Chaucer Insurance Motor Fleet Policy Wording

Chaucer Insurance Motor Fleet Policy Wording Explained

What is Chaucer Insurance Motor Fleet Policy?

Chaucer Insurance Motor Fleet Policy is an insurance policy designed to cover multiple vehicles under a single policy. It is a type of business insurance that provides a single policy to cover a company’s entire fleet of vehicles, including cars, vans, trucks, and motorcycles. The policy provides coverage for physical damage, liability, and other risks associated with owning and operating a fleet of vehicles. It also includes coverage for medical payments, legal fees, and other related expenses.

What Does the Chaucer Insurance Motor Fleet Policy Cover?

The Chaucer Insurance Motor Fleet Policy covers a wide range of risks associated with owning and operating a fleet of vehicles. It provides coverage for physical damage, liability, and medical payments. It also covers legal fees and other related expenses. Some policies may include additional coverage for rental vehicles, towing and roadside assistance, and theft recovery. The policy also covers legal expenses and other related costs.

What Are the Benefits of Chaucer Insurance Motor Fleet Policy?

The primary benefit of Chaucer Insurance Motor Fleet Policy is that it provides comprehensive coverage for a company’s entire fleet of vehicles. It also offers protection against liability, medical payments, and other related expenses. By combining multiple vehicles under a single policy, companies can take advantage of lower premiums and more cost-effective coverage. Additionally, the policy allows for flexibility in terms of coverage and deductible amounts.

What Are the Limitations of Chaucer Insurance Motor Fleet Policy?

The Chaucer Insurance Motor Fleet Policy is limited in terms of the types of vehicles it can cover. It does not cover commercial vehicles, such as buses, taxis, or trailers. Additionally, the policy may not cover certain types of drivers, such as those with a poor driving record or a history of accidents. Furthermore, the policy may not provide coverage for certain types of losses, such as those caused by natural disasters or theft.

How Can I Get a Chaucer Insurance Motor Fleet Policy?

In order to get a Chaucer Insurance Motor Fleet Policy, you will need to contact an insurance broker or agent. The broker or agent will be able to provide you with details about the policy, as well as quotes for different coverage options. You may also be able to find information about the policy online, as well as compare quotes from different insurers.

Conclusion

The Chaucer Insurance Motor Fleet Policy is an excellent option for companies that operate a fleet of vehicles. It provides comprehensive coverage for physical damage, liability, medical payments, and other related expenses. Additionally, the policy is flexible in terms of coverage and deductible amounts. To get a Chaucer Insurance Motor Fleet Policy, contact an insurance broker or agent. They will be able to provide you with more information and help you find the policy that fits your needs.

The Insiders Guide to Motor Fleet Insurance & How to Secure the Best

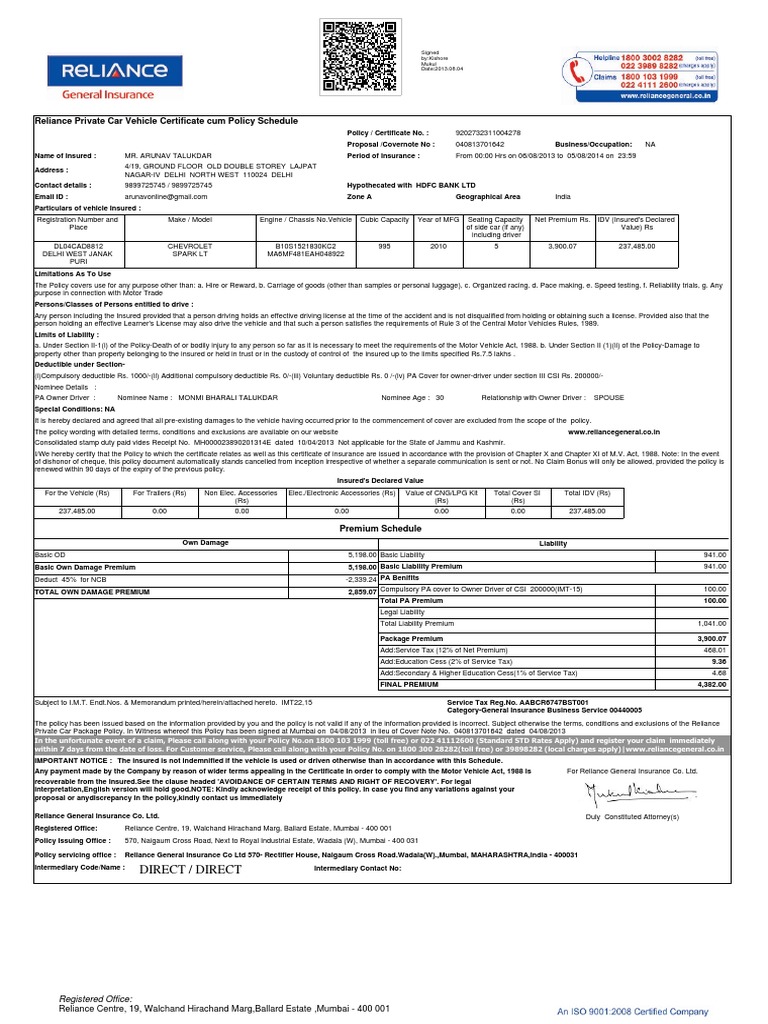

Vehicle Insurance Policy Format | Vehicle Insurance | Liability Insurance

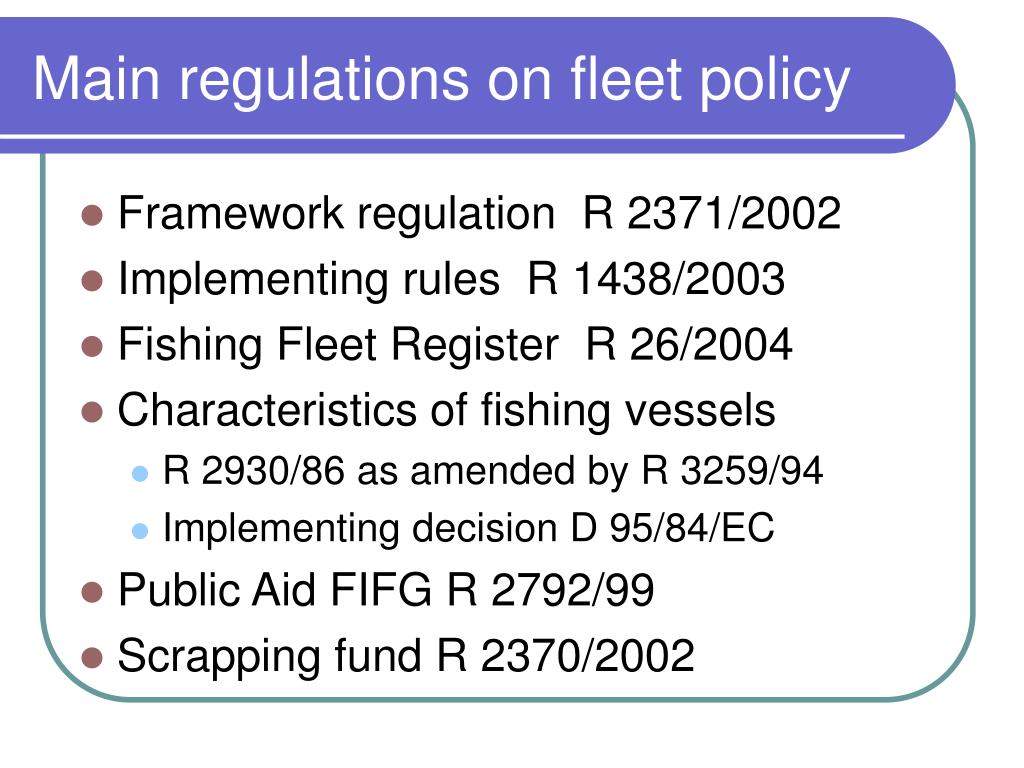

PPT - RELATIONS BETWEEN CONSERVATION POLICY, FLEET POLICY AND

Motor Insurance: Motor Insurance Policy Wording Pdf