Intact Auto Insurance Cancellation Policy

Tuesday, October 31, 2023

Edit

Intact Auto Insurance Cancellation Policy

What is Intact Auto Insurance?

Intact Auto Insurance is a reliable insurance provider that offers Canadian drivers the protection they need for their vehicles. Whether you've recently bought a car, need to renew your policy, or are simply looking for a more affordable option, Intact is a great choice. The company offers a range of coverage types, from basic liability to comprehensive insurance packages. Intact also makes cancelling your policy easy.

How to Cancel your Intact Auto Insurance Policy

Cancelling your Intact Auto Insurance policy is a straightforward process. To start, you'll need to contact Intact by phone or email. You can find the contact information on their website or social media pages. You'll then need to provide your name, policy number, and the reason why you want to cancel your policy. Once your request is received, Intact will begin the cancellation process. It is important to note that cancellation fees may apply, so make sure to ask about any fees before cancelling.

When to Cancel your Intact Auto Insurance Policy

It is important to note that you can cancel your Intact Auto Insurance policy anytime, as long as you give at least 30 days notice. If you cancel your policy within 30 days of renewal, you may be eligible for a refund of premium. You should also make sure to cancel your policy before you drive a new vehicle. Intact only covers cars that are listed on your policy, so if you plan to drive a new car, you'll need to make sure to inform Intact before cancelling your policy.

How Cancelling your Intact Auto Insurance Policy Works

When you cancel your Intact Auto Insurance policy, the company will send you a confirmation letter with the details of your cancellation. This letter will include the date your coverage will end, as well as any refund or fees you may be responsible for. You should keep this letter, as it is proof that you have cancelled your policy. Once your policy is cancelled, you will no longer be covered by Intact Auto Insurance.

What to do After Cancelling your Intact Auto Insurance Policy

Once you have cancelled your Intact Auto Insurance policy, you'll need to find a new insurer. There are many companies that offer auto insurance in Canada, so it's important to shop around and compare policies to find the best coverage for your needs. It's also important to make sure that the new insurer is licensed in your province, as this will help ensure that you are getting the best coverage for your needs.

Conclusion

Cancelling your Intact Auto Insurance policy is a straightforward process. However, it's important to make sure that you give at least 30 days notice and keep a copy of your cancellation letter. After cancelling your policy, you'll need to find a new insurer that offers the best coverage for your needs. By following these steps, you'll be able to ensure that you are getting the best coverage for your vehicle.

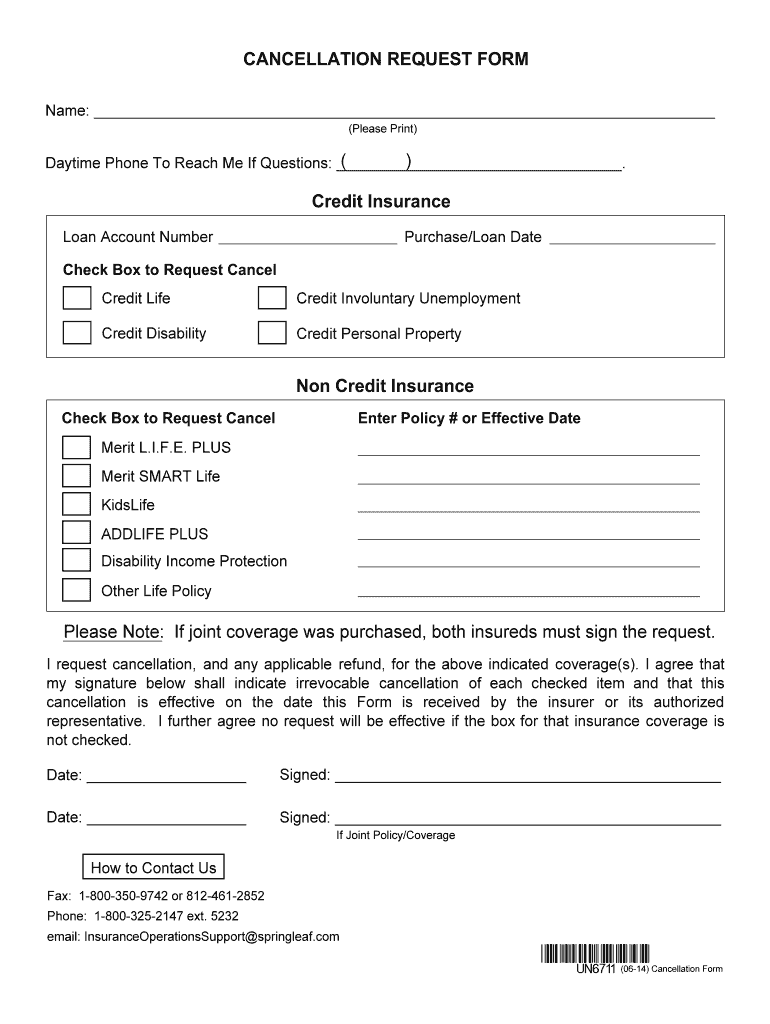

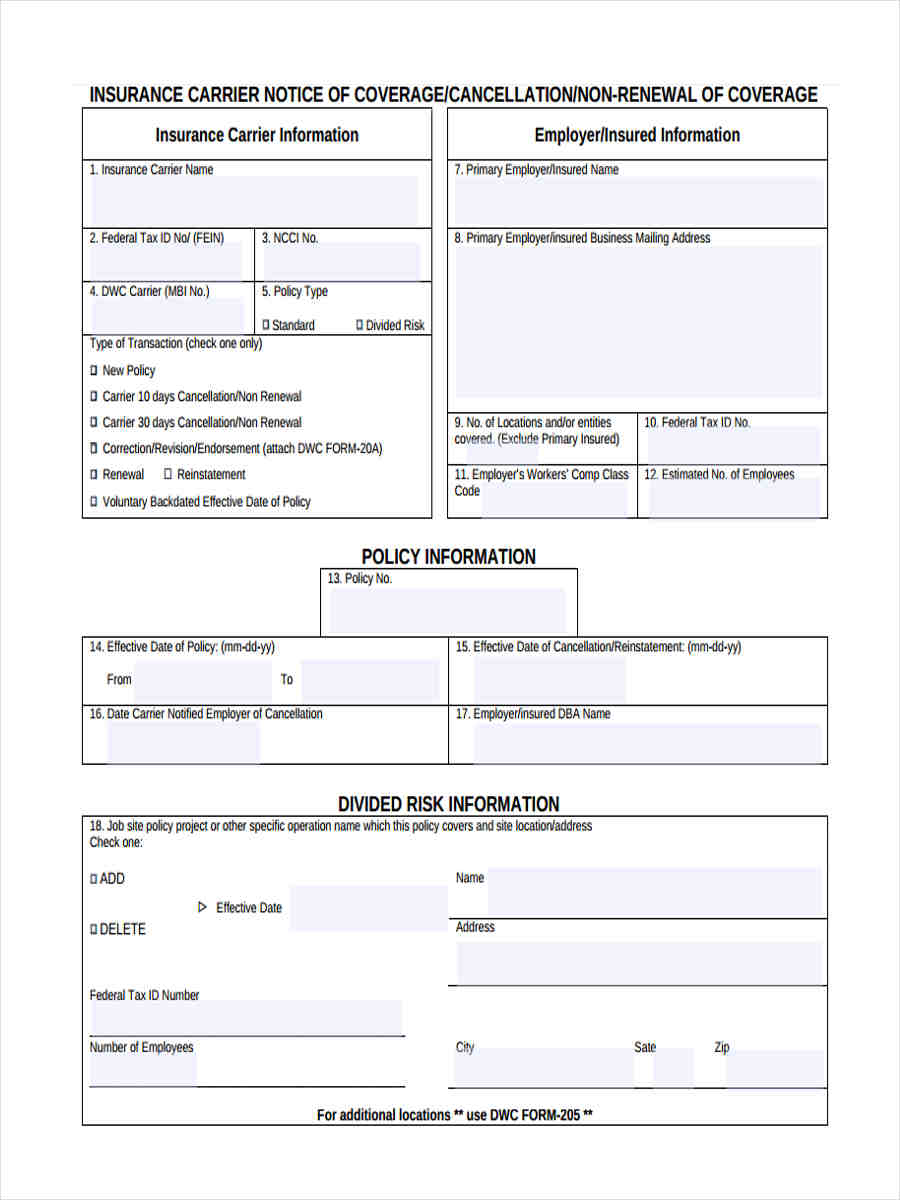

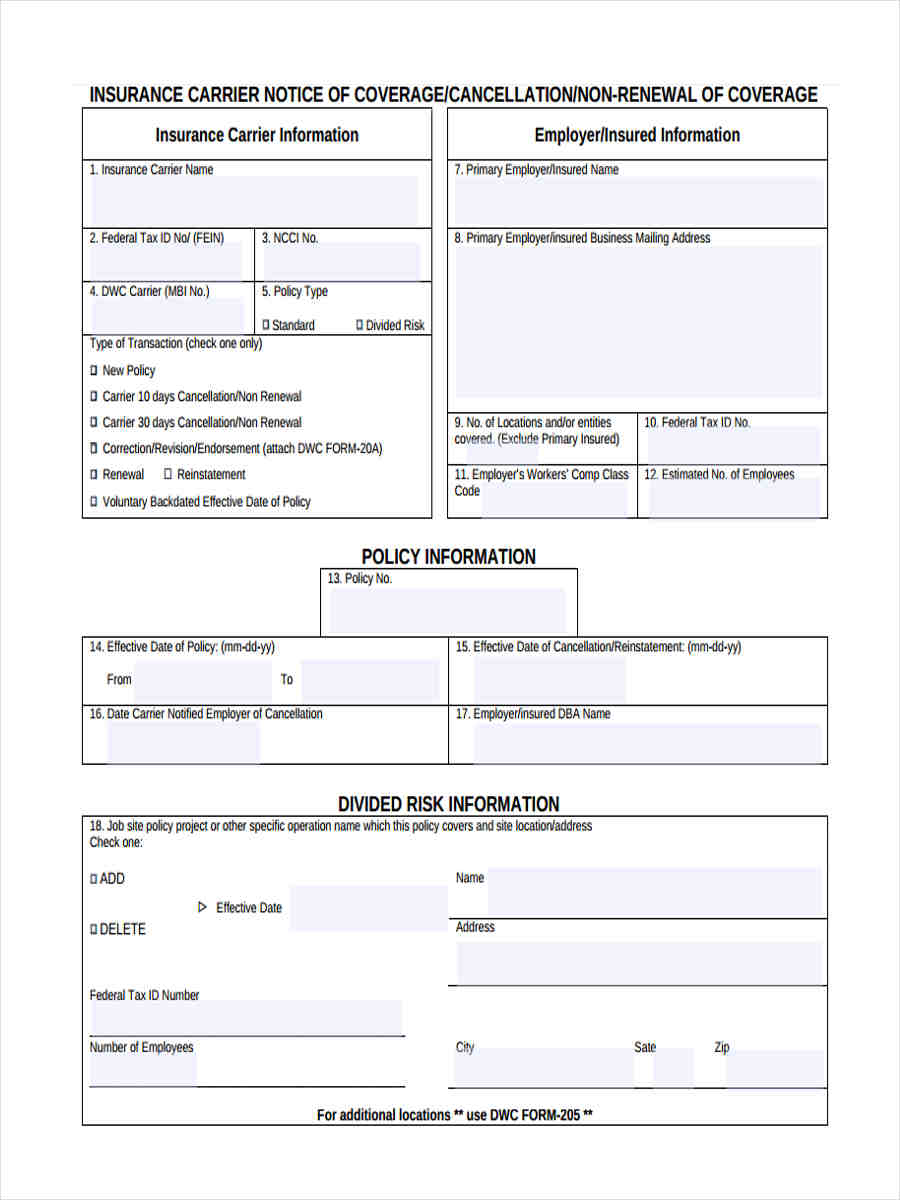

FREE 8+ Sample Notice of Cancellation Forms in MS Word | PDF

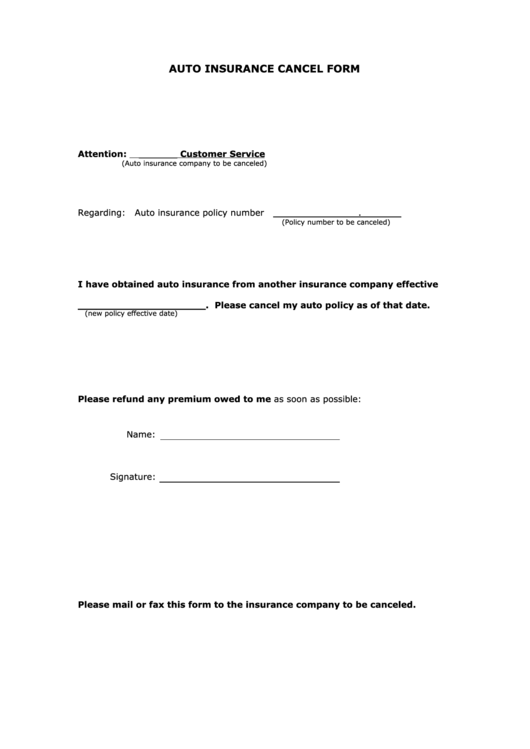

Top 5 Insurance Cancellation Form Templates free to download in PDF format

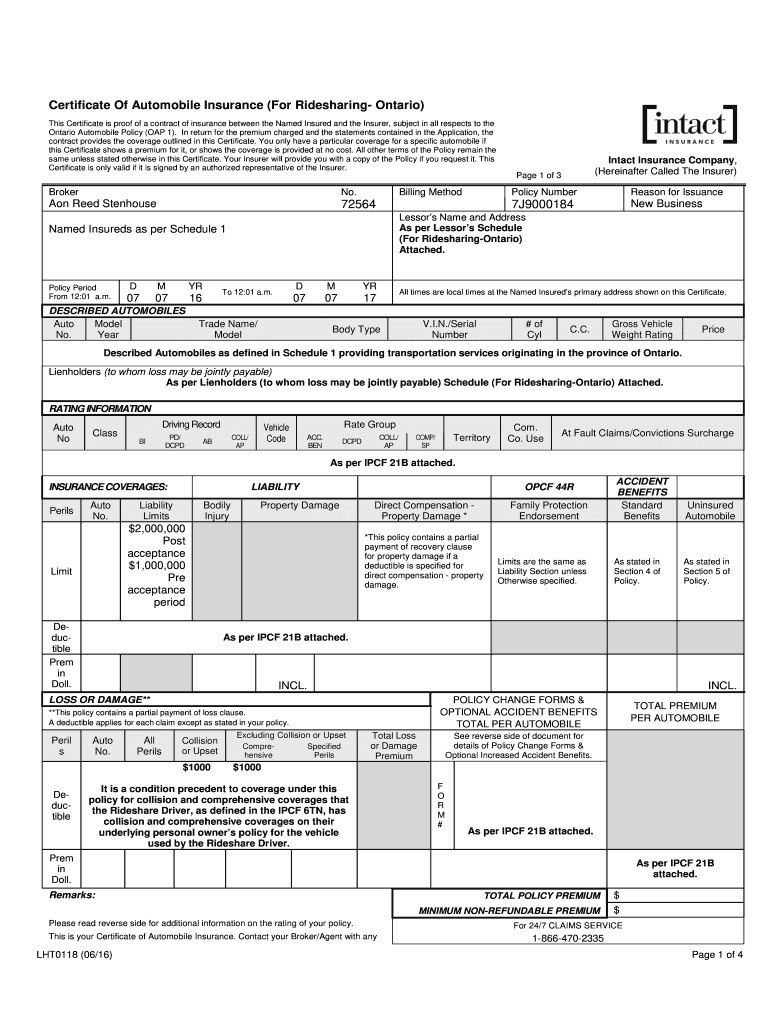

Canada Intact Insurance LHT0118 2016 - Fill and Sign Printable Template

10+ Cancellation Letter Template - Format, Sample & Example (2022)

Life Cancellation - Fill Out and Sign Printable PDF Template | signNow