Car Insurance Rates For 18 Year Olds

Car Insurance Rates for 18 Year Olds

What You Need to Know About Car Insurance Rates for 18 Year Olds

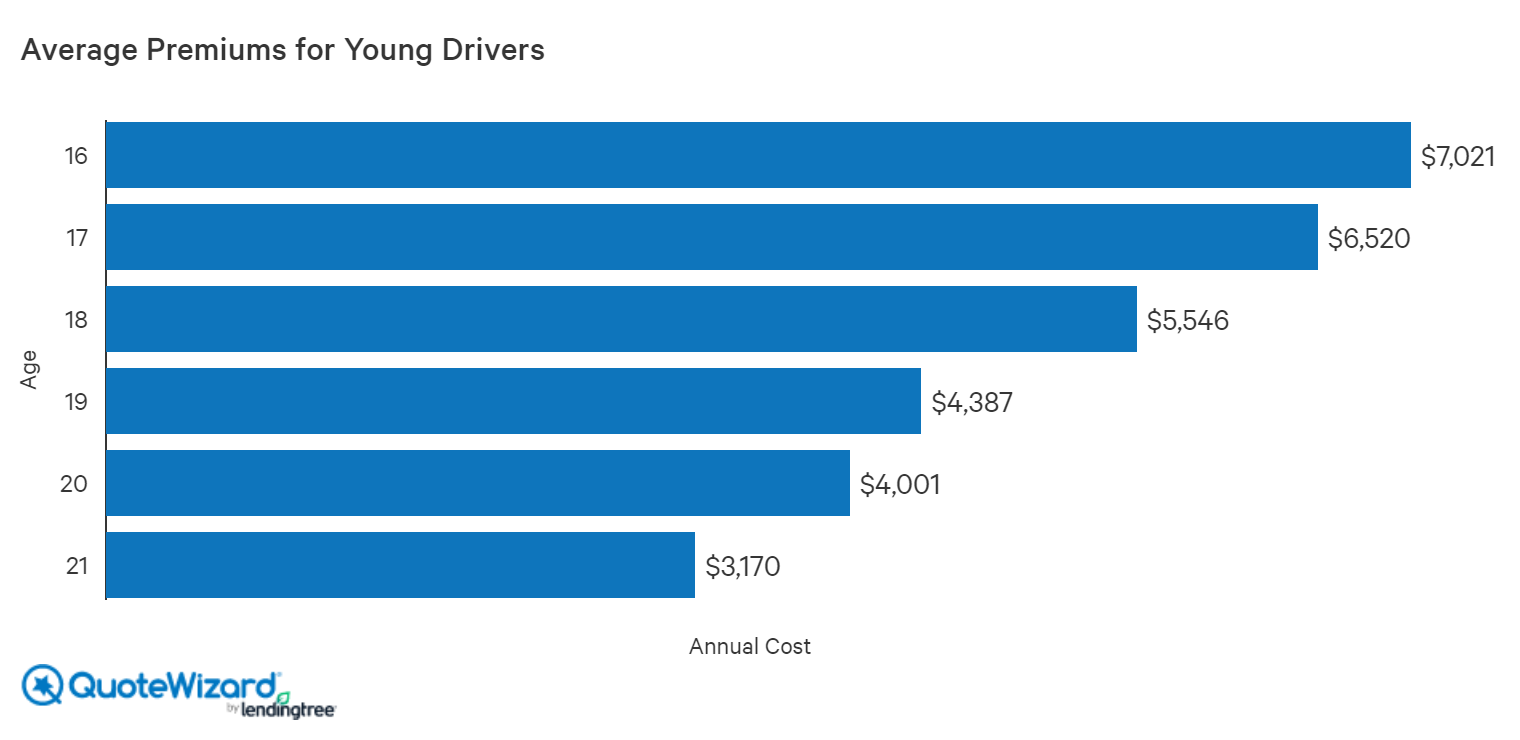

When you’re 18 years old, you’re on the cusp of adulthood. You’re probably just starting college or your first job, and you’re ready to start living life on your own terms. But if you’re planning to drive, you need to know what car insurance rates for 18 year olds look like. Unfortunately, car insurance rates for 18 year olds are higher than average, as young drivers are seen as inherently riskier by insurers. Here’s what you need to know about car insurance rates for 18 year olds.

Why Are Car Insurance Rates for 18 Year Olds So High?

Insurance companies base their rates on a variety of factors, including your age, driving record, and the type of car you drive. But when it comes to 18 year olds, insurers are typically reluctant to offer the lowest rates. That’s because 18 year olds are seen as inexperienced drivers who are more likely to get into accidents. As a result, insurers charge higher rates to 18 year olds in order to offset their higher risk. It’s important to note, though, that 18 year olds who have a good driving record may be eligible for discounts and other incentives.

How to Lower Your Car Insurance Rates as an 18 Year Old

If you’re 18 years old and looking to lower your car insurance rates, there are a few things you can do. First, consider joining a parent’s policy if you’re still living at home. By doing so, you can often get a discount on your premiums. You can also look into discounts for good students or taking a defensive driving course. Finally, make sure to shop around for the best deal. Different insurers will offer different rates, and you should compare quotes from at least three companies before making a decision.

What Are the Cheapest Cars to Insure for 18 Year Olds?

If you’re an 18 year old looking for an affordable car to insure, there are certain models that tend to have lower rates. Generally, smaller cars with fewer features are seen as safer and therefore cheaper to insure. Examples of budget-friendly cars include the Honda Civic, Toyota Corolla, and Ford Focus. You should also look for cars with good safety ratings, as these cars tend to be cheaper to insure. Finally, avoid cars with high-performance engines, as these cars can be significantly more expensive to insure.

How to Save Money on Car Insurance as an 18 Year Old

If you’re an 18 year old looking to save money on car insurance, there are several strategies you can use. First, make sure to take advantage of any discounts you may be eligible for. Good student discounts, defensive driving courses, and low mileage discounts can all help to reduce your premiums. You should also consider raising your deductible, as this can reduce your premiums. Finally, shop around for the best deal. Different insurers will offer different rates, and you should compare quotes from at least three companies before making a decision.

Average Car Insurance For 18 Year Old Male Per Month - New Cars Review

How Much Is Car Insurance Per Month For A 18 Year Old ~ news word

How Much Is It To Insure A Car | Life Insurance Blog

How Much Is Car Insurance Per Month For A 18 Year Old ~ news word

Comparison shopping is one of the easiest ways to save on car insurance