Low Rates On Car Insurance

Surprising Low Rates On Car Insurance

The Benefits of Low Rates

Finding low rates on car insurance is a great way to save money. This is especially true if you are trying to save money on car insurance premiums. It is important to understand the benefits of low rates before you make any decisions. Low rates can help you save money on your monthly premiums. You can also save money on deductibles, which can help reduce the amount of money you have to pay out of pocket if you have an accident or need to file a claim. Low rates can also help you get the coverage you need without breaking the bank.

Finding Low Rates

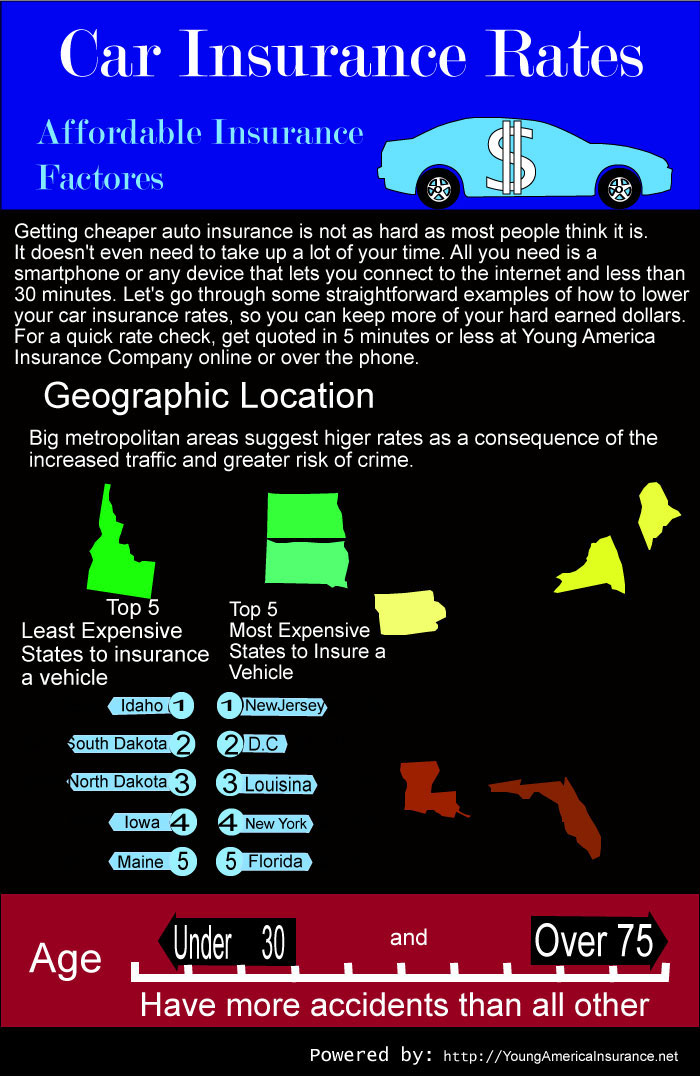

Finding low rates on car insurance can be difficult. It is important to compare different car insurance companies and plans to make sure you are getting the best deal. It is also important to look at factors such as the type of car you drive, your driving record, the age of the driver, and any discounts you may be eligible for. All of these factors can affect the rates you will be offered.

Comparing Rates

When comparing rates, it is important to understand the differences between different plans and policies. Different coverages and deductibles can affect the overall cost of your car insurance. It is also important to look at the coverage limits offered and any discounts that may be available. Many companies offer discounts for good driving records, for having multiple cars insured with them, and for having certain safety features on your car. It is important to compare all of these factors in order to find the best rates.

Shop Around for the Best Deal

When looking for low rates on car insurance, it is important to shop around. Different insurers will offer different rates and it is important to compare them in order to get the best deal. There are many websites available that can help you compare rates so you can find the right policy for you. It is also important to read the policy carefully before signing up for any coverage. This will ensure that you understand what is covered and what isn’t.

Get Quotes From Multiple Providers

It is also important to get quotes from multiple providers when looking for low rates on car insurance. Different companies will offer different rates and it is important to compare them in order to find the best deal. It is also important to read the policy carefully before signing up for any coverage. This will ensure that you understand what is covered and what isn’t. Shopping around for the best deal is the best way to save money on car insurance.

Conclusion

Finding low rates on car insurance can be difficult, but it is possible. It is important to compare different plans and policies in order to get the best deal. Shopping around and getting quotes from multiple providers is the best way to make sure you are getting the best deal. Understanding the benefits of low rates can help you save money on your monthly premiums. By following these tips, you can find the coverage you need without breaking the bank.

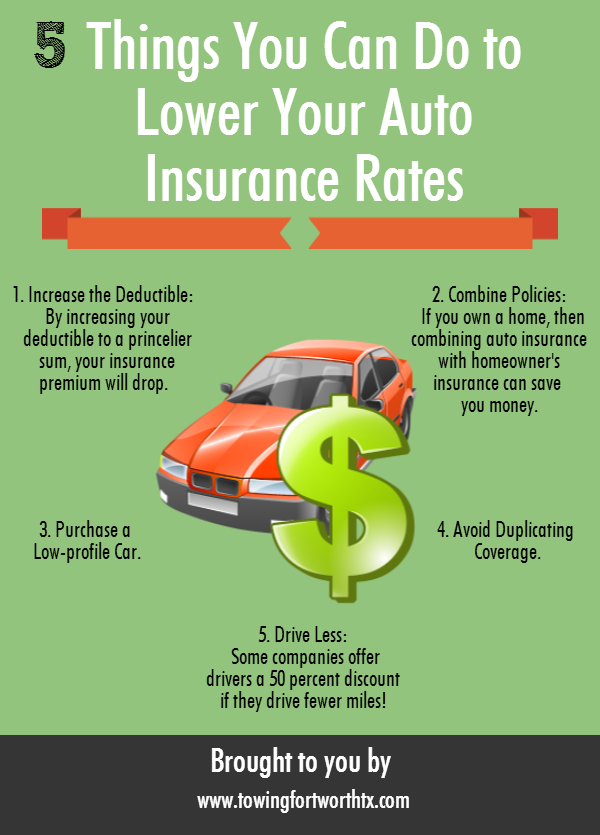

Lower Your Auto Insurance Rates with 5 steps

Car Insurance - Online Insurance Quote

Low Price Car Insurance / The Cheapest Car Insurance Companies August

How to Lower Your Car Insurance Rates | Young America Insurance Today

Average Monthly Car Insurance Rate