Average Car Insurance Rates For Teens

Tuesday, November 7, 2023

Edit

Average Car Insurance Rates For Teens

What Is the Average Car Insurance Rate for Teens?

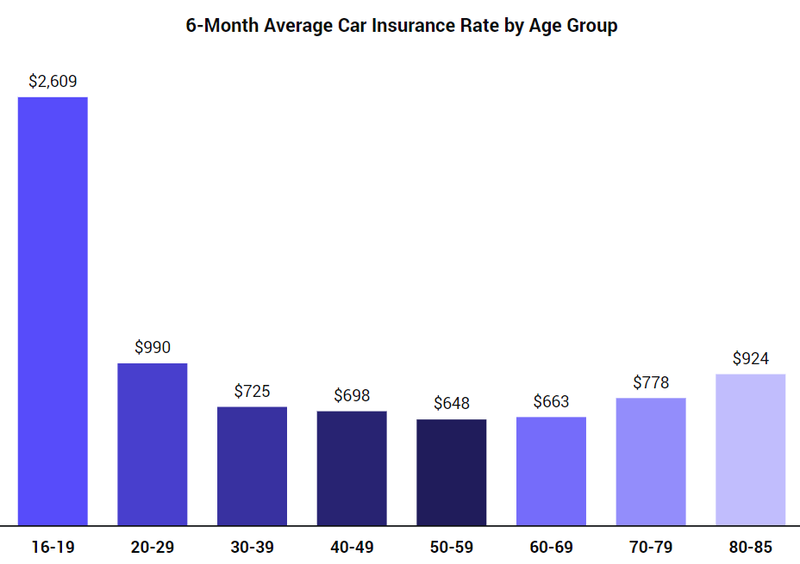

Car insurance for teens can be expensive, but you can take steps to keep costs down. How much does car insurance cost for teens? According to the Insurance Information Institute (III), the average cost of car insurance for teens is around $2,100 per year. This is substantially higher than the average cost of car insurance for adults, which is around $1,250 per year. The main reason for this is that teens are seen as higher-risk drivers and therefore have higher insurance premiums.

Factors That Impact Car Insurance Rates for Teens

There are several factors that can impact the cost of car insurance for teens. These include the following:

- The type of car that the teen is driving. Sports cars, luxury cars, and cars with powerful engines will typically have higher insurance rates.

- The teen’s driving record. Teens who have a good driving record and no history of accidents will typically have lower insurance rates.

- The teen’s age. Younger teens typically have higher insurance rates than older teens.

- The teen’s location. Car insurance rates can vary from state to state and even from city to city.

- The type of coverage that is purchased. Comprehensive and collision coverage will typically cost more than basic liability coverage.

- The teen’s credit score. A good credit score can lead to lower insurance rates.

Ways to Help Lower Car Insurance Rates for Teens

While car insurance for teens can be expensive, there are several things that parents can do to help lower the cost. These include the following:

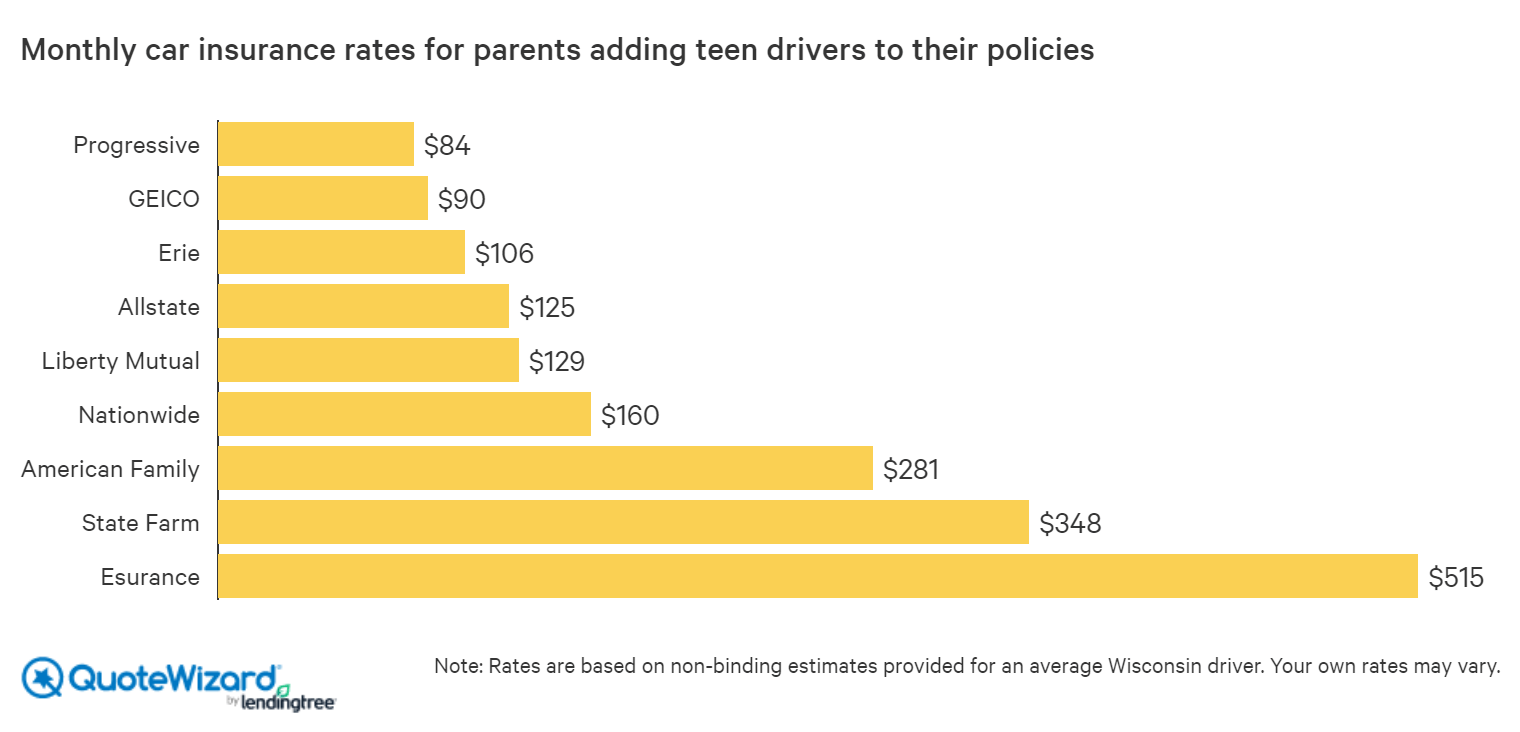

- Adding the teen to an existing policy. Adding the teen to an existing policy can help lower the cost of car insurance. It’s also important to note that there may be discounts available for adding multiple vehicles to an existing policy.

- Encouraging good grades. Many insurance companies offer discounts for teens who have good grades in school.

- Encouraging safe driving habits. Teens who have a good driving record and no history of accidents may be eligible for discounts.

- Shopping around. Comparing car insurance rates from multiple insurance companies can help parents find the best rate.

- Considering a higher deductible. Increasing the deductible on the policy can help lower the cost of car insurance.

Conclusion

Car insurance for teens can be expensive, but there are several things that parents can do to help lower the cost. Adding the teen to an existing policy, encouraging good grades, and shopping around for the best rates are all good ways to help keep car insurance costs down. It’s also important to remember that car insurance rates can vary from state to state and even from city to city. So, it’s important to compare rates from multiple companies to find the best rate.

2021 Car Insurance Rates by Age and Gender - NerdWallet

Teenage Car Insurance Average Cost Per Month ~ artfirstdesign

Best Car Insurance for Teens | QuoteWizard

Average Cost Of Car Insurance For 19 Year Old Female - Car Retro

What Age Does Car Insurance Go Down And Why? - Cover