How To Get Car Insurance For A Month

How To Get Car Insurance For A Month

Introduction

Buying car insurance is an important decision that no driver can ignore. Unfortunately, many people are not aware of the options they have when it comes to their car insurance policy. One such option is getting car insurance for a month. This type of policy allows drivers to have the coverage they need without having to commit to a long term policy. In this article, we'll discuss the advantages and disadvantages of getting car insurance for a month and how to go about finding the right policy.

Advantages of Getting Car Insurance for a Month

There are many advantages to getting car insurance for a month. The most obvious advantage is that it allows drivers to save money. By not having to commit to a long term policy, drivers can save money by only paying for the coverage they need for the month. Additionally, this type of policy is perfect for those who only drive occasionally. By only having to pay for a month of coverage, drivers who only drive once in a while can save money.

Additionally, getting car insurance for a month allows drivers to switch insurance companies more easily. By only having to commit to a month of coverage, drivers can shop around for the best deals and switch companies if they find a better deal. This makes it much easier for drivers to find the best insurance policy for their needs.

Disadvantages of Getting Car Insurance for a Month

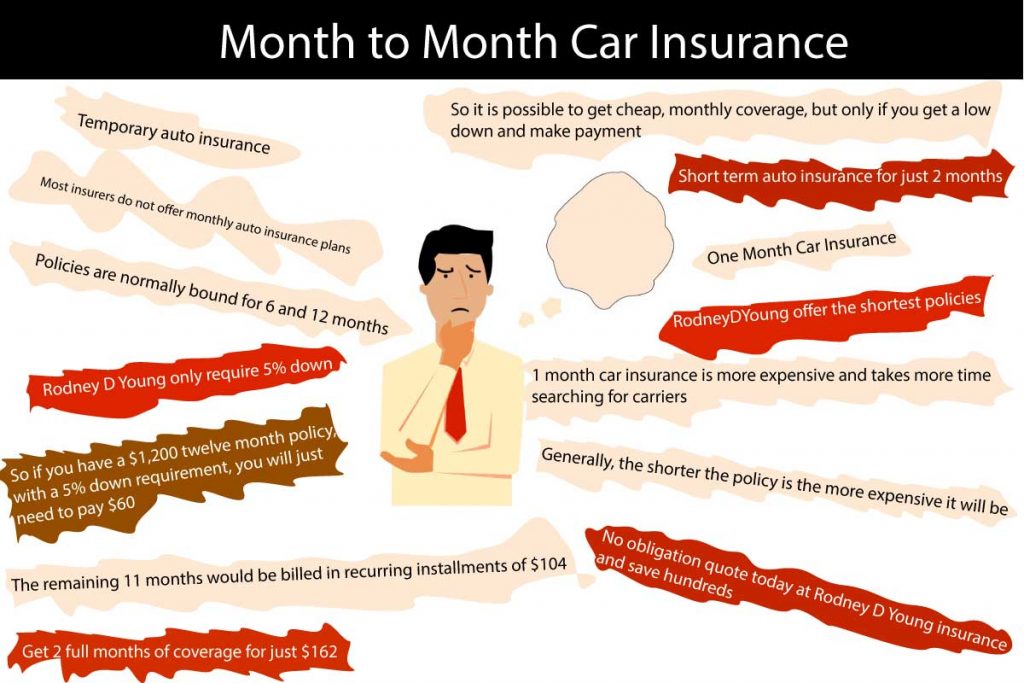

While there are many advantages to getting car insurance for a month, there are also some disadvantages. One of the biggest disadvantages is that it can be more expensive than a long term policy. Since drivers are only committing to a month of coverage, insurance companies may charge a higher rate for this type of policy. Additionally, some insurance companies may not offer this type of policy, making it harder for drivers to find the coverage they need.

Another disadvantage is that it can be difficult to keep track of monthly payments. Since drivers are only committing to a month of coverage, they need to remember to renew their policy each month. This can be difficult to keep track of, especially if drivers have multiple policies. Additionally, drivers may have to pay extra fees if they forget to renew their policy or are late in making their payments.

Finding the Right Policy

If you're looking to get car insurance for a month, it's important to shop around and compare different policies. By comparing different policies, you can find the one that offers the coverage you need at the best price. Additionally, you should make sure to read the policy carefully to make sure that it covers all of the items that you need. It's also a good idea to look for discounts, such as those for having multiple policies or being a safe driver.

Finally, it's important to remember that getting car insurance for a month is not for everyone. If you're a frequent driver or have a long commute, you may be better off with a long term policy. Additionally, you should make sure that you can afford the monthly payments before committing to a policy.

Auto Insurance Month To Month / Cheap Month To Month Car Insurance

Pre Paid Month To Month Car Insurance by month2month007 - Issuu

Month to Month Car Insurance | Just at Rodney D Young

One Month Free Car Insurance at DirectAsia Insurance - YouTube

Pin on Auto