Event Insurance For One Day

Event Insurance For One Day: What You Need to Know

What Is Event Insurance?

Event insurance is a type of insurance coverage specifically designed to protect the insured against potential financial losses that may occur as a result of hosting an event. It is also known as non-owned event liability insurance, special event insurance, or one-day event insurance. This type of insurance provides coverage for a variety of event-related expenses, including property damage, personal injury, legal defense costs, and medical expenses. It can also cover any losses due to cancellation or postponement of the event.

Who Needs Event Insurance?

Event insurance is recommended for anyone organizing an event, no matter how big or small. From a small backyard barbecue to a large wedding reception, event insurance can provide the necessary protection against any potential financial losses that may occur as a result of hosting the event. It is important to note that event insurance is typically not provided by a homeowner’s or renter’s insurance policy, so it is important to purchase a separate policy that provides the necessary coverage.

What Does Event Insurance Cover?

Event insurance typically covers a variety of expenses, including property damage, personal injury, legal defense costs, and medical expenses. It can also cover any losses due to cancellation or postponement of the event. Depending on the policy, other types of coverage may also be available, such as product liability and advertising liability insurance.

What Does Event Insurance Not Cover?

Event insurance typically does not cover intentional acts, such as vandalism or theft, or any injuries or losses that occur as a result of an intoxicated guest. It also does not cover any damages caused by a natural disaster, such as a hurricane or flood. Additionally, it does not cover any losses due to a decline in attendance, or any losses resulting from a decline in the value of any items purchased for the event.

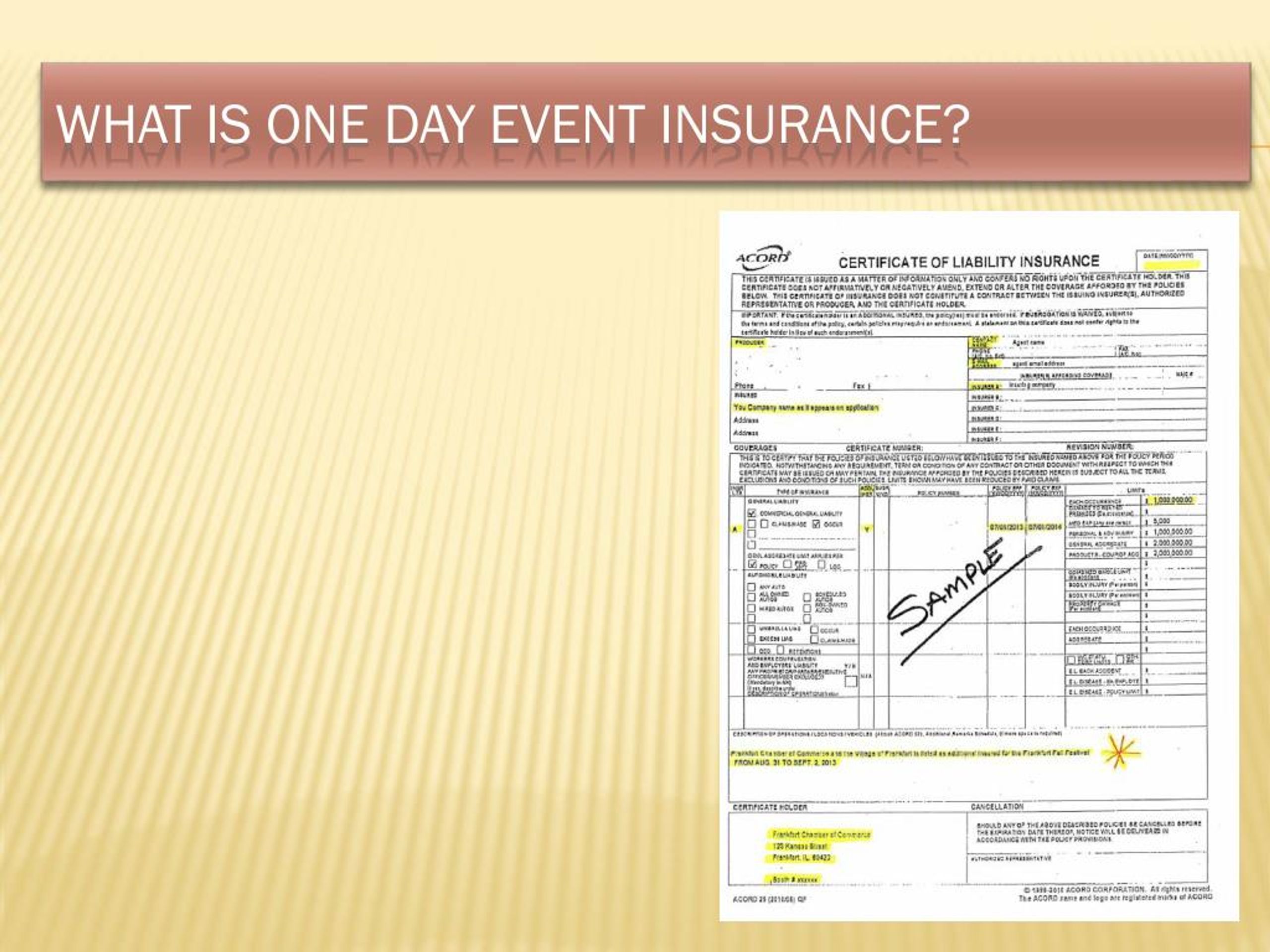

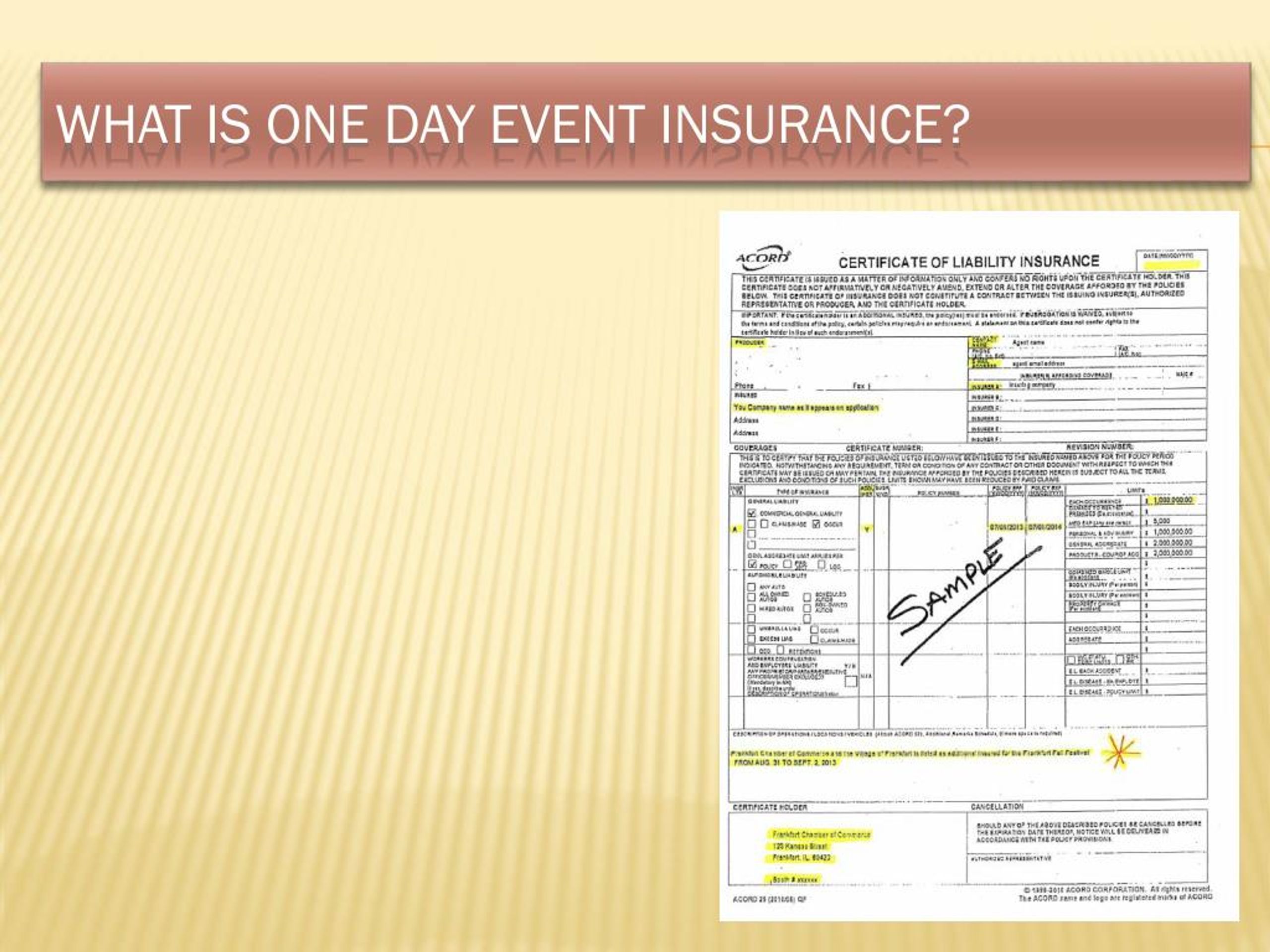

How Do I Get Event Insurance?

Event insurance is typically purchased from an insurance provider. Many providers offer different types of policies, so it is important to shop around and compare policies to find the one that best meets your needs. It is also important to read the policy carefully to ensure that it provides the necessary coverage. Additionally, make sure to get a certificate of insurance from the provider to prove that you have the necessary coverage.

Conclusion

Event insurance is an important form of protection for any event, providing coverage for a variety of potential financial losses. It is important to shop around and compare policies to find the one that best meets your needs, and make sure to read the policy carefully to ensure that it provides the necessary coverage. Additionally, make sure to get a certificate of insurance from the provider to prove that you have the necessary coverage.

PPT - Cheapest Auto Insurance Companies PowerPoint Presentation, free

The 4 Best One-Day Event Insurance Companies for 2022 - BravoPolicy

Pin on Small Business Insurance

One Day Insurance / Short Term License Plate Insurance Ideal For One