Named Non Owner Policy Nc

Understanding Non Owner Policy NC

A Non Owner Policy NC is a type of auto insurance coverage that provides liability coverage for individuals who do not own a car of their own. This policy is often purchased by individuals who rent cars or borrow cars frequently. It is also a good option for those who don’t own a car but still need to be insured so that they can drive legally. The coverage provided by this type of policy is similar to the coverage provided by a regular auto insurance policy, but it is typically more affordable and offers a greater degree of protection for those without a vehicle.

Who Should Consider a Non Owner Policy NC?

Non Owner Policy NC is an excellent option for people who don’t own a car but still need insurance coverage. This type of policy is especially beneficial for those who frequently rent cars or borrow cars from friends or family. Additionally, it is a great option for those who may be looking to purchase a car in the future but don’t need the insurance coverage right away. This type of policy allows them to get the necessary coverage without having to make the commitment to a full car insurance policy.

What Does a Non Owner Policy NC Cover?

A Non Owner Policy NC provides liability coverage for individuals who do not own a car. This includes liability coverage for any bodily injury or property damage that may be caused by the insured while operating a vehicle. Additionally, some policies may also provide protection for medical payments and uninsured motorists, depending on the policy. The coverage provided by this type of policy is typically less than the coverage provided by a traditional car insurance policy, but it is often more affordable and provides more protection for those without a vehicle.

What Are the Benefits of a Non Owner Policy NC?

The primary benefit of a Non Owner Policy NC is that it provides coverage for those who don’t own a car but still need to be insured. This type of policy is more affordable than a traditional car insurance policy, and it allows individuals to get the necessary protection without having to make the commitment to a full car insurance policy. Additionally, this type of policy can provide coverage for medical payments and uninsured motorists, depending on the policy.

How Much Does a Non Owner Policy NC Cost?

The cost of a Non Owner Policy NC will vary depending on the individual’s driving record, the coverage level desired, and the insurance company providing the policy. Generally, this type of policy is more affordable than a traditional car insurance policy and can provide more protection for those without a vehicle. Additionally, the cost of this type of policy may be less than the cost of renting a car for a period of time, making it an attractive option for those who don’t own a car but still need to be insured.

Where Can I Find a Non Owner Policy NC?

Non Owner Policy NC is available through most major insurance companies. It is important to shop around and compare rates and coverage levels in order to find the best policy. Additionally, it is a good idea to speak with an insurance agent to discuss the different coverage levels and options available. This will ensure that the individual is getting the best coverage for their needs.

Non Owner Auto Insurance | Compare quotes wih Good to Go

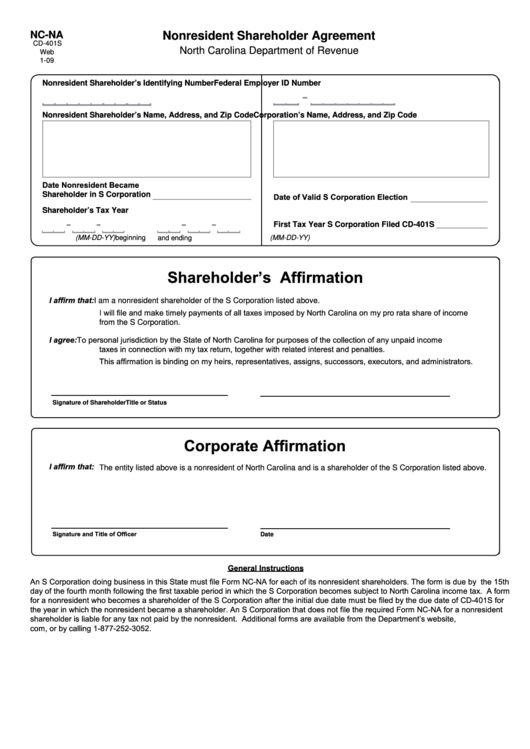

Form Nc-Na - North Carolina Nonresident Shareholder Agreement printable

Non-Owner Car Insurance Explained

AEE Reports

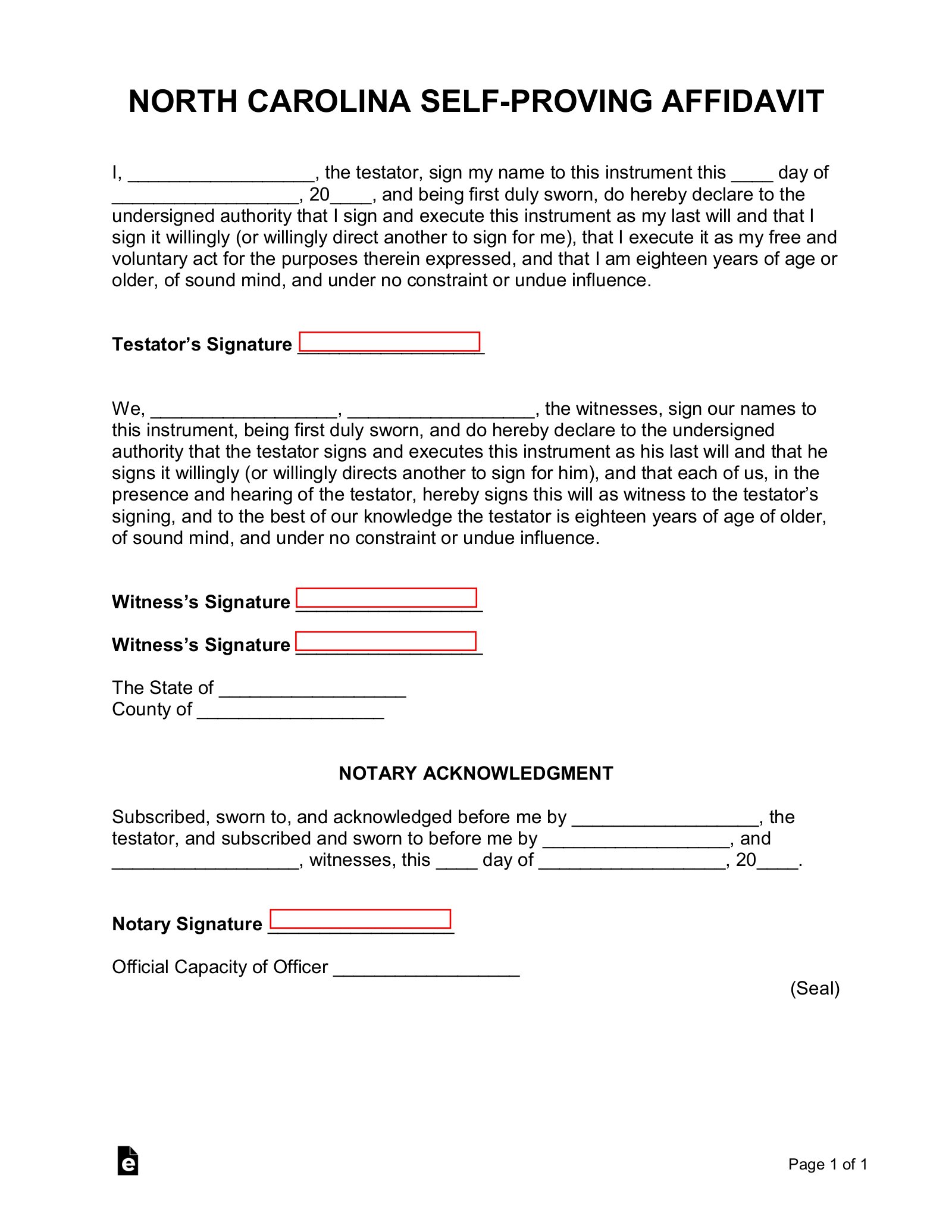

Free North Carolina Self-Proving Affidavit Form - PDF | Word – eForms