Car Insurance For New York

Car Insurance for New York Drivers

What is Car Insurance?

Car insurance is a type of insurance policy that covers financial losses that may occur as a result of an accident involving a car. Car insurance policies also provide coverage for other incidents such as vandalism, theft, and weather-related damages. Each policy is tailored to an individual's specific needs and their car. The amount of coverage varies from one state to the next, and in the case of New York, all drivers must have car insurance.

Do I Need Car Insurance in New York?

Yes, New York requires all drivers to have car insurance. The state has a minimum requirement for liability coverage that all drivers must meet. The minimum liability coverage is $25,000 per person per accident for bodily injury, $50,000 for total bodily injury in an accident, and $10,000 for property damage. It is important to note that these are only the minimum requirements and drivers may want to consider additional coverage for added protection.

What Types of Car Insurance are Available in New York?

In New York, there are a variety of car insurance options available. Drivers can choose from liability, comprehensive, collision, and personal injury protection. Liability coverage is the most basic coverage and is required by law. Comprehensive and collision coverage provide protection against damages due to an accident, vandalism, theft, or other covered incidents. Personal injury protection provides coverage for medical bills, lost wages, and other costs associated with an accident.

How Much Does Car Insurance Cost in New York?

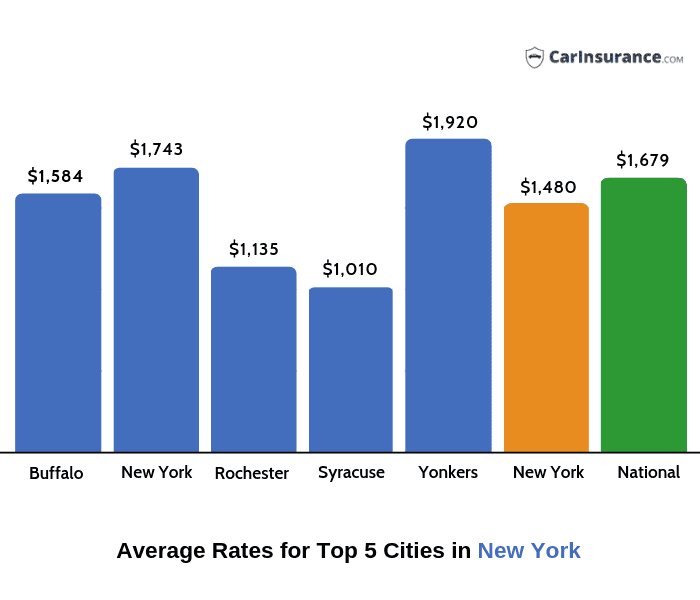

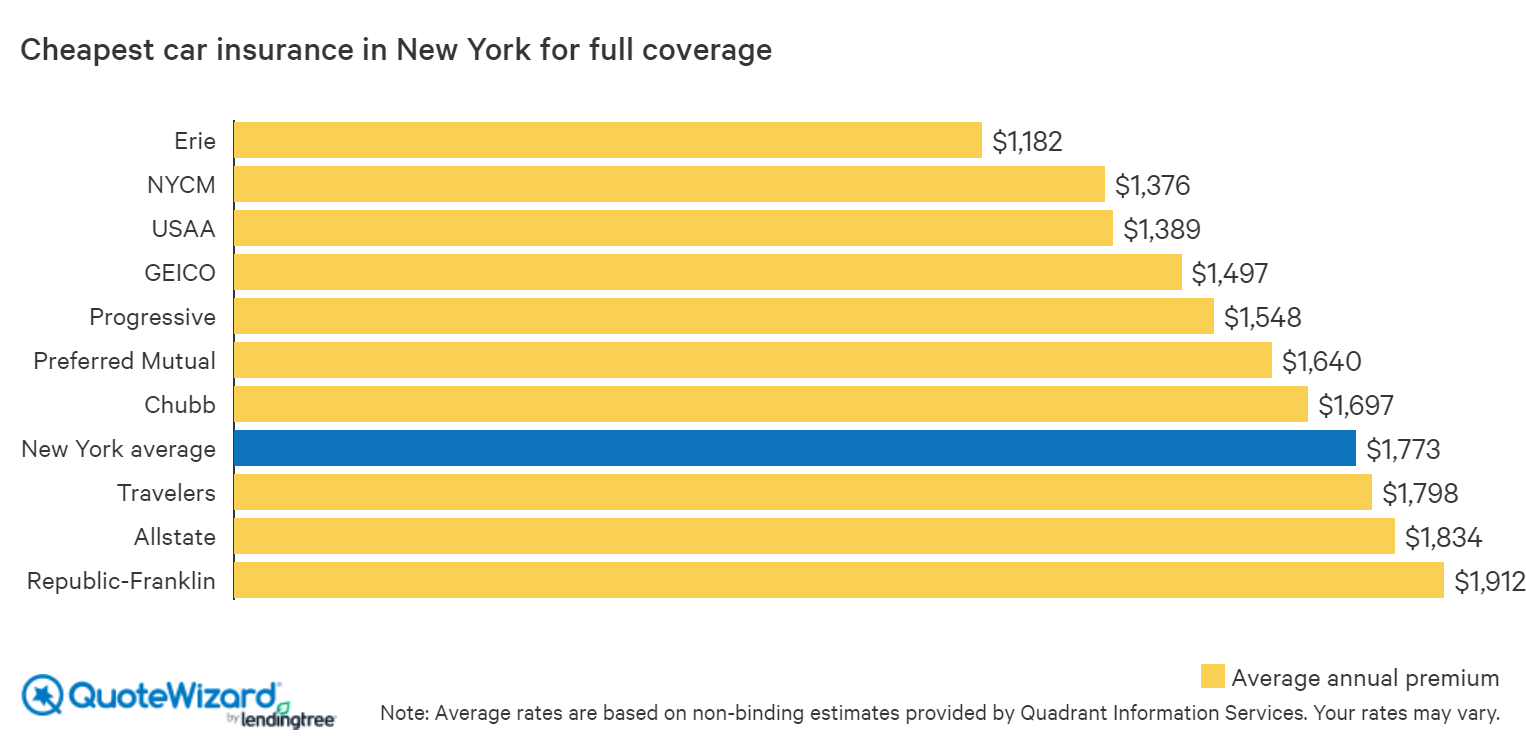

The cost of car insurance in New York will vary depending on a variety of factors including the type of coverage, the make and model of the vehicle, and the driver's driving record. In general, the average cost of car insurance in New York is around $1,400 per year. However, it is important to note that this is just an estimate and the actual cost of car insurance will vary depending on the individual's needs.

What is the Best Way to Get Car Insurance in New York?

The best way to get car insurance in New York is to shop around and compare rates from different insurers. It is also important to understand the different types of coverage available and to make sure that the coverage meets the individual's needs. Additionally, drivers should take the time to read through the policy and make sure they understand the terms and conditions of the policy.

Conclusion

Car insurance is an important part of owning and operating a vehicle in New York. All drivers must have car insurance in order to legally drive in the state. There are a variety of car insurance options available in New York, so it is important to shop around and compare rates from different insurers. By doing so, drivers can ensure that they are getting the best coverage for their needs at the most affordable price.

Cheap Car Insurance in New York 2019

Car Insurance in New York - Find Best & Cheapest Car Insurance in NY

The Cheapest Car Insurance in New York | QuoteWizard

Get Now Car Insurance in New York City - YouTube

20+ Car Insurance Quotes Nyc - Best Day Quotes