Bodily Injury And Property Damage Liability Coverage

Bodily Injury And Property Damage Liability Coverage: What You Need To Know

What is Bodily Injury and Property Damage Liability Coverage?

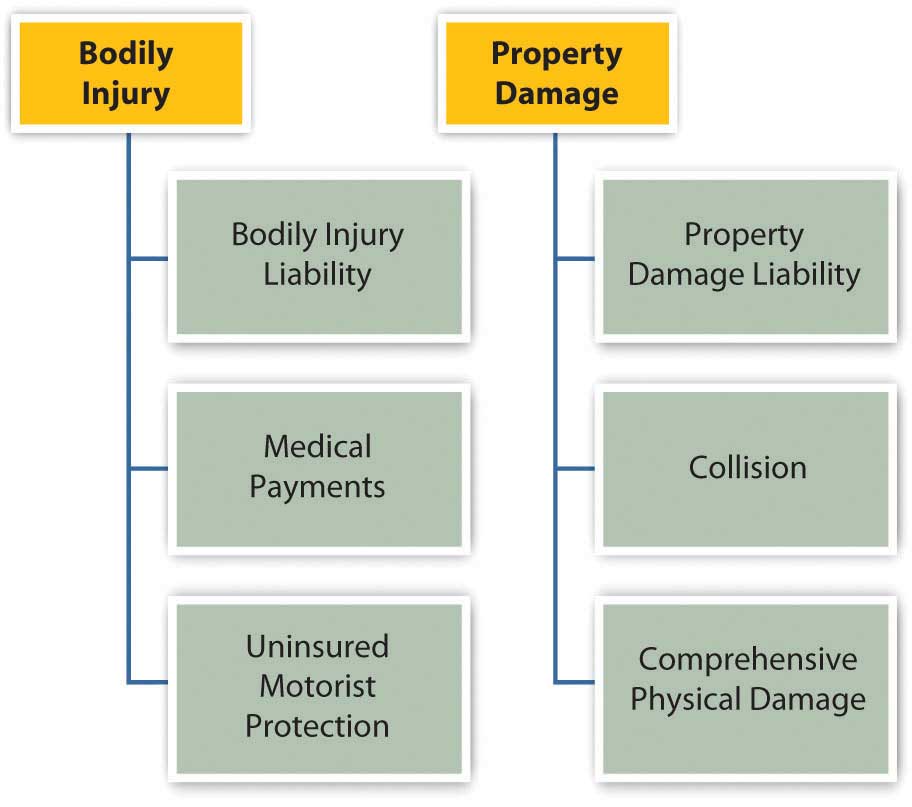

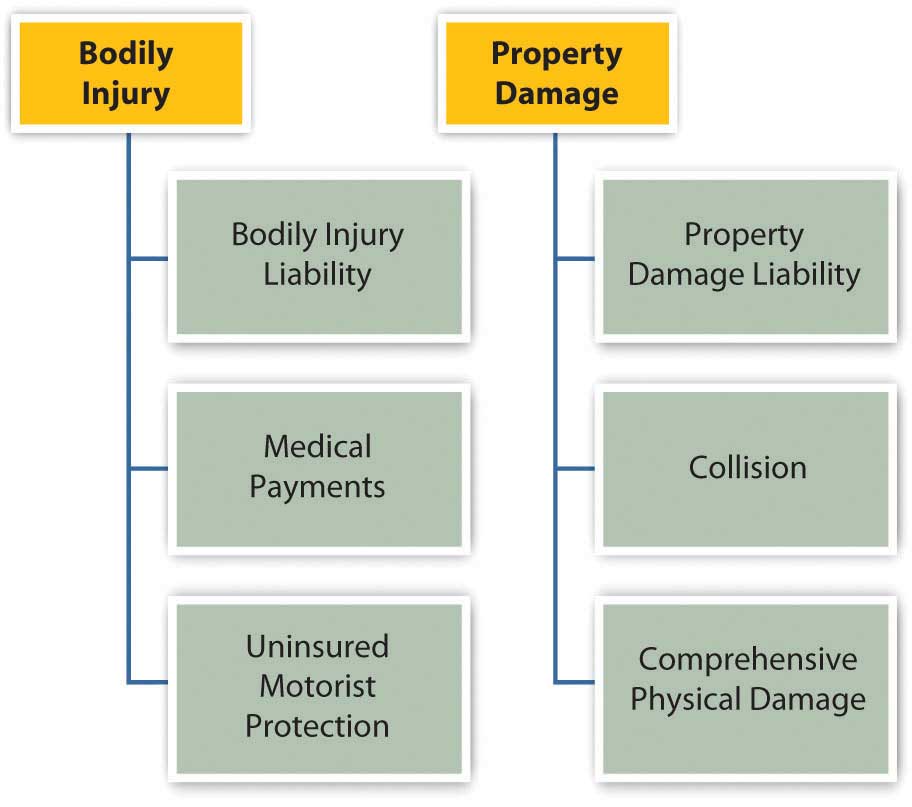

Bodily Injury and Property Damage Liability Coverage is an important type of auto insurance coverage that provides financial protection if you are legally responsible for an accident that results in an injury to someone else or damage to their property. It pays for legal defense costs and settlements, up to the limits of your policy, for claims of bodily injury and property damage caused by an accident in which you or another driver with your permission is at fault. Bodily Injury and Property Damage Liability Coverage is usually required by state law, although the minimum amounts of coverage may vary. It is important to purchase enough coverage to adequately protect yourself and your assets.

What Does Bodily Injury and Property Damage Liability Coverage Do?

Bodily Injury and Property Damage Liability Coverage provides financial protection if you are legally responsible for an accident that results in an injury to someone else or damage to their property. If you are found at fault for an accident, Bodily Injury and Property Damage Liability Coverage will pay for legal defense costs and settlements, up to the limits of your policy. This coverage is usually required by state law, although the minimum amounts of coverage may vary. It is important to purchase enough coverage to adequately protect yourself and your assets.

When Do You Need Bodily Injury and Property Damage Liability Coverage?

Bodily Injury and Property Damage Liability Coverage is often required by state law. Most states require drivers to carry at least the minimum amount of Bodily Injury and Property Damage Liability Coverage on their auto insurance policy. The minimum amounts of coverage vary by state, so it is important to check with your state’s department of motor vehicles to find out the minimum amount of coverage required. It is also important to purchase enough coverage to adequately protect yourself and your assets.

What Does Bodily Injury and Property Damage Liability Coverage Not Cover?

Bodily Injury and Property Damage Liability Coverage does not cover any damage to your own property or any damage to the property of any drivers named on your policy. It also does not cover any medical bills incurred by you or any drivers named on your policy. Additionally, it does not cover any property damage or injuries caused by an uninsured or underinsured driver.

How Much Does Bodily Injury and Property Damage Liability Coverage Cost?

The cost of Bodily Injury and Property Damage Liability Coverage can vary depending on your specific auto insurance policy. Generally, Bodily Injury and Property Damage Liability Coverage is less expensive than other types of auto insurance coverage, such as collision or comprehensive coverage. The minimum amounts of coverage required by state law will vary, so it is important to check with your state’s department of motor vehicles to find out what the minimum amount of coverage required is. Additionally, it is important to purchase enough coverage to adequately protect yourself and your assets.

Conclusion

Bodily Injury and Property Damage Liability Coverage is an important type of auto insurance coverage that provides financial protection if you are legally responsible for an accident that results in an injury to someone else or damage to their property. It is often required by state law and the minimum amounts of coverage may vary. It is important to purchase the right amount of coverage to adequately protect yourself and your assets.

Personal Risk Management: Insurance

What Is Bodily Injury Liability? | Lerner and Rowe Injury Attorneys

What is Atlanta bodily injury liability? | Atlanta Insurance

Bodily Injury Liability [What does it Cover?] | Ogletree Financial

![Bodily Injury And Property Damage Liability Coverage Bodily Injury Liability [What does it Cover?] | Ogletree Financial](https://insurancequotes2day.com/wp-content/uploads/2019/09/liability-limits-by-state.jpg)

Should I Have Bodily Injury Liability Insurance? | The Ferrara Law Firm