Cheapest Breakdown Cover In Uk

Cheapest Breakdown Cover In UK

What is Breakdown Cover?

Breakdown Cover is an insurance policy that provides you with roadside assistance and recovery in the event of your vehicle breaking down. It is designed to protect you against the cost of breakdowns, which can be extremely expensive if you don’t have the necessary cover. Breakdown cover is available from a range of providers, including car insurance companies, banks, and breakdown services.

Types Of Breakdown Cover

Breakdown cover can come in two forms: comprehensive cover and basic cover. Comprehensive cover is the more comprehensive of the two, providing you with a range of additional benefits such as home start, roadside repairs, and even cover for lost keys. Basic cover is more limited and usually only covers roadside assistance and recovery.

Cheapest Breakdown Cover In UK

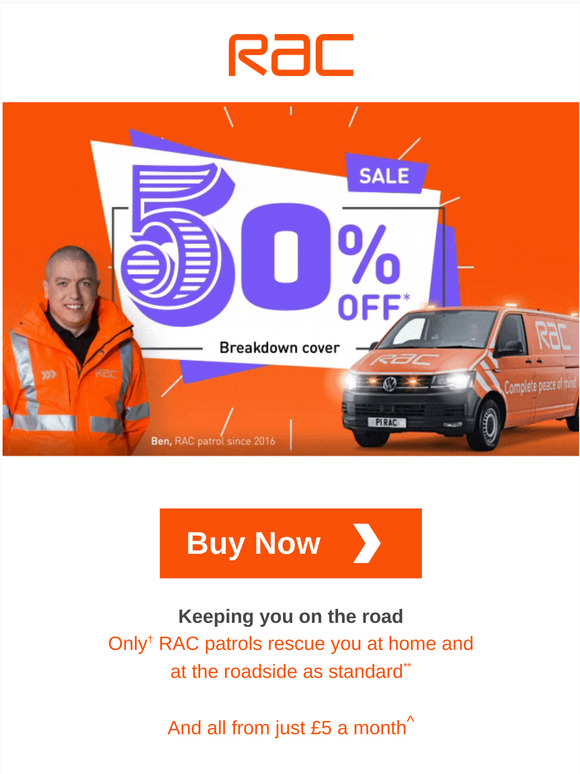

If you’re looking for the cheapest breakdown cover in the UK, then you’ll be glad to know there are a number of providers that offer low-cost policies. This includes the likes of Admiral, Churchill, and RAC, all of which offer basic cover for around £25-£30 per year. For those looking for more comprehensive cover, the likes of Green Flag and the AA offer policies for around £50-£60 per year.

Benefits of Breakdown Cover

The benefits of having breakdown cover are numerous. Firstly, it can provide you with peace of mind knowing that you are protected against the cost of breakdowns. It can also provide you with a range of additional benefits such as home start, roadside repairs, and cover for lost keys. Furthermore, it can help you to save money in the long run as you won’t have to pay for expensive repair bills.

How To Choose The Right Breakdown Cover

The best way to choose the right breakdown cover is to compare the different providers and their policies. Make sure to read the small print and understand the level of cover you’ll be getting for the price. Look out for any additional benefits that the provider may offer, such as home start, roadside repairs, and cover for lost keys. You should also consider the level of customer service you’ll be receiving, as this can be an important factor in your decision. Finally, make sure to shop around to get the best deal for your budget.

Conclusion

Breakdown cover is an essential form of insurance for any driver. It can provide you with peace of mind knowing that you’re protected against the cost of breakdowns. It can also provide you with a range of additional benefits such as home start, roadside repairs, and cover for lost keys. There are a number of providers that offer low-cost policies, so make sure to shop around to get the best deal for your budget.

50% off RAC Breakdown Cover, £4.50 | LatestDeals.co.uk

Breakdown Cover Premium Increase - Caleb Roberts

Want CHEAPER Car Breakdown Cover? Get Instant Free Quotes & Compare

rac loans: Get half price breakdown cover | Milled

The best car breakdown cover to buy in 2020 | Carbuyer