Insurance More Than Car Payment

Insurance More Than Car Payment: What You Need to Know

What Is Insurance More Than Car Payment?

Insurance more than car payment is an insurance policy that covers more than just the cost of a car. It provides coverage for a variety of potential losses and damages, including medical bills and property damage. In the event of an accident, this type of insurance will help pay for the costs associated with repairing or replacing a vehicle. It also provides additional coverage for items such as medical bills, lost wages, and other damages. Additionally, this type of insurance can be used to pay for repairs to a vehicle that has been damaged in an accident.

Why Should You Consider Insurance More Than Car Payment?

Insurance more than car payment can be beneficial for a number of reasons. First and foremost, it provides financial protection in the event of an accident. If a driver is found to be at fault in an accident, their insurance company will provide coverage for the cost of repairs and other damages. Additionally, this type of insurance can provide protection for medical bills, lost wages, and other damages that may occur in the event of an accident. Finally, it can provide added peace of mind because it covers more than just the cost of a car.

What Are Some Types of Insurance More Than Car Payment?

There are several types of insurance more than car payment available. Comprehensive insurance covers damages to a vehicle that may occur due to a collision or other incident. Collision insurance covers repairs and other damages that may occur if a car is damaged by another vehicle. Liability insurance covers medical bills and other damages that may occur in the event of an accident. Finally, Uninsured Motorist coverage protects a driver if they are involved in an accident with an uninsured motorist.

What Should You Consider When Choosing an Insurance More Than Car Payment Policy?

When choosing an insurance more than car payment policy, it is important to consider the type of coverage that is being offered. It is also important to compare the coverage offered by different companies to determine which policy is the best fit for your needs. Additionally, it is important to consider the cost of the policy. This will help determine if the policy is affordable and provide the coverage that is needed.

How Can You Find an Insurance More Than Car Payment Policy?

The best way to find an insurance more than car payment policy is to shop around. Comparing different policies from various companies can help you find the best policy for your needs. Additionally, it is important to read the policy carefully to make sure that it provides the type of coverage that is needed. Finally, it is important to make sure that the policy is affordable and provides the coverage that is needed.

Conclusion

Insurance more than car payment can provide financial protection in the event of an accident. It can also provide additional coverage for medical bills, lost wages, and other damages that may occur in the event of an accident. There are several types of insurance more than car payment available, and it is important to compare different policies to find the best fit. Additionally, it is important to make sure that the policy is affordable and provides the coverage that is needed.

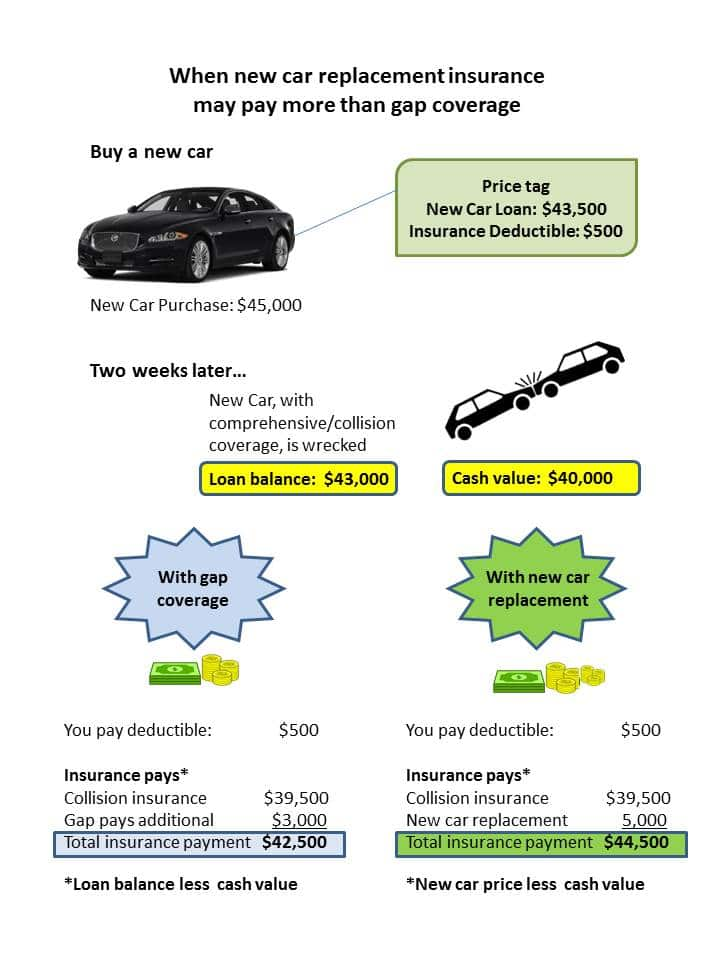

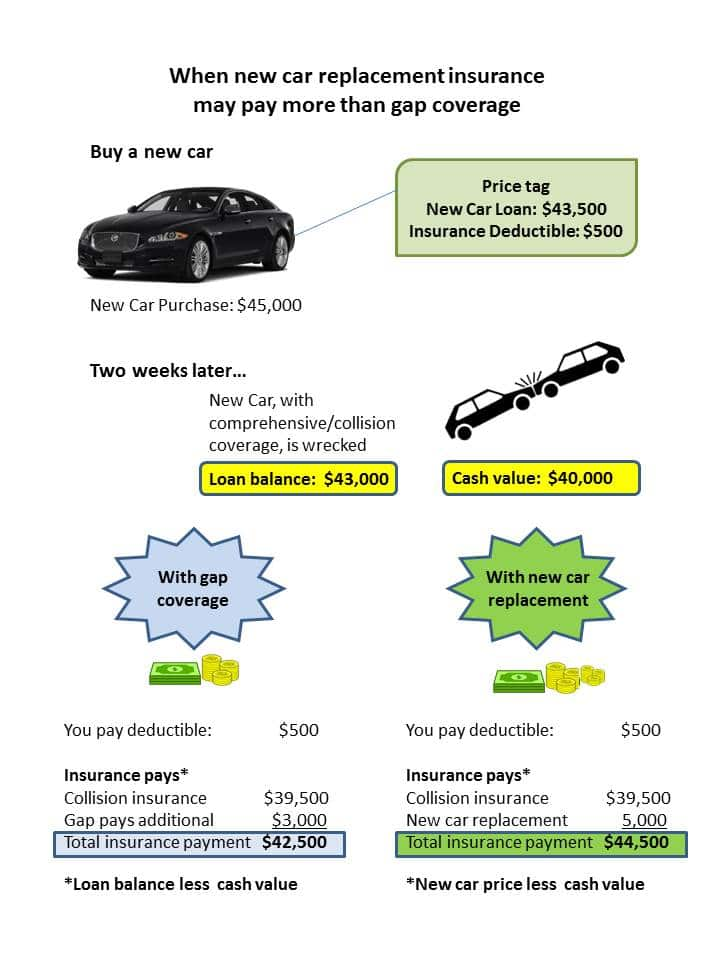

Gap Insurance for your New or Leased Cars

Looking at the costs of auto insurance in Ontario, and ways motorists

Page for individual images | Quoteinspector.com - QuoteInspector.com

Budget-Aware Ways to Make Car Insurance Payments | Direct Auto

Tips for Saving Money on Car Insurance - zoom blog The future of