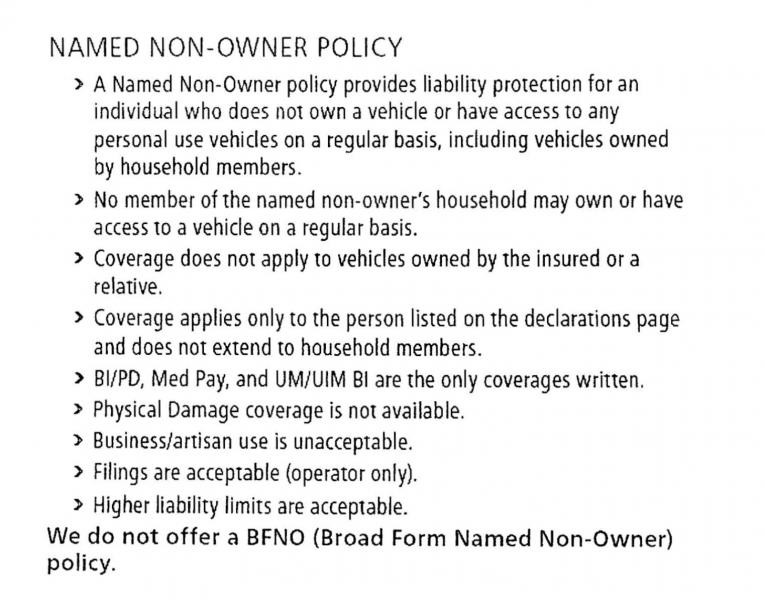

Named Non Owner Policy Definition

What is Named Non-Owner Car Insurance?

Named non-owner car insurance is a policy that provides coverage for people who drive vehicles that they do not own. The policy provides protection for individuals who are not the owners of the car, yet are regularly driving it. It is designed to provide protection for people who are driving someone else’s car or for those who rent cars regularly. It is important to note that not every insurance company offers this type of coverage, so it is important to do research and compare different companies to find the best coverage and most affordable prices.

Why Do I Need Named Non-Owner Car Insurance?

Named non-owner car insurance is important because it provides coverage for individuals who are driving but do not own their own vehicle. This type of policy is ideal for individuals who use rental cars or for those who often drive someone else’s car. It can also be beneficial for those who are required to have a certain amount of coverage in order to keep their driver’s license or to qualify for certain discounts. Without this type of coverage, individuals may be at risk of not being able to pay for expensive repair costs or medical bills should an accident occur.

What Does Named Non-Owner Car Insurance Cover?

The coverage provided by named non-owner car insurance varies depending on the company and the policy purchased. Generally, the policy covers liability, medical payments, and uninsured motorist coverage. Liability coverage pays for damages to another person’s vehicle or property if you are responsible for an accident. Medical payments coverage pays for medical expenses if you are injured in an accident. Uninsured motorist coverage pays for damages to your vehicle if you are hit by an uninsured driver.

Who is Eligible for Named Non-Owner Car Insurance?

In order to be eligible for named non-owner car insurance, individuals must meet certain criteria. Generally, the policy is available to those who do not own their own car, who do not have a current auto insurance policy, or who have had their license revoked or suspended. The policy is typically available for individuals who have had their license for at least three years and have a clean driving record.

How Much Does Named Non-Owner Car Insurance Cost?

The cost of named non-owner car insurance varies depending on the company and the policy purchased. Generally, the policy is more expensive than traditional auto insurance because it is limited in scope. The cost is also based on factors such as the driver’s age, driving record, and the type of vehicle they are driving. It is important to shop around and compare rates to get the best deal possible.

Where Can I Purchase Named Non-Owner Car Insurance?

Named non-owner car insurance can be purchased from most major insurance companies. It is important to compare different companies and policies to find the best coverage and most affordable prices. It is also important to read the fine print of any policy to make sure it provides the coverage you need. Additionally, it is important to understand the state laws regarding auto insurance and make sure the policy meets those requirements.

Non Owner Auto Insurance | Compare quotes wih Good to Go

Non Owners Car Insurance Policy

Non-Owner Car Insurance - United Policyholders

Policies & Procedures

What's A Non-Owner SR 22?