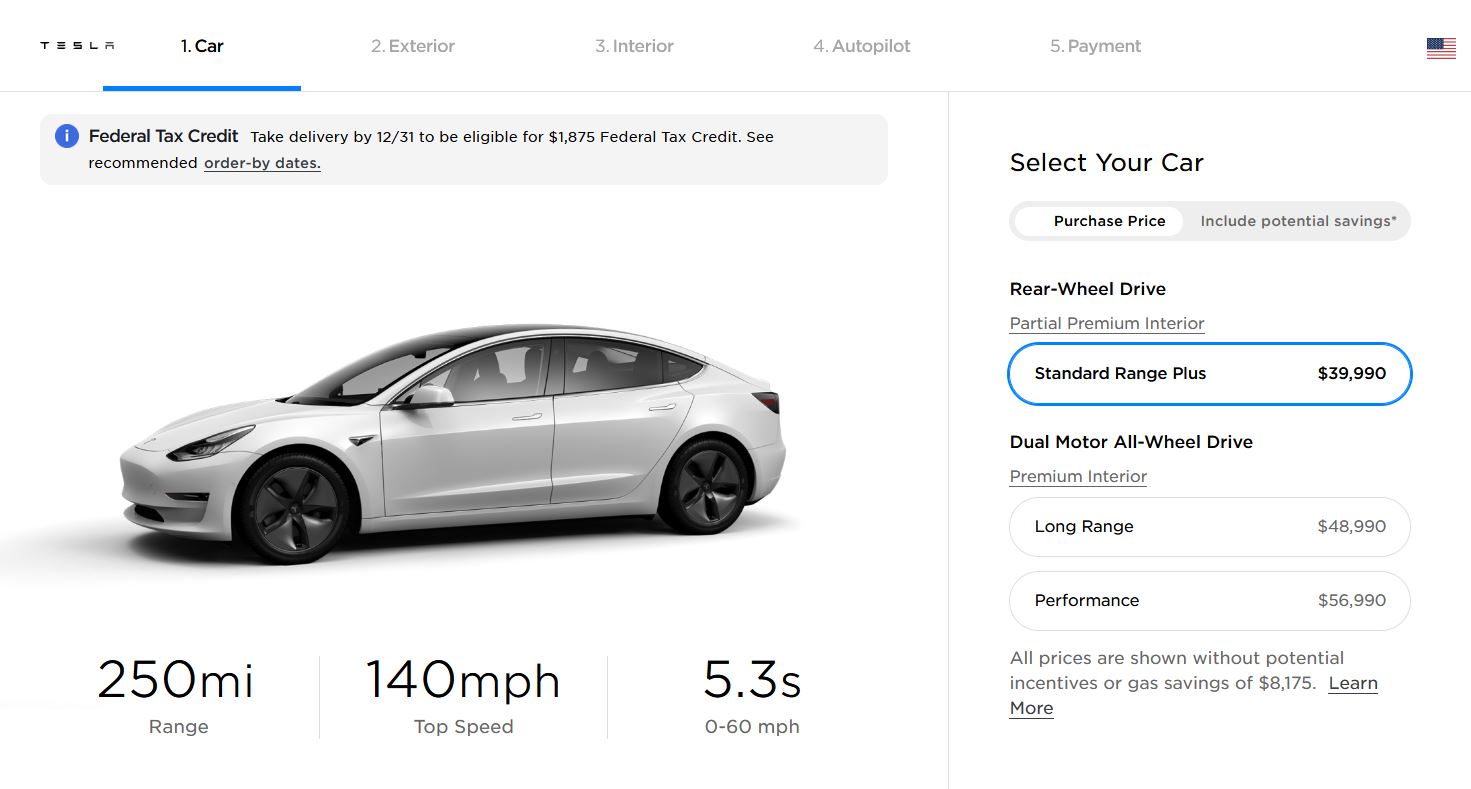

Tesla adjusts Model 3 pricing in final 2019 push as EV tax credits come

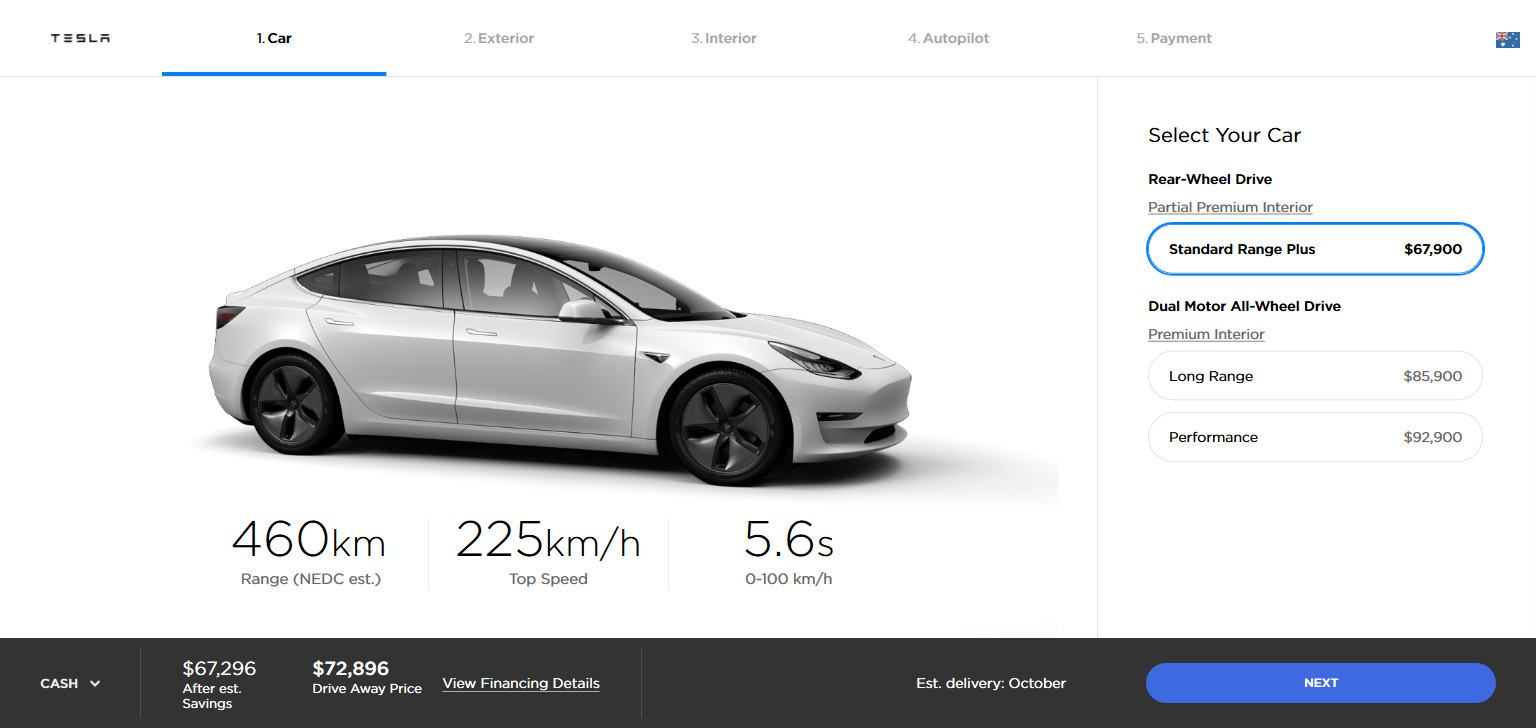

Tesla Model 3 prices jump in Australia as dollar falls against greenback