Car Insurance Gap In Coverage

What is Car Insurance Gap Coverage?

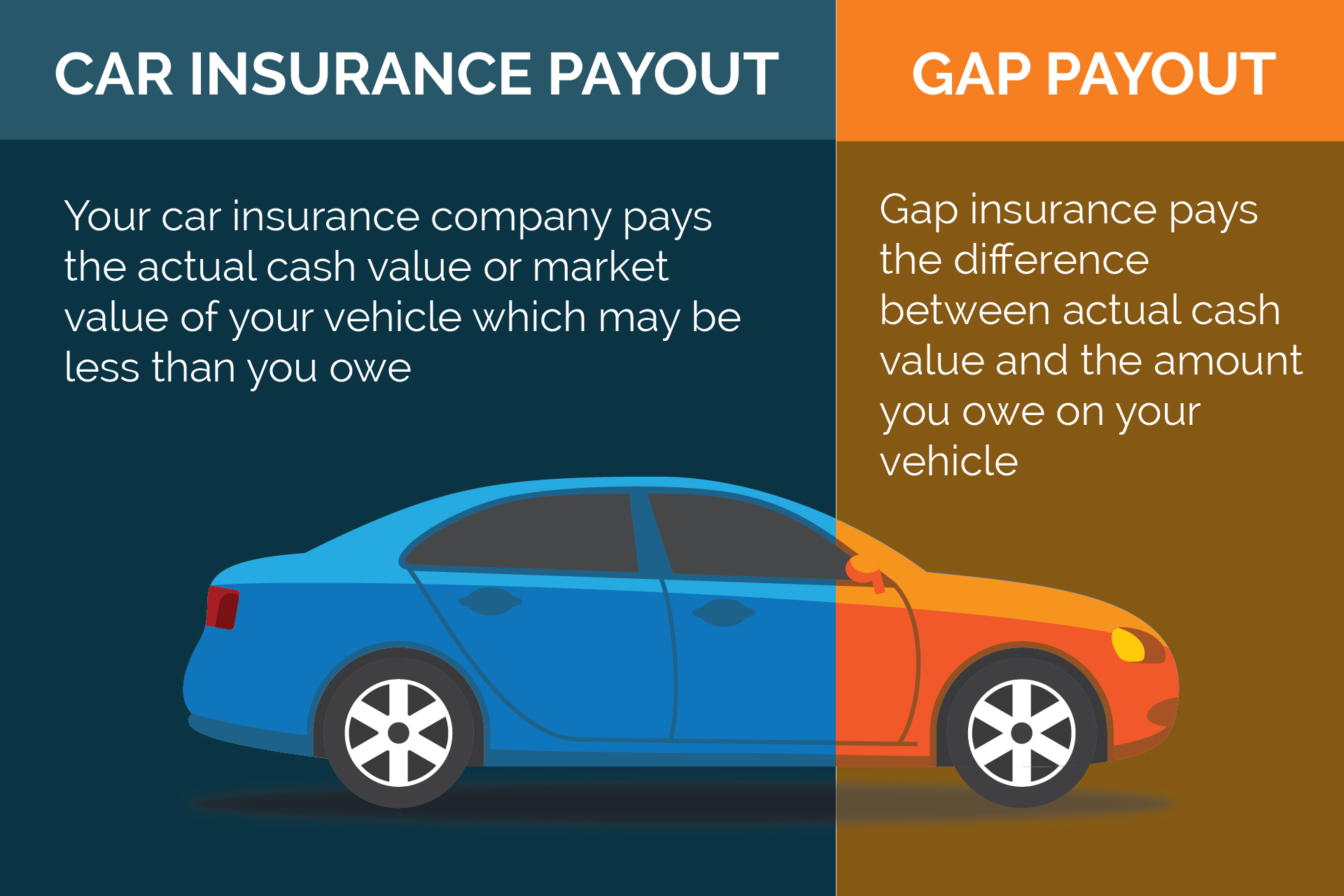

Car insurance gap coverage is an extra insurance policy that helps cover the difference between the actual cash value of your vehicle and the balance of your auto loan in the event of a total loss. It is also known as “guaranteed auto protection” or “auto loan/lease gap coverage.”

Car insurance gap coverage is an important addition to any comprehensive car insurance policy. The reason is simple: if your car is totaled in an accident, your insurance company will pay out only the current market value of your car. This can be significantly less than what you still owe on the car loan or lease. An auto gap insurance policy can bridge the financial gap between your insurance settlement and the balance of your loan or lease, up to the limits of your policy.

Why Do You Need Car Insurance Gap Coverage?

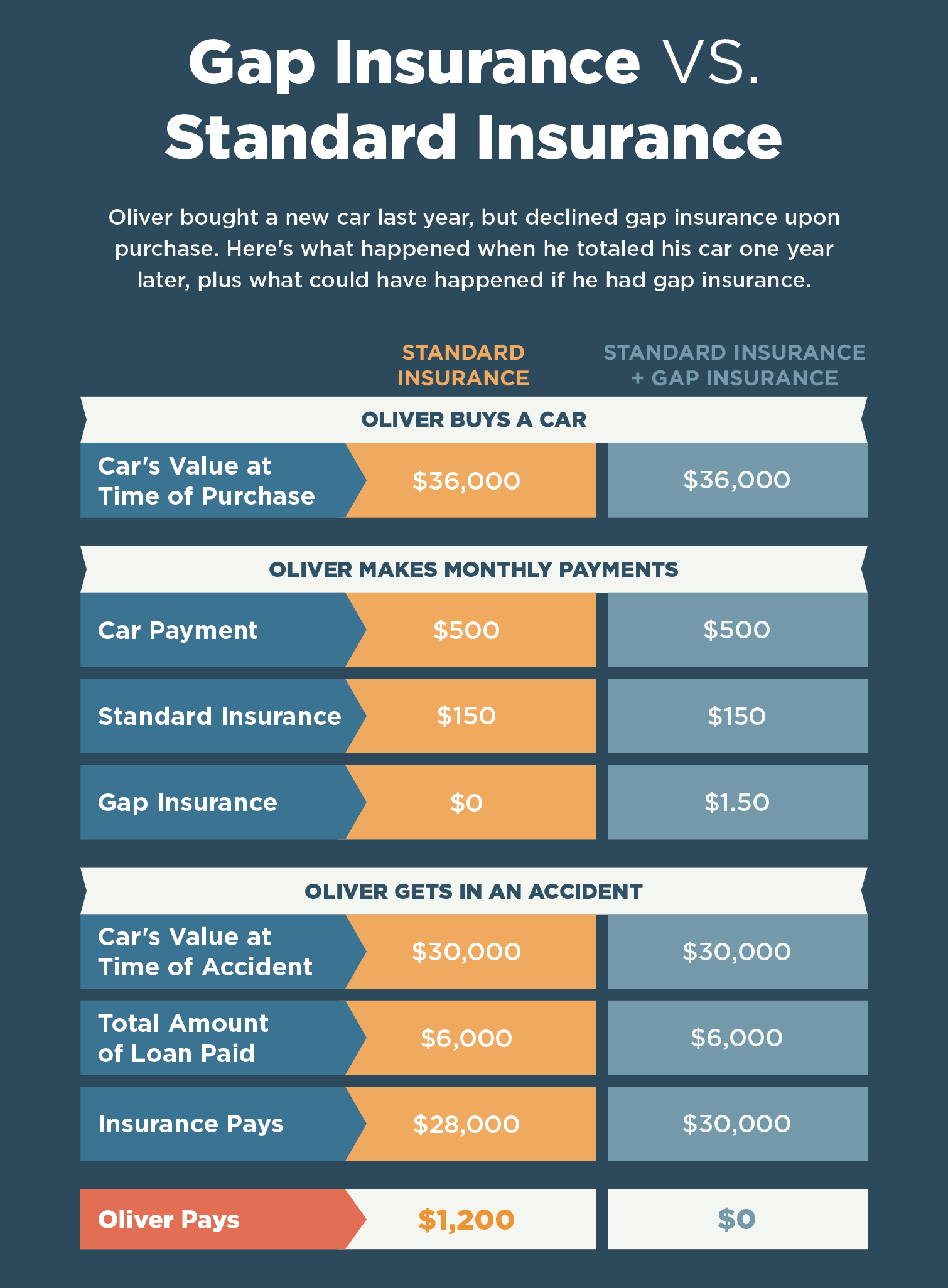

If your car is totaled in an accident, you will be liable for the balance of your loan or lease, even if the amount is more than the actual cash value of your car. This is known as being “upside down” on your loan or lease. Car insurance gap coverage helps you avoid having to pay for an auto loan or lease balance on a car you no longer own.

For example, if you purchased a car for $20,000 and you still owe $15,000 on the loan and the car is totaled in an accident, your car insurance company will issue a settlement based on the car’s current market value, which could be significantly lower than the $15,000 balance you owe. Car insurance gap coverage will help you pay the difference between the settlement and the loan balance.

Who Should Get Car Insurance Gap Coverage?

If you have a loan or lease on your car, you should strongly consider car insurance gap coverage. Even if your car is worth more than what you owe, you should still consider a gap policy. Many things can happen that could cause your car’s value to drop drastically, such as an accident or theft.

If you purchased your car with a loan, it is also important to note that gap coverage is not included in all auto insurance policies. You will need to purchase a separate policy and you should shop around for the best coverage and rate.

When Should You Buy Car Insurance Gap Coverage?

Car insurance gap coverage should be purchased at the same time as your comprehensive and collision car insurance policy. You should also review your policy at least once a year, or when you make a major purchase on your car, such as a new stereo or transmission. If the value of your car is now more than what you owe, you may be able to drop your gap coverage.

Car insurance gap coverage can help you avoid paying out-of-pocket for an auto loan or lease balance if your car is totaled in an accident. It is important to understand the terms and conditions of your policy and to review your policy regularly to make sure it meets your needs and budget.

Understanding Auto Insurance “Gap Coverage“

Gap Insurance For Cars Is It Worth It - Is Car GAP Insurance Worth It

Do Not Get Taken For A Ride When Looking For Auto Insurance — shaketext5

How Many Americans Have Health Insurance Can Be Fun For Everyone - A

What Is GAP Insurance And When Should Drivers Buy It