American General Whole Life Insurance Policy

Friday, November 3, 2023

Edit

American General Whole Life Insurance Policy

What is Whole Life Insurance?

Whole Life Insurance is a type of permanent life insurance that provides coverage for the insured’s entire life. It is a long-term policy that will provide both death benefits and cash value. It is a type of life insurance that has both a death benefit and a cash value component. Unlike Term Life Insurance, Whole Life Insurance does not expire or terminate after a certain period of time. Whole Life Insurance is designed to provide coverage for the duration of the insured’s life and the policy will remain in effect until the insured passes away.

The cash value component of Whole Life Insurance is a separate account that accumulates over time. The cash value can be accessed through policy loans or withdrawals, which are generally tax-free. Whole Life Insurance is an excellent way to secure your family’s financial future and can help provide peace of mind for years to come.

American General Whole Life Insurance Policy

American General Whole Life Insurance is a popular choice for those seeking a secure and reliable permanent life insurance policy. The company is known for its competitive rates and excellent customer service. American General Whole Life Insurance policies offer several features and benefits, such as flexible premiums, guaranteed death benefits, and the potential to accumulate cash value over time.

American General Whole Life Insurance policies are available with a variety of coverage options, including term, whole, universal, and variable life insurance. The company also offers a wide range of riders and endorsements, allowing policyholders to customize their coverage to meet their individual needs.

How Does American General Whole Life Insurance Work?

With American General Whole Life Insurance, policyholders pay premiums over the life of the policy. These premiums are used to cover the cost of the death benefit and the cash value accumulations. Over time, the policy accumulates cash value, which can be accessed through policy loans or withdrawals.

American General Whole Life Insurance policies also offer the potential for policy dividends, which are generally declared and paid annually. Dividends are not guaranteed and will vary depending on the performance of the company’s investments.

Benefits of American General Whole Life Insurance

American General Whole Life Insurance offers several key benefits. The policy is designed to provide coverage for the duration of the insured’s life and the policy will remain in effect until the insured passes away. The policy also offers the potential to accumulate cash value over time, with the ability to access the funds through policy loans or withdrawals.

American General Whole Life Insurance also offers flexible premium payments, allowing policyholders to make payments that fit their budget. The company also offers a wide range of riders and endorsements, allowing policyholders to customize their coverage to meet their individual needs.

How to Get American General Whole Life Insurance

American General Whole Life Insurance policies are available through independent insurance agents. The company also offers online services, allowing customers to compare policies and get quotes from the comfort of their own home. Customers can also contact the company directly for more information about their products and services.

American General Whole Life Insurance is an excellent option for those seeking a secure and reliable permanent life insurance policy. The company is known for its competitive rates and excellent customer service. Customers can contact American General directly to get more information about their Whole Life Insurance policies and to find an agent in their area.

Conclusion

American General Whole Life Insurance is an excellent option for those seeking a secure and reliable permanent life insurance policy. The company is known for its competitive rates and excellent customer service. The policy offers the potential for cash value accumulation, flexible premium payments, and several riders and endorsements to customize coverage to meet the policyholder’s individual needs. Customers can contact American General directly to get more information about their Whole Life Insurance policies and to find an agent in their area.

American General Life Insurance : Life Insurance | NEW HOT NEWS

Articles Junction: Types of Life Insurance Policies Life Insurance

What the Experts Don’t Know about Bank On Yourself, Part 2 – Bank On

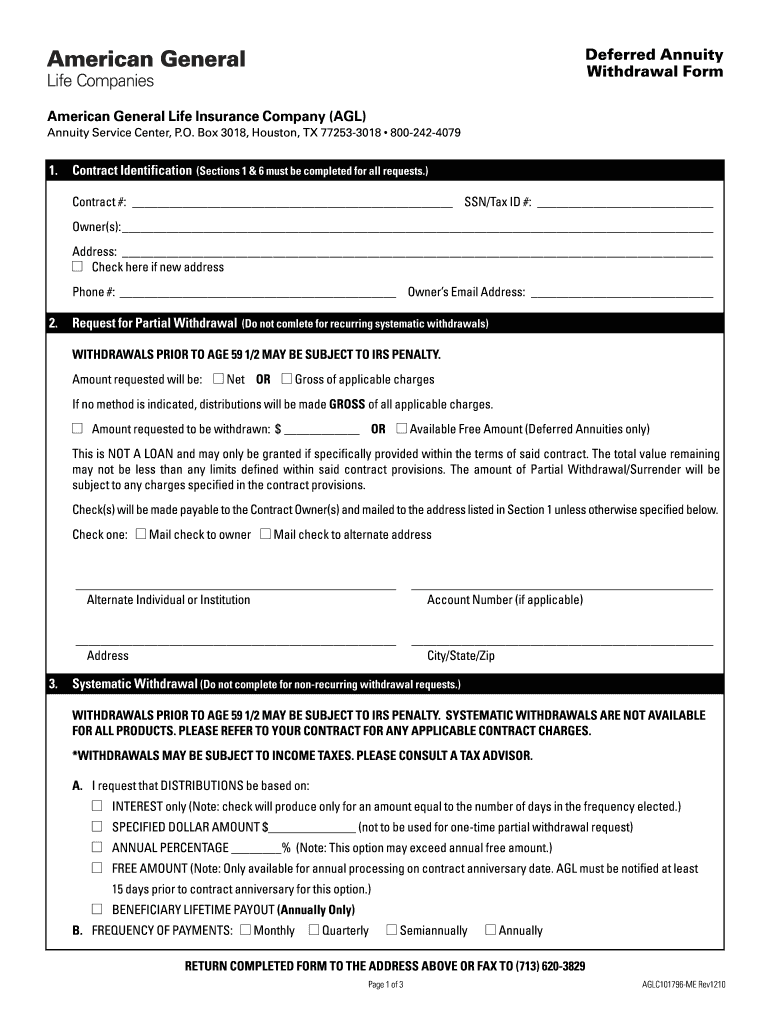

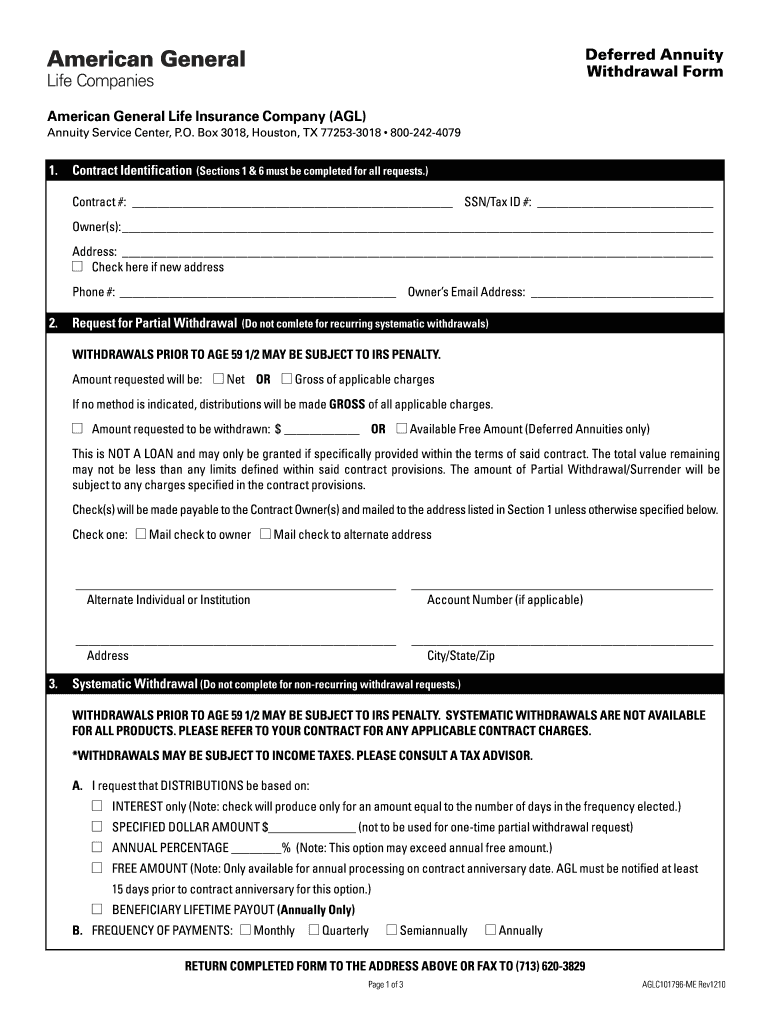

American General Life Insurance Forms - Insurance Forms

Fillable Online American General Life Insurance Company (the Company